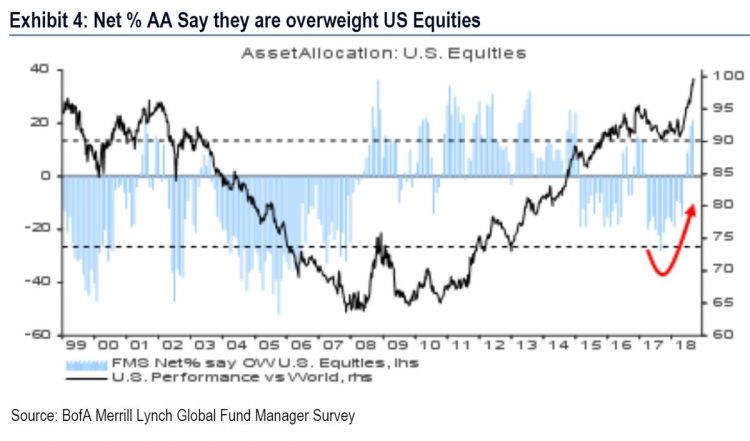

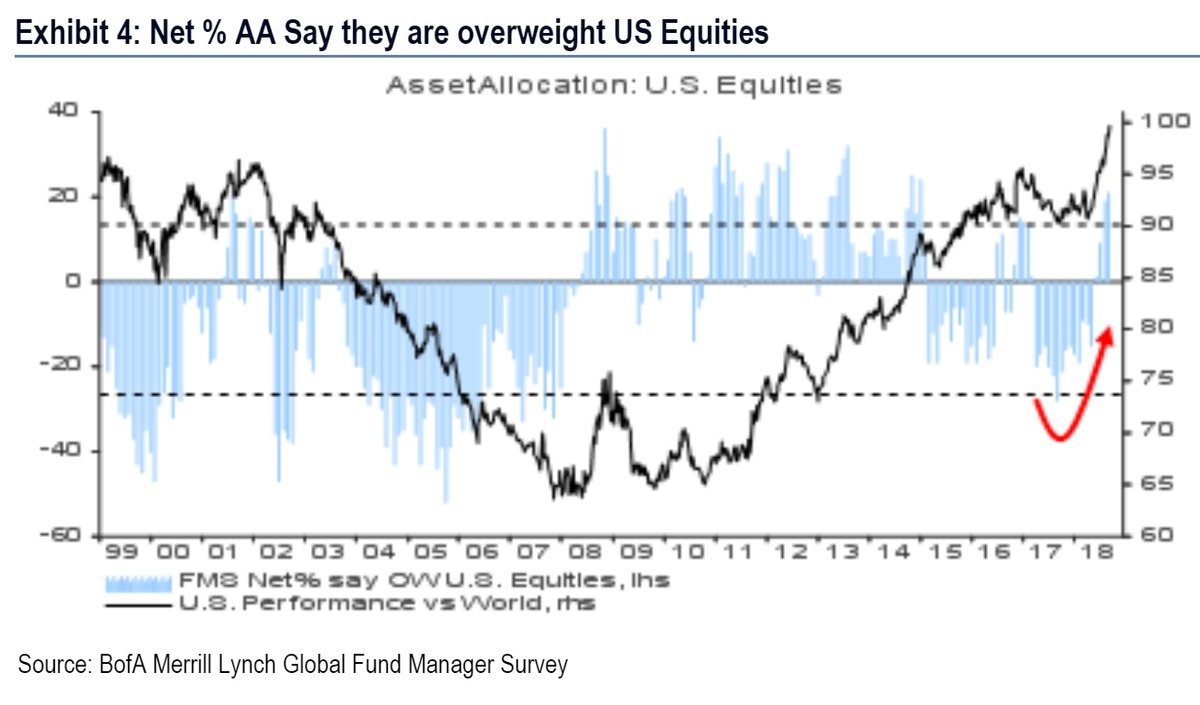

The US stock market has been on a fantastic run in 2018 even though returns are close to the historical average because other markets have seen weakness. As you can see from the chart below, US stocks underperformed last cycle and outperformed this cycle.

Source: Bank Of America Merrill Lynch

Some of this relative performance is caused by China as the Shanghai Composite is now at the lowest point since 2014. Emerging markets have had a weak 2018 with the iShares MSCI Emerging Markets index falling 12.56% this year.

