The market works in long term cycles even though it seems like changes occur often. There will always be news which drives short term action, but in the long run there are strategies which last for years or even decades. In the past 11 years, growth stocks have outperformed value stocks. It’s easy to ignore short term cyclical noise, but it’s not easy to have conviction in long term secular market dynamics, especially when it negatively affects your returns.

If an analytical process works for an investor, he/she will continue to ride the wave. The wave gets bigger as more capital follows it. A strategy which gave some investors their career success will not be abandoned quickly. Standing in front the wave simply doesn’t work if it lasts for years. The difference between stubbornness and discipline is a fine line; ultimately you need to ask yourself if your logic is wrong if it hasn’t been working for years.

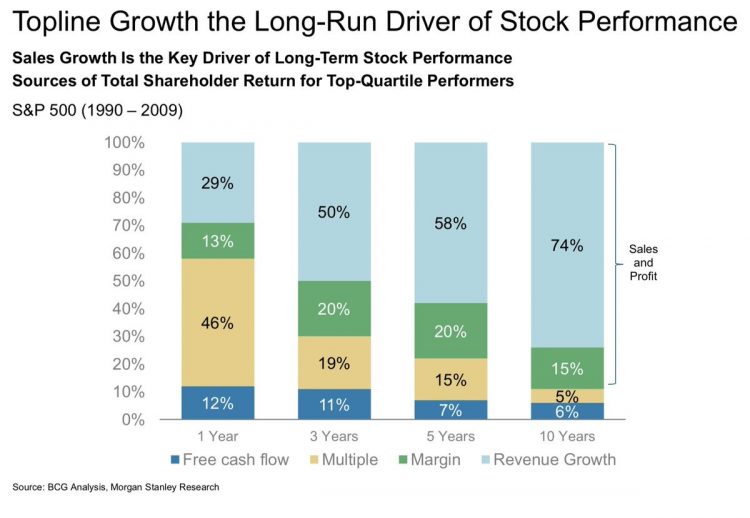

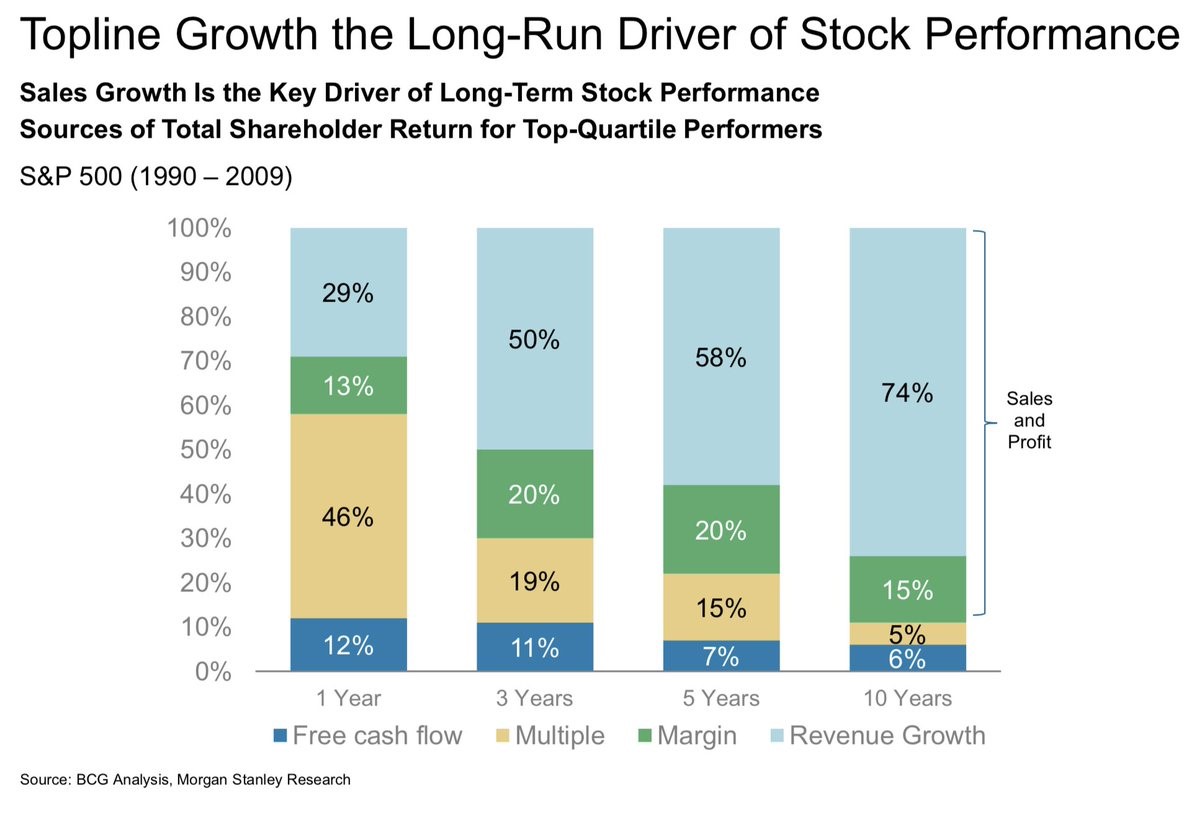

Sales Growth Drives Returns

We explained why long trends in thinking stay in play. They snowball as capital follows what is working. Therefore, you need to deeply examine what is working to understand how to profit off the wave. One major trend is the importance of sales growth. In this cycle, growth stocks have outperformed value stocks which has left value investors with losses or has caused them to alter their strategy. Interestingly, revenue growth had been an important valuation metric even before this cycle.

As you can see from the Morgan Stanley chart below, from 1990 to 2009,revenue growth was the biggest driver of long term shareholder returns.

Source: Morgan Stanley

The other aspects listed are free cash flow, stock multiples, and changes to margins. Discounted free cash flow models are a great way to understand how a firm operates and which operations of the business are important. However, predicting sales growth has been more fruitful to realizing returns over the long term.

Latest Sales Results From Q2