Since the beginning of the year, international news has slowly but consistently been grinding slower. It started with a series of policy missteps from China followed by Japan’s 4Q contraction. US news has also slowly ground weaker. The EU can’t seem to generate any inflation and, thanks to a strong sterling, the UK is relying solely on domestic demand for growth. While Canada emerged from recession in 2H15, it is still experiencing the negative implications of oil’s collapse. This week’s news furthers these trends.

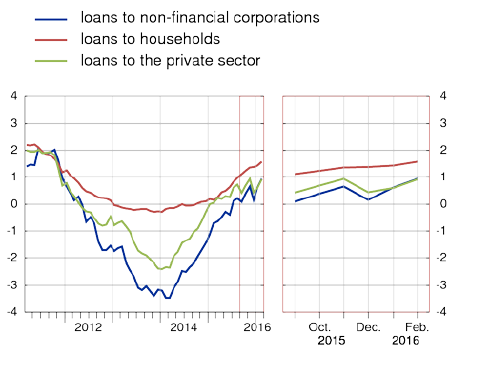

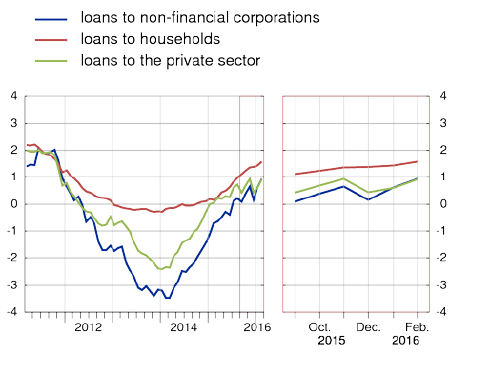

EU news was mixed. Loan growth continues rising: household loans increased 1.6% M/M while business loans were up .9%. Both statistics continue to increase:

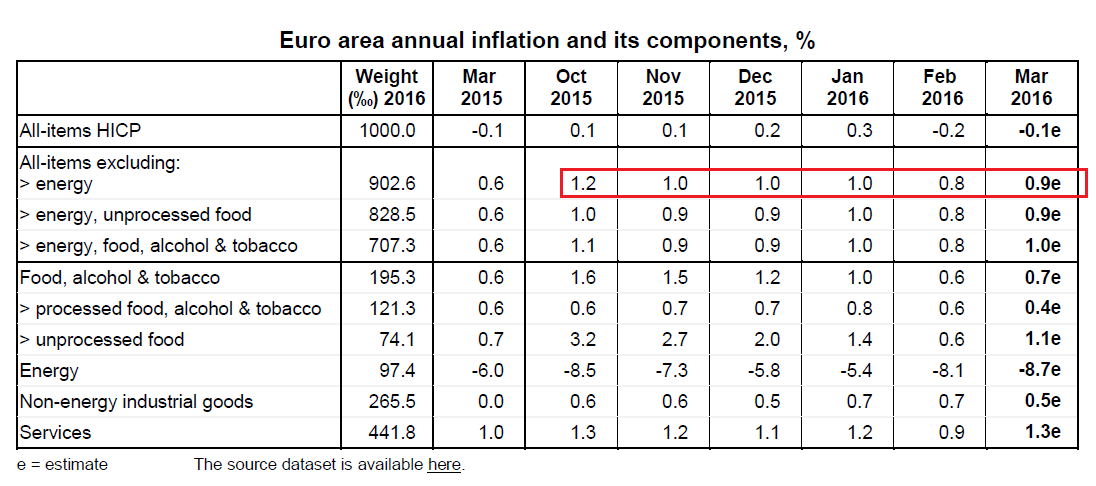

Sentiment readings were mostly lower: consumer and economic sentiment numbers declined while the business climate indicator was stable. And inflation was once again negative, declining .1% Y/Y. On the plus side, the ex-energy rate increased .9% and the ex-food number rose .7%:

But, the decline indicates the ECB still has plenty to do regarding inflation.

