After witnessing volatile trades during the day, Indian share markets ended their session marginally lower. Losses were largely seen in the realty sector, capital goods sector and IT sector, while metal stocks ended the day higher.

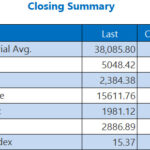

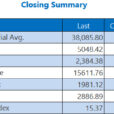

At the closing bell, the BSE Sensex stood lower by 73 points (down 0.2%) and the NSE Nifty closed lower by 38 points (down 0.4%). The BSE Mid Cap index ended the day down by 1.2%, while the BSE Small Cap index ended the day down by 0.8%.

Asian stock markets finished on a negative note as of the most recent closing prices. The Hang Seng was down 1.3% and the Nikkei stood lower by 0.2%.

The rupee was trading at 66.56 to the US$ at the time of writing.

In the news from pharma sector, Biocon share price witnessed selling pressure today on reports of US Food and Drug Administration (USFDA) observations of the company’s Bangalore facility.

The company’s Bangalore sterile drug product facility has got seven observations from USFDA and six observations from the European regulator.

Speaking of pharma stocks, did you know the BSE Healthcare Index is down 20% over the past three years? During the same period, the BSE Sensex is up 21%.Biocon share price ended the day down by 5.5% on the BSE.

And this was a sector they called ‘evergreen’.

Have Investors boarded a plane that’s about to crash? Or is it just turbulence on the way to a smooth and safe landing?

In other news, PC Jeweller share price was in focus today. At the closing hours, the stock of the company reversed its early losses and rose from the day’s low after the management of the company termed reports of the arrest of MD and CEO Balram Garg by the CBI as factually incorrect.

PC Jeweller share price ended its trading session up by 9.7% on the BSE today.

In the news from global financial markets, the US Federal Reserve left interest rates unchanged at 1.50-1.75% in its recently held monetary policy meet. While doing so, they also acknowledged that inflation is close to their target without indicating any intention to veer from their gradual path of interest-rate increases.