As you can see from the blue bars in the chart above, the Bank of America Merrill Lynch survey shows fund managers were mostly underweight U.S. stocks last cycle and have been mostly overweight this cycle. You can see the turnaround from late 2017 to mid-2018 where fund managers recently went from being underweight US stocks to being overweight.

Once the global synchronized economic expansion ended, investors needed to find the winners. America has been a big winner this year as growth has been strong partially because of the tax cuts. With lower taxes, repatriated capital funding record buybacks, and an economy which still has momentum, there is a great recipe for outperformance. The U.S. market did well in 2017, but so did almost every other market, so there wasn’t outperformance.

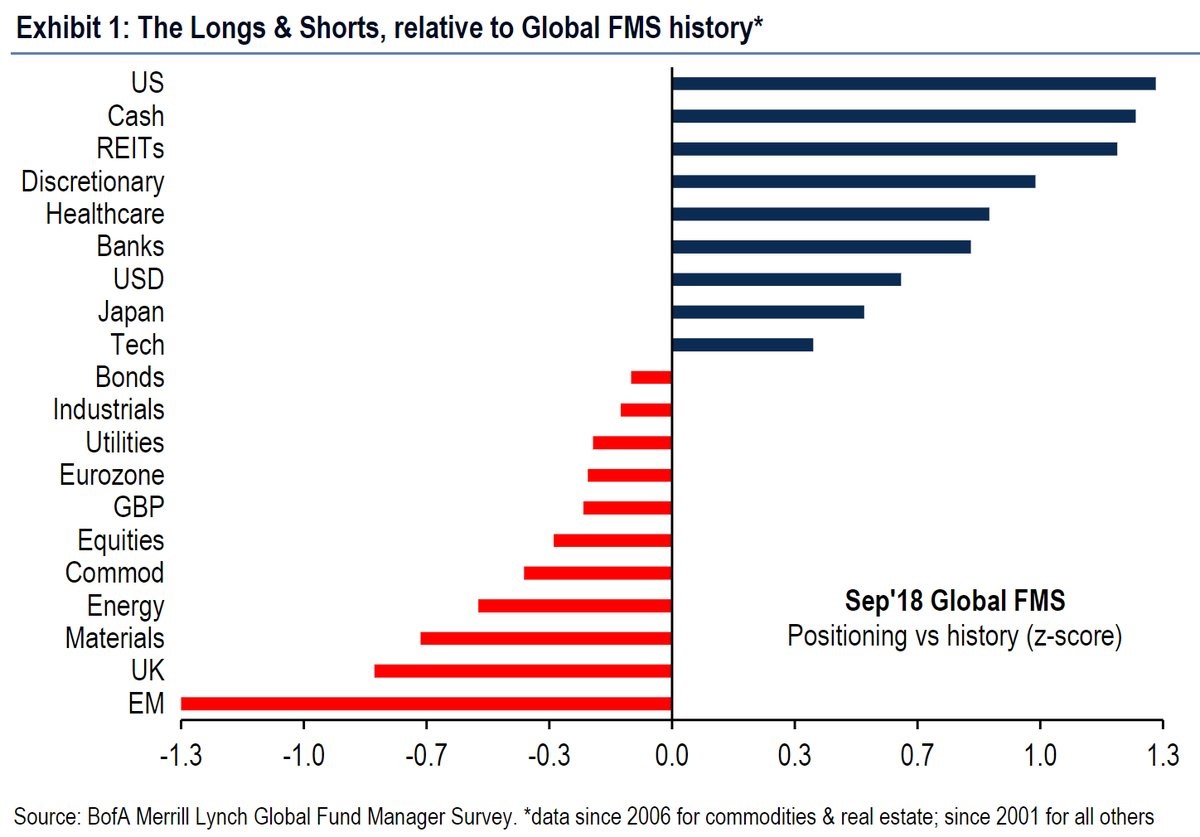

The chart below brings us the most updated information on the relative weighting of global fund mangers according to the Merrill Lynch survey.

Source: Bank Of America Merrill Lynch

Fund managers are the most overweight America as it has the highest z-score. Even though a huge part of America’s outperformance this cycle has been catalyzed by the tech leaders like Apple and Alphabet, tech has a slightly negative z-score as the FANG names have underperformed this quarter. Quarter to date, Amazon is the 95th best performer in the S&P 500. Alphabet is 287th best, Netflix is 447th, and Facebook is 490th.