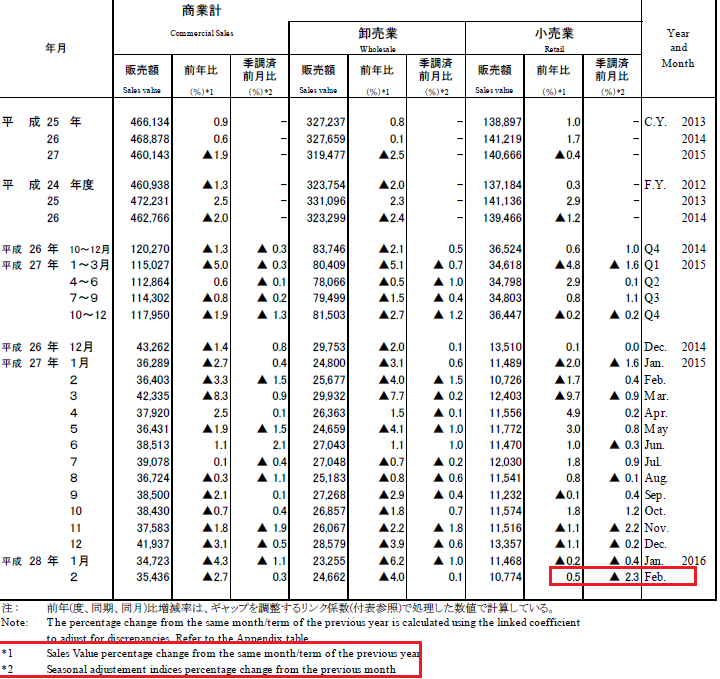

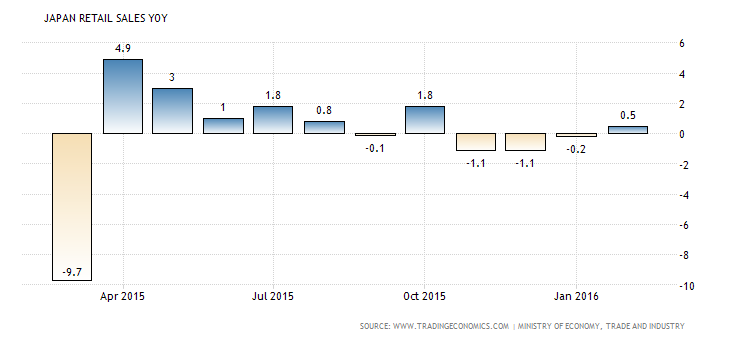

Japan’s news continues to cause concern. The impressive 3.2% unemployment rate isn’t translating into consumption growth: retail sales decreased a fourth consecutive month on a Y/Y basis (down 2.3%) and were up for the first time in four months M/M (.5%).

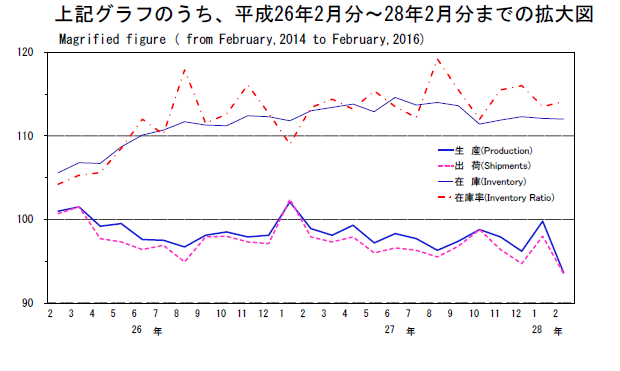

And industrial production dropped 2.2% M/M:

Finally, the Markit manufacturing index printed at 49.1, its lowest level in 3 years. Overall production, domestic and international orders declined.Industrial production and retail sales are two coincident indicators whose latest readings indicate the fourth quarter contraction is bleeding into 1Q16.

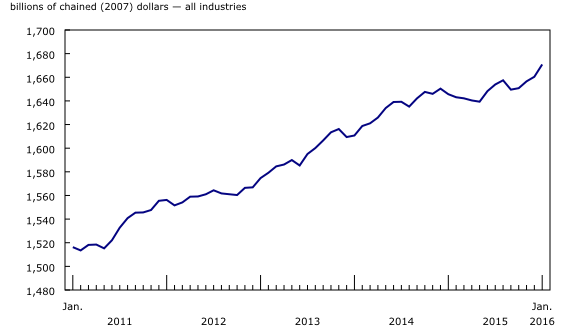

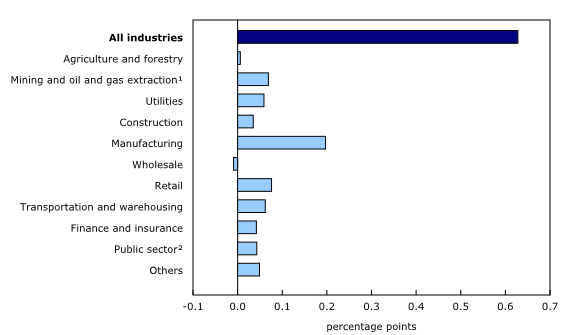

Canada is on the mend. GDP expanded for the fourth consecutive month. Most importantly, most sectors contributed to the expansion:

Industrial prices declined 1.1%, but, like most countries, energy prices were the primary culprit. Finally, Lynn Patterson of the Bank of Canada gave a speech titled, “Adjusting to the Fall in Commodity Prices: One Step at a Time.”It’as too long to effectively quote; best to read it in full.