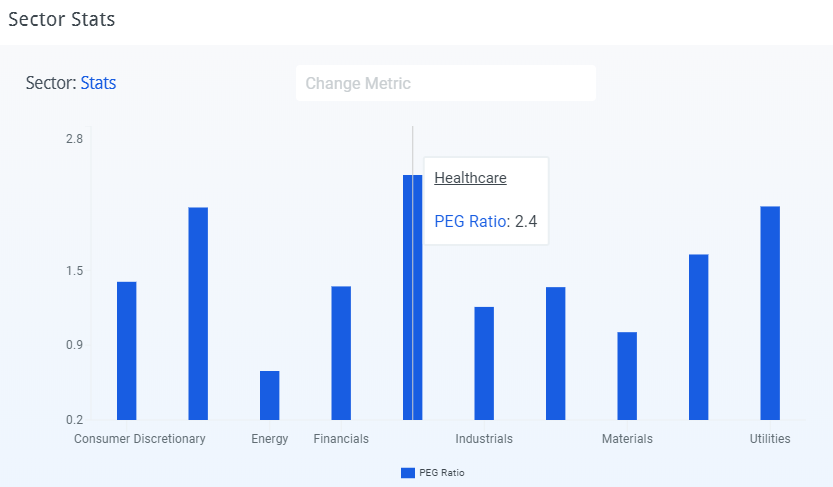

Growth at a Reasonable Price in this Market?

Growth at a Reasonable Price, or GARP, is an investing strategy that attempts to find the ideal middle-ground between growth and value stocks. These stocks are thought to be not too risky on the growth side, and not deep value, beaten down stocks that might not recover. The definitive ratio for this strategy is the PEG, or the P/E ratio divided by trailing 12-month EPS growth. The Healthcare sector currently sports the highest, or worst, PEG ratio, while the more capital-intensive industries (Energy, Materials, and Industrials) show the best ratios. A PEG ratio under one is considered GARP-worthy.

Source: finbox.io

Eleven interesting candidates were found utilizing a modified GARP screen with finbox.io’s screener, which focused on the Forward PEG (between 0 and 1), required positive free cash flow, a Short Interest ratio under 3 (the NYSE’s Short Interest ratio is 3.6), and both analyst and quant model upside of 15% plus.

Full Screening Criteria:

– Upside (finbox.io) > 15

– Upside (Analyst Target) > 15

– Analyst Targets > 4

– Confidence (finbox.io Fair Value) is HIGH

– Market Capitalization > $1b

– EV / LTM Free Cash Flow > 0

– PEG Ratio Fwd between 0 and 1.01

– Short Ratio less than 3

A quick look at the Analysis of the screen indicates its efficacy. This group of 11 stocks would have outperformed the S&P 500 by 400 basis points over the last year, although the gap has been closing since the market began getting nervous earlier this year.

Source: finbox.io

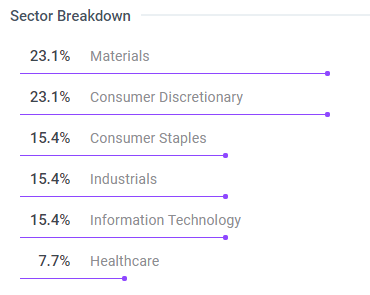

The makeup of the GARP candidates is a little surprising, with consumer sectors ranking in the top three, but as expected, Healthcare is at the bottom. One note, the PEG ratio is obviously earnings-based, which is not always a great indication of company health. Screening for positive cash flow helps filter out companies that may not be as operationally healthy as earnings purport.

Source: finbox.io

Sorting on Net Profit Margin, the top five candidates were YY Inc (Nasdaq: YY), Regeneron Pharmaceuticals Inc (Nasdaq: REGN), Chemours Co (NYSE: CC), Broadcom Inc (Nasdaq: AVGO), and Coca-Cola European Partners PLC (NYSE: CCE).