Re-calibrating expectations for profitability; for monetary policy; and of course for ‘corporate earnings’, has dominated the ongoing rationalizations or interpretations, of what’s going on; what’s happened; or what it means.

(We all know what led up to the market break; the selling in FANG as well as others that’s gone on for weeks and in some cases months; the tighter monetary policy and the ridiculous assertion by President Trump tonight, that the Fed is ‘crazy’; as well as way a strong Dow and S&P masked lots of underlying distribution for months. Nevertheless, aside forecasting this, with the ‘Crash Alert Conditions Prevail’ warning just a week ago, and not from hubris, let’s review known prospects; as well as unknown risks.)

Today’s ‘wall-to-wall’ financial media reflections are certainly a good effort at explaining what ‘is’ going on (as if they had no idea before?); generally focused on the Fed; focused on most recent (or current) defensive action; and less so on several other factors, that we believe dominate the topic of ‘what’s really afoot’.

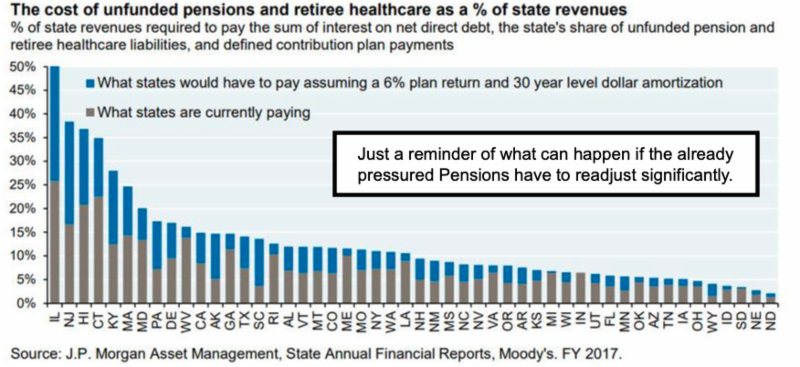

Those realities that are often ignored include: a) the Federal Reserve very clearly shifting monetary policy to ‘snugging-up’ rates and offloading their Balance Sheet, without comparable quantifiable replacement (tightening reduces liquidity regardless of rates especially as paper matures); b) the recent spike by rates that was (on a short-term basis) more than they had expected even from the last Fed Funds rate hike (hence debate about the concern regarding China simply holding but not being a participant in the 10-year Auction); c) the ‘trade & tariff’ issues, which to a degree override some other concerns, and d) the soft-pedaling of the upcoming Midterms, which risk shifting virtually everything with respect to projections regarding another growth leg-up.