Just two days ago we warned of the dramatic disconnect between equity insurance and credit insurance markets – at levels last seen before Bear Stearns collapse. As the Yuan devaluation shuddered EUR/CNH carry traders and battered European assets, US equity markets stumbled onwards and upwards, impregnable in their fortitude with The Fed at their back no matter what. However, US corporate bond markets were a bloodbath…

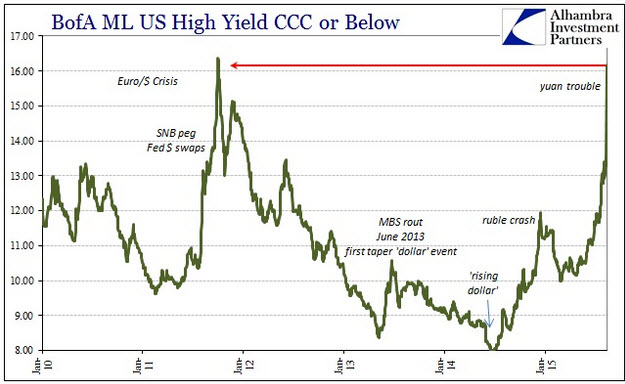

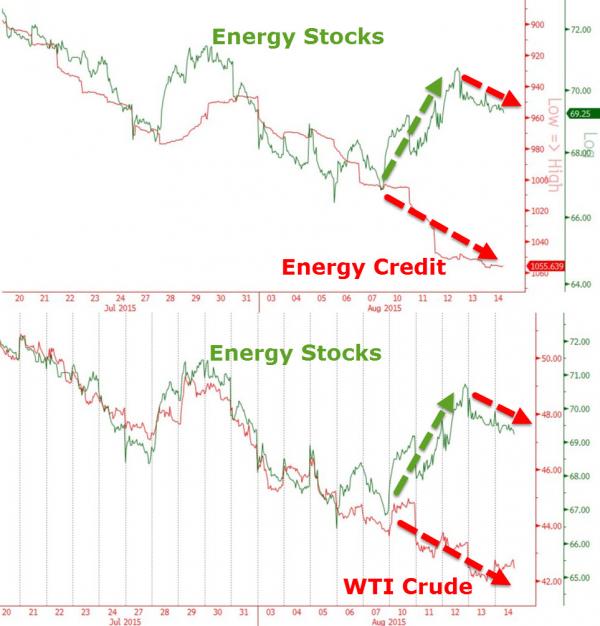

The Bank of America/Merrill Lynch High Yield CCC Yield got absolutely slammed this week, rising from 13.58% to 16.18%! The biggest spike in yields since the financial crisis.

That would suggest, as all listed above, that there has been inordinate and tremendous “dollar” pressure not in foreign, irrelevant locales but creeping into the contours of the domestic and internal framework.

And while the junkiest of the junk saw the biggest decompression since Lehman, the rest of the high yield bond market is also starting to catch the credit cold..

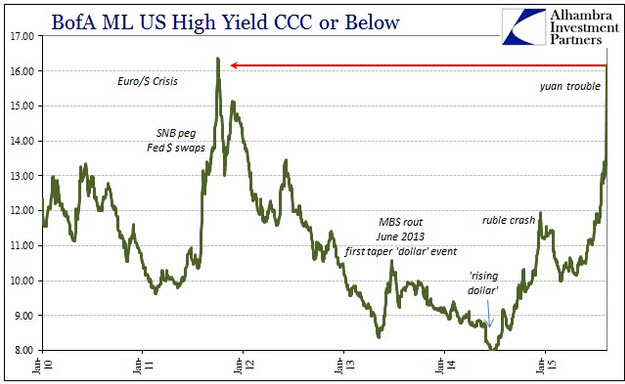

Of course, some of this is energy related which has blown wider to record wides... (once again equity just totally ignoring the carnage)…

But it’s not all energy.

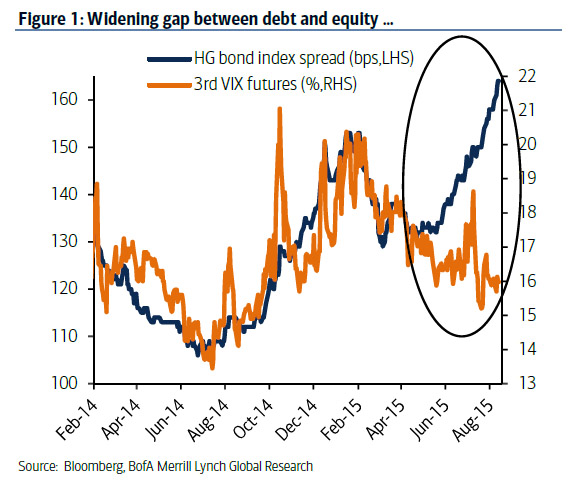

Just two days ago BofA points out that in just the past two weeks, credit spreads from our HG corporate bond index have widened another 9bps to 164bps while equity volatility is down another percentage point (although technically BofA uses the 3rd VIX futures as its measure of equity volatility rather than VIX itself to get a smoother series that is less affected by the daily noises and seasonalities).

This is how the resulting dramatic divergence looks like:

Why is this notable?

In BofA’s own words: “this spread currently translates into 10.26 bps of credit spread per point of equity vol, the level reached on March 6, 2008 – ten days before Bear Stearns was forced to sell itself to JP Morgan for $2/sh. Recall that – unlike the credit market – the equity market well into 2008 was very complacent about the subprime crisis that led to a full blown financial crisis.”