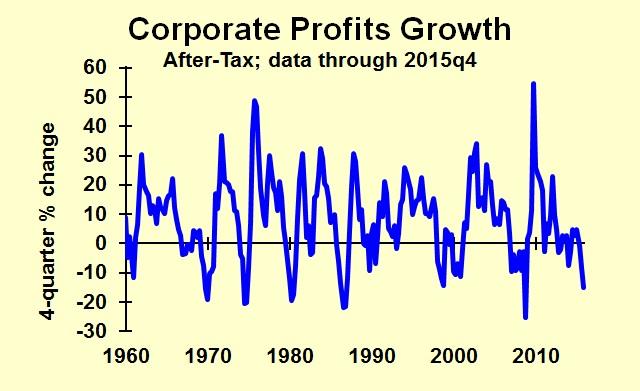

Corporate profits dropped eight percent in the fourth quarter of 2015, most of the decline coming from petroleum and coal products. In fact, that sector’s profits were not only down; they turned from black ink to red ink in a single quarter. Without petroleum’s misfortune, corporate profits would have edged down only 1.7 percent. The remainder of the decline was primarily from heavy industry (machinery, computers, and motor vehicles).

Oil prices have rebounded a bit from February’s bottom—but keep in mind the profits news regarded fourth quarter of last year, when oil averaged $42 a barrel. So the oil patch will continue to bleed a while longer.

Weak profits outside of petroleum stem from poor conditions in the industrial side of the economy, as I described partially in a previous article, The Puzzling Weakness In U.S. Companies’ Capital Spending. No immediate turnaround is likely here.

Note how volatile the time series is. Double-digit percent changes are common. And the trend has been downward since 2011. Over the past four years, profits have dropped 13 percent.

Looking forward, I expect continued moderate economic growth this year and next, which normally would help profits. However, my forecast for GDP growth is in line with the past few years’ growth, and that obviously hasn’t helped profits. Labor costs may well rise faster than top-line growth. I expect petroleum to stop its bleeding, while other sectors improve. This may be the bottom for profits, but it’s hard to see a big rebound.