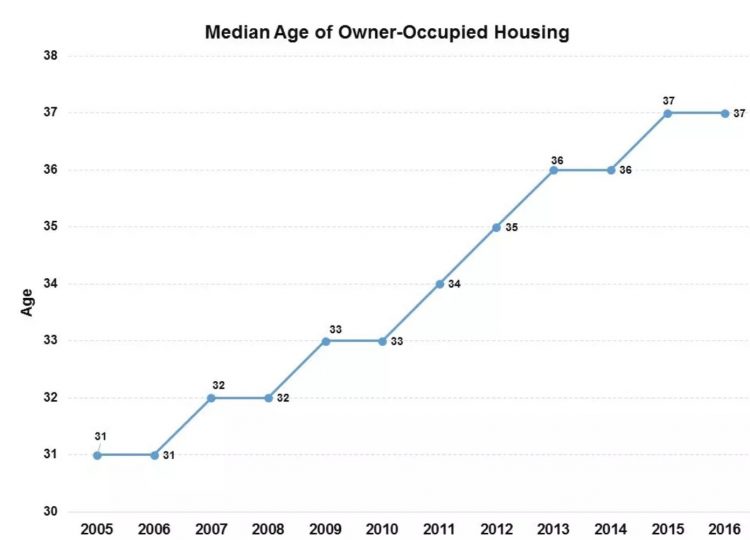

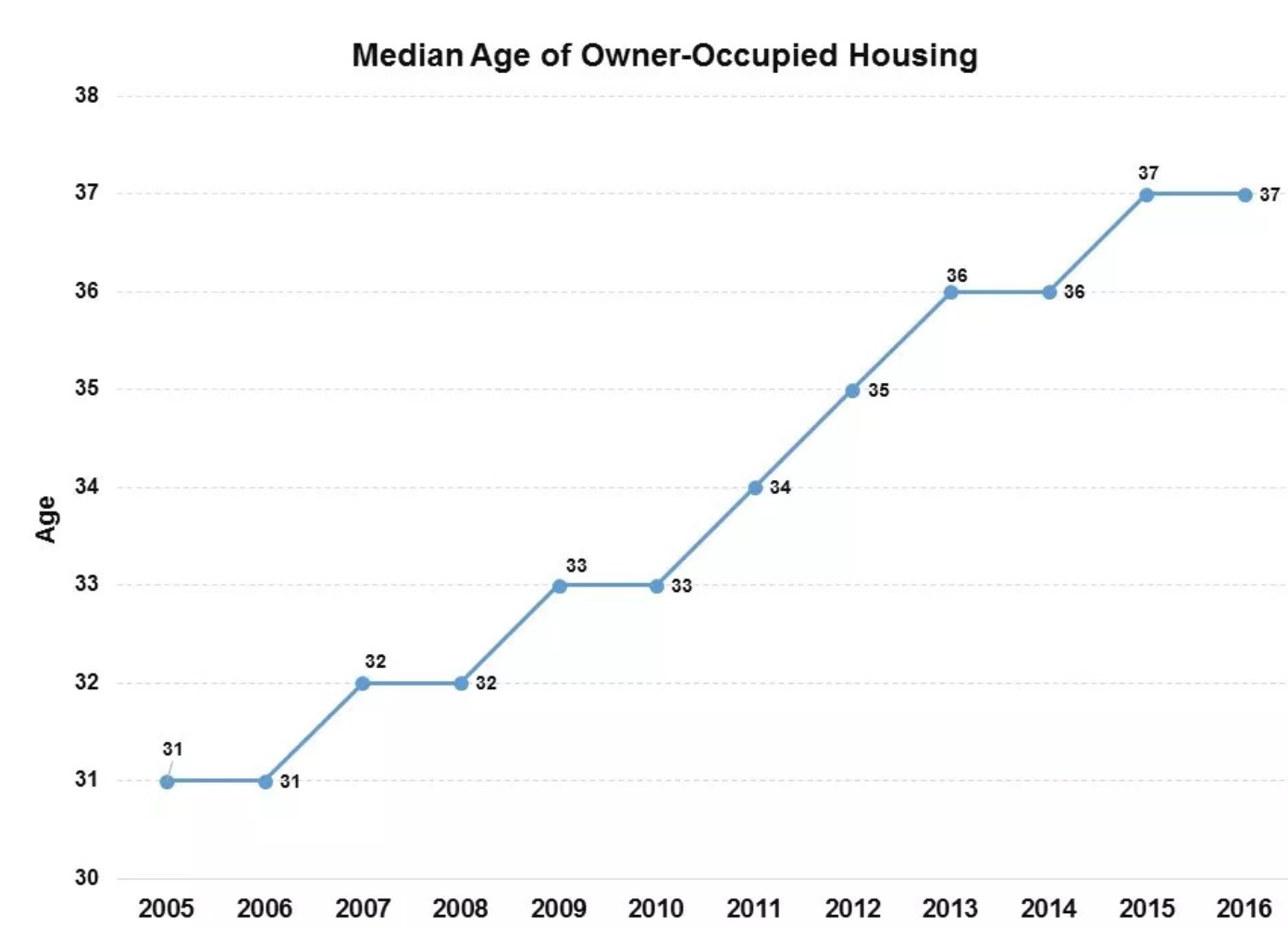

We have reviewed the impact demographics could have on the housing market and how millennials are delaying homeownership in many different articles. Even though bullish investors are hoping for a big spike in demand for housing, millennials aren’t delivering on their potential yet. The most popular age in America is 27. As you can see from the chart below, the median age of homeowners has increased from 31 in 2005 to 37 in 2016. In that time, the median age in America increased from 36.1 to 37.8. Therefore, most of the reason for this increase is because millennials aren’t buying houses at a young age.

