I’m following-up on yesterday’s post about my Five Favorite Canadian Consumer Stocks with my top five on the U.S. market.

Five years ago, I created Dividend Stocks Rock. The idea was to build the most comprehensive and effective dividend investing platform. Throughout the past five years, our portfolios did very well (see for yourself). A key part of this success is attributed to asset allocation.

Both consumer defensive and consumer cyclical are two key sectors to build a strong dividend growth portfolio. The first sector will provide you with a shield against major fluctuation while the latter will add some spice to your investment recipe. Here are my favorite consumer stocks:

Disney (DIS)

Disney is the king of content. In 2006, IT bought Marvel for $4 billion. Six years later, Disney sealed another $4 billion deal with the Lucasfilm purchase. Both deals prove Disney’s incredible ability to generate billions of dollars with purchased content. Their latest acquisition, Fox assets, will bolster their content universe to a whole new level. Over the past five years, DIS blockbuster movies and theme parks showed strong potential and have driven both revenues and earnings up. Now that the company announced it will stream ESPN along with the rest of its content in 2019, DIS just unlocked another world of opportunities.

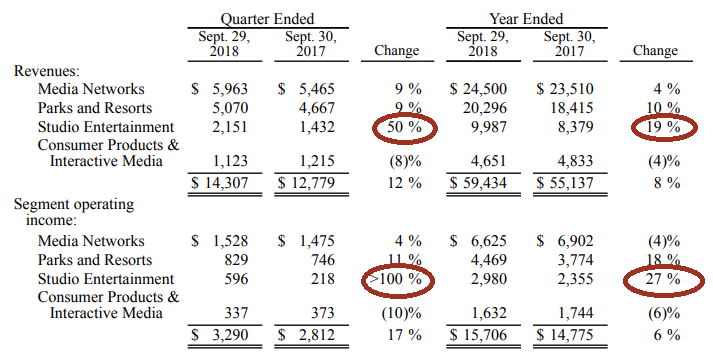

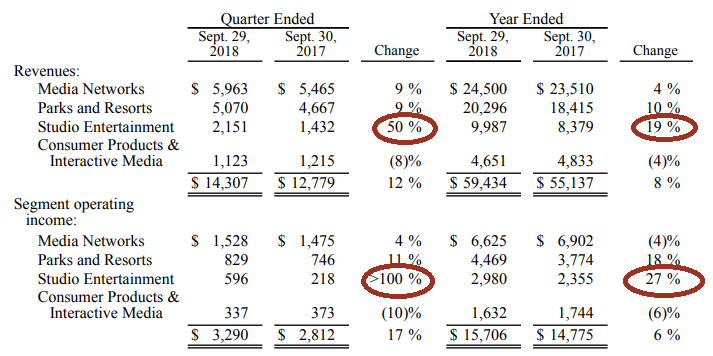

Source : DIS Q4 2018 report

As the company mastered the art of cross-selling, Disney has become an incredible cash flow machine. Its free cash flow has increased significantly in the past five years. Disney just found another way to use its universe of content through streaming. By launching two new services in 2019, the company will become a great complement to Netflix (NFLX). It will not compete against Netflix, it will simply use its popularity (and the fact NFLX developed this market) to surf on the streaming wave. The acquisition of Fox assets will add more fuel to this money-making machine.