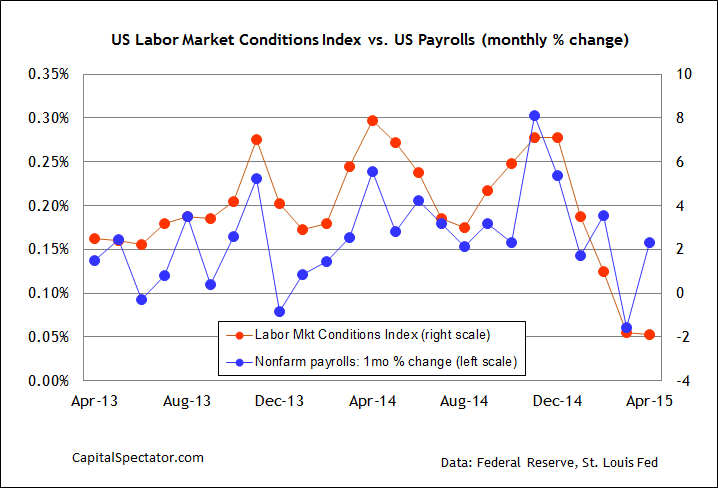

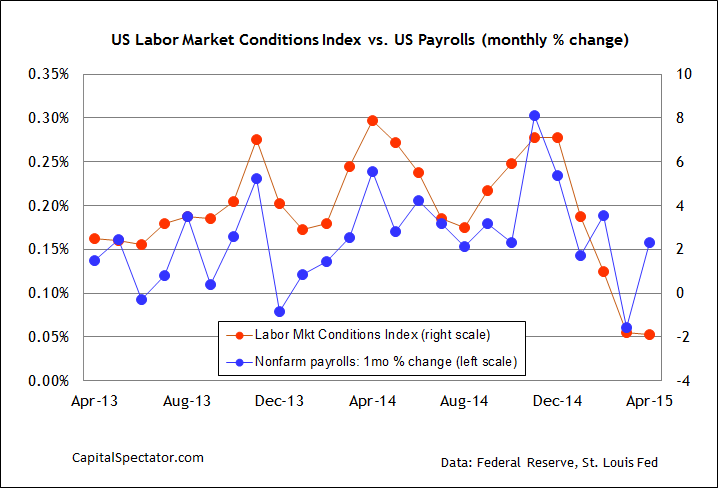

US payrolls bounced back in April, rising a solid 223,000 after March’s dismal gain of just 85,000. The news cheered the crowd and renewed faith in the case for macro optimism. But if the second-quarter is on the path of recovery after a rough winter, it’s not obvious in the Federal Reserve’s 19-factor Labor Market Conditions Index (LMCI), which ticked lower again in April and posted its second-consecutive negative reading.

LMCI, which is designed to capture the broad trend in the labor market based on a wide spectrum of data, slipped to -1.9 last month, the lowest level in nearly three years. Is this a sign that the labor market is weaker than the April bounce-back in payrolls implies? History shows that the monthly percentage changes in payrolls tend to track LMCI’s monthly fluctuations relatively closely, but not always. As one example, based on revised data, LMCI held steady at a comparatively elevated level in December while the monthly increase in payrolls decelerated substantially. Soon after, LMCI reflected the slowdown in the labor market.

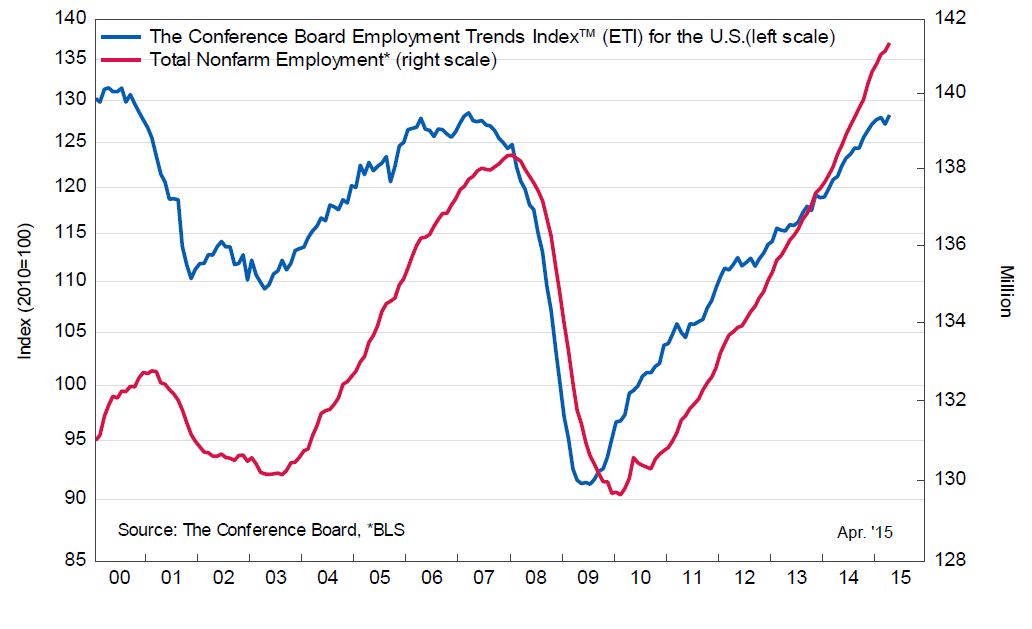

Is the latest weakness in LMCI another case of a delayed reaction to a change in the labor market? It wouldn’t be the first time. One reason for thinking that LMCI will perk up comes via the Conference Board’s Employment Trends Index (ETI), which aggregates eight labor market indicators.

ETI inched up to a new post-recession high last month. Conference Board spokesman Gad Levanon said in a press release that:

April’s bounceback in the Employment Trends Index is somewhat reassuring, but expectations remain that job growth will be slower this year compared with last year. Given that the labor force is barely expanding, job growth of about 200,000 per month will be sufficient to continue rapidly lowering the unemployment rate.

The fact that initial jobless claims remain close to a 15-year low offers another clue for thinking that the labor market’s recent challenges will improve in the months ahead. Perhaps, then, it’s reasonable to expect that LMCI will rebound as well in next month’s report.