Source: chart

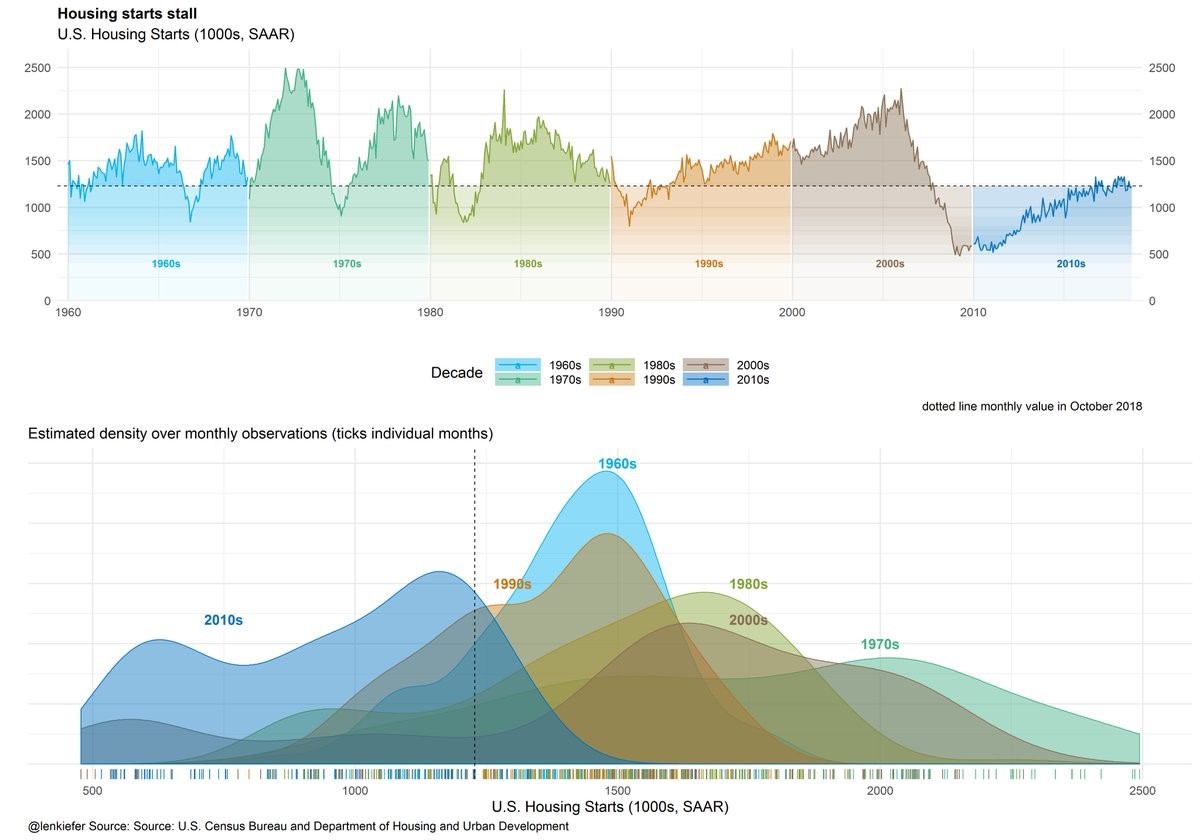

Millennials are having a tough time buying houses because of student debt and housing being unaffordable in most areas besides the Midwest. If prices fall, more millennials will buy houses, but that demand will push up prices again. The rising rates in the past year certainly don’t help. The chart below shows the historical changes in housing starts.

Source: Leonard Kiefer

It’s interesting because this cycle looks more like a recession than an expansion. It’s possible that the expansion extends for a few more quarters and housing starts increase further. If this is the end of the cycle, there was a dearth of housing starts. There haven’t been enough starter homes built to help millennials become homeowners. Sometimes it doesn’t make sense to buy a starter home if you’re only planning to live in it for a few years because of all the costs associated with buying and selling a home. Either way the lack of options isn’t allowing many millennials to buy their first home.

Housing Starts & MBA Applications

We will review the latest housing starts & MBA applications reports because housing has been one of the first indicators which has warned about a possible recession. October housing starts missed estimates, coming in at 1.228 million while expectations were for 1.24 million. They grew 1.5% month over month and fell 2.9% year over year. Multi-family starts were up 10.3% to a 363,000 rate which is great because there is a dearth of affordable apartments in many cities because of zoning laws. Single family housing starts were down 1.8%. They rose 4.7% in the south, were strong in the Midwest, and fell in the west and northeast.