On Monday we syndicated an outlook for crude oil that was at least a little bit alarming. Specifically, Oil Price Information Service’s co-founder Tom Kloza cautioned that seasonal influences could crimp demand for oil. This is around the time of year when refineries are maintained; some of them are also still switching over to heating oil production.

End result? A backup in the supply of unrefined crude that ultimately puts downward pressure on prices. Another round of hurricanes that shutter refiners will only exacerbate the problem, that at least sometimes those shutdowns are matched by production shutdowns as well.

The $64,000 question is, is there any empirical evidence that there’s a seasonal slowdown that puts the kibosh on crude prices? Or, is this just another one of those half-baked assumptions that sounds intelligent on paper but ignores the dozens of other factors that could apply bullish pressure on crude prices?

The answer may surprise you. The answer is yes, crude oil really is moving into a time of year when bearish price pressure is reliable. There is a caveat though.

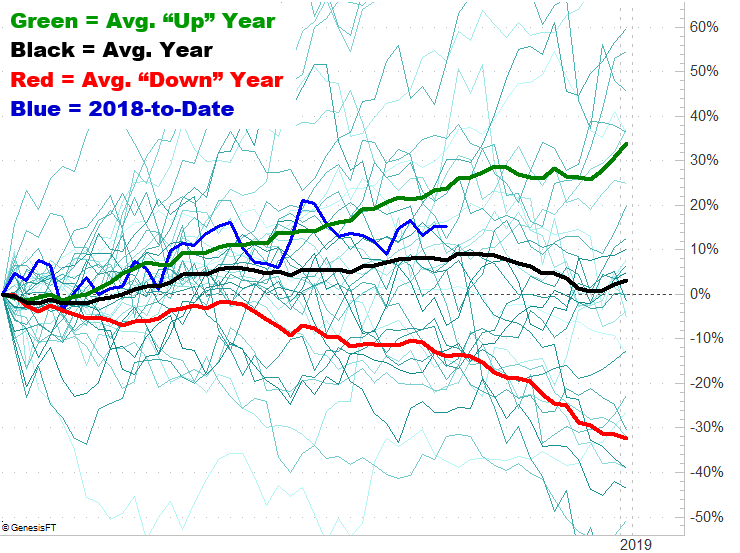

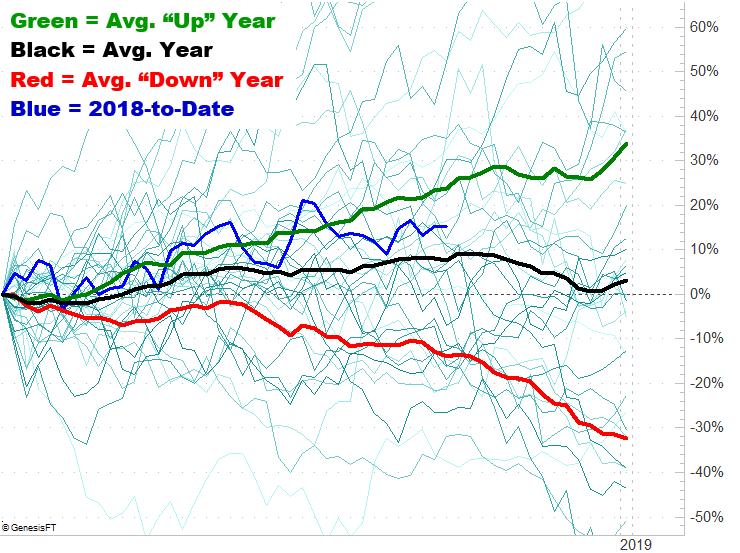

The graphic below tells the tale. On it are four main plots… the average day-to-day outcome of a bullish year for crude oil prices, plotted in blue, where the red plot indicates the average day-to-day net change in the price of oil in a losing year for the commodity. The black line is the average performance for bullish and bearish years. The blue line? That’s where crude oil prices are year-to-date… a bit ahead of the norm.

The thin green/blue lines in the background are the actual path crude oil prices followed for each and every year going back to 1984. Clearly, that data isn’t useful on its own for trend-spotting purposes, though it is worth noting that crude prices exhibit huge standard deviations. That is to say, the actual results in any given year can vary widely from the norm. Interestingly, this year is odd in that it’s been relatively typical.