Despite Thursday’s bounce and Friday’s half-hearted effort to follow through on that move, stocks just logged their second consecutive losing week. Indeed, Friday’s failed follow-through is even more alarming, in that the bulls had their chance to get things going again, but ultimately yielded to the bears.

There are still some technical support levels that could get in the way of a pullback, but there plenty of hurdles above too. More than anything right now, stocks are trapped in the middle. Now wouldn’t be a bad time to remain on the sidelines and let everyone else duke it out.

We’ll look at the matter in some detail below (as always), but first, let’s review last week’s economic announcements and preview this week’s economic news.

Economic Data

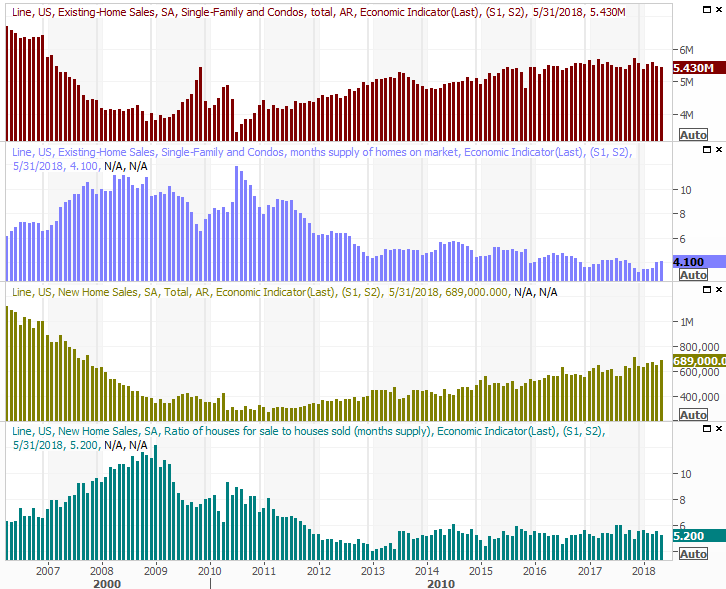

The party started early last week, with Monday’s new-home sales report rounding out the existing-home sales report from the prior week. They were far better than expected, rolling in at an annualized pace of 689,000 units.

Home Sales and Inventory Charts

Source: Thomson Reuters

That strength in existing home sales offset weakness seen in new-home sales last month. On both fronts, sales may be tempered by an ongoing lack of inventory.

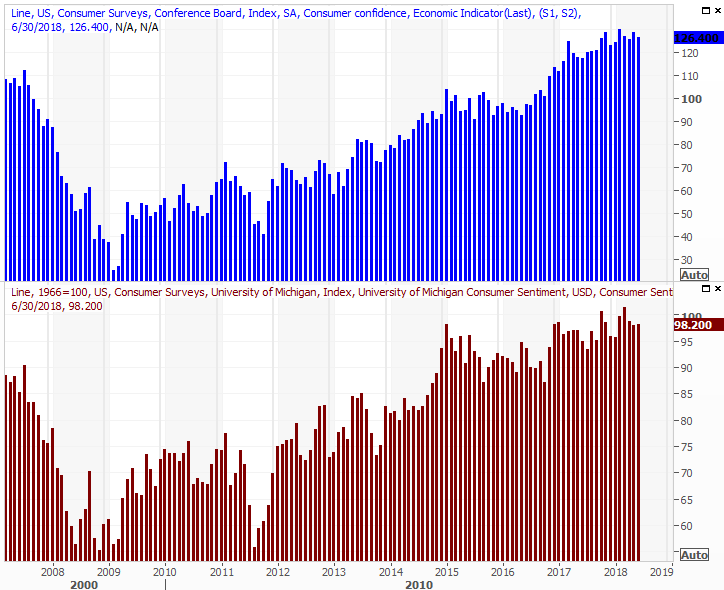

It was also a big week for consumer sentiment. The Conference Board’s consumer confidence level fell a bit, and more than expected, but is still at a high level, and still broadly trending higher. The University of Michigan’s read on consumer sentiment also slipped a little, but again, it’s still trending higher… into multi-year highs.

Consumer Sentiment Charts

Source: Thomson Reuters

The Case-Shiller index was updates on Tuesday, underscoring the previous week’s FHFA home price report. As expected (and as has been the case for months now), we say more progress. The Case-Shiller Index was up 6.6% year-over-year, and the FHFA home price index was up 0.1% month-to-month. Both say home prices continue to firm up, abating any concern about the apparent slowing in existing home sales.