Several months ago, I penned an article about the problems with “passive indexing” and specifically the problem of the “algorithms” that are driving roughly 80% of the trading in the markets. To wit:

“When the ‘robot trading algorithms’begin to reverse (selling rallies rather than buying dips), it will not be a slow and methodical process, but rather a stampede with little regard to price, valuation, or fundamental measures as the exit will become very narrow.”

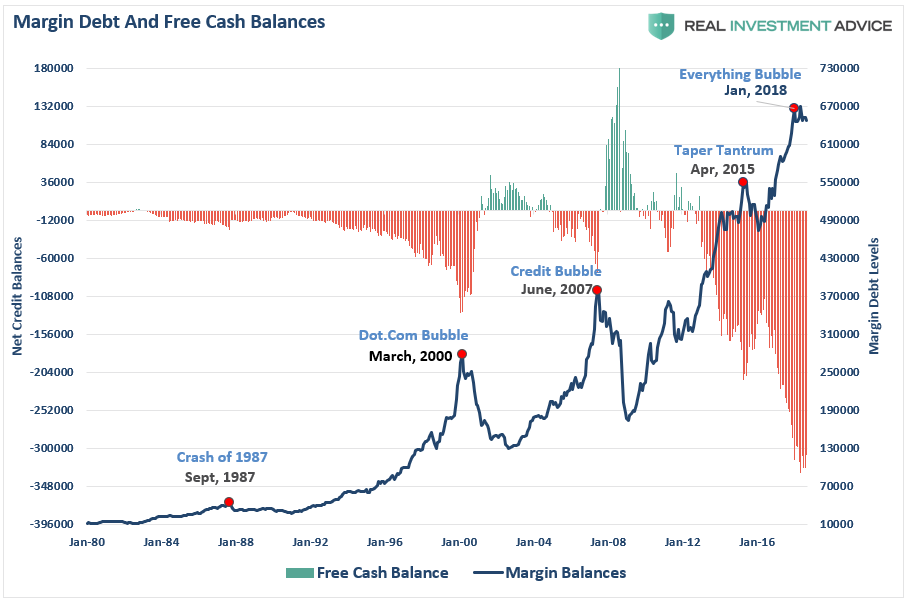

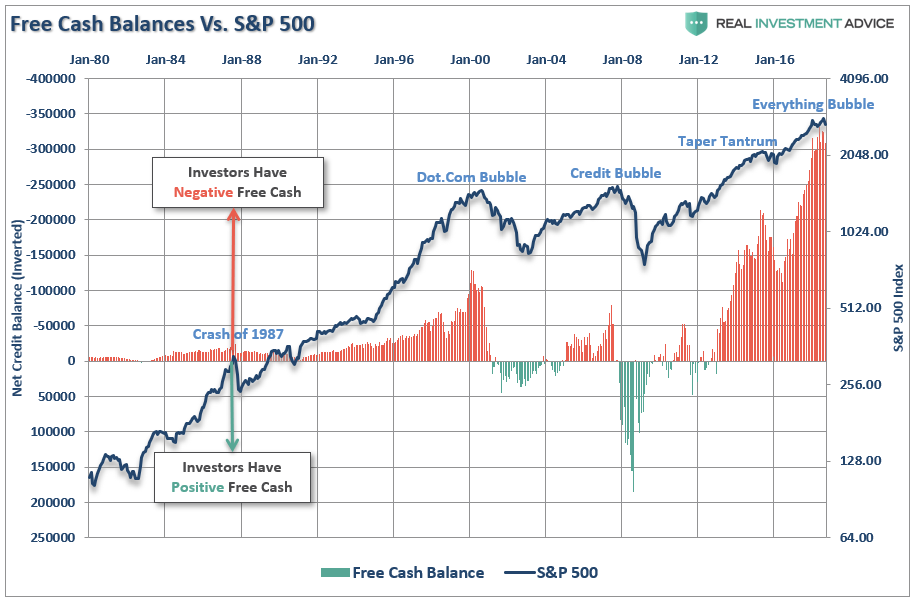

Fortunately, up to this point, there has not been a triggering of margin debt, as of yet, which remains the “gasoline” to fuel a rapid market decline. As we have discussed previously, margin debt (i.e. leverage) is a double-edged sword. It fuels the bull market higher as investors “leverage up” to buy more equities, but it also burns “white hot” on the way down as investors are forced to liquidate to cover margin calls. Despite the two sell-offs this year, leverage has only marginally been reduced.

If you overlay that the S&P 500 index you can see more clearly the magnitude of the reversions caused by a “leverage unwind.”

The reason I bring this up is that, so far, the market has not declined enough to “trigger” margin calls.

At least not yet.

But exactly where is that level?

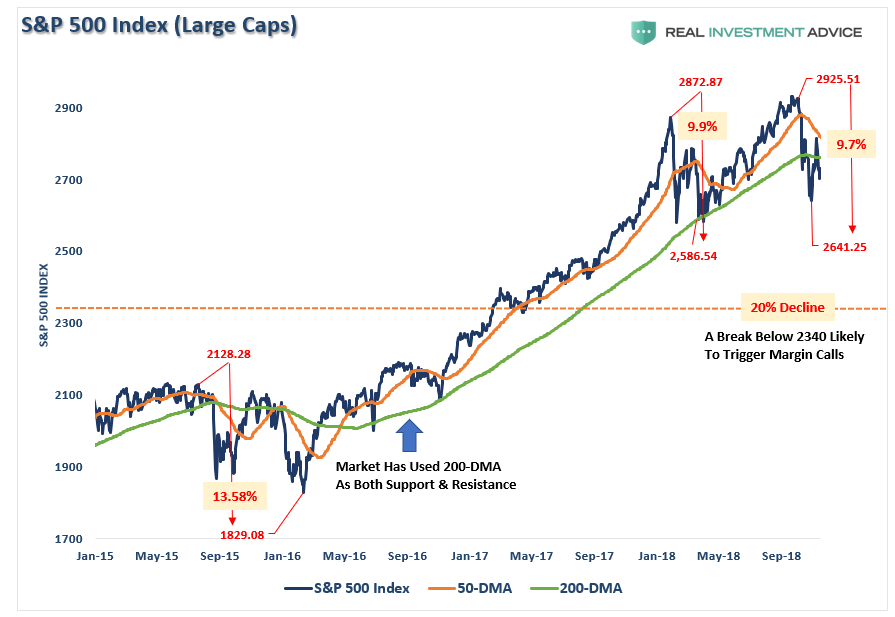

There is no set rule, but there is a point at which the broker-dealers become worried about being able to collect on the “margin lines” they have extended. My best guess is that point lies somewhere around a 20% decline from the peak. The correction from intraday peak to trough in 2015-2016 was nearly 20%, but on a closing basis, the draft was about 13.5%. The corrections earlier this year, and currently, have both run close to 10% on a closing basis.

My best guess is that if the market breaks the October lows, which given the current state of the market is a very high probability, we will likely see an accelerated “sell off” as the realization of a “bear market” starts to set in. If the such a decline triggers a 20% fall from the peak, which is around 2340 currently, broker-dealers are likely going to start tightening up margin requirements and requiring coverage of outstanding margin lines.

This is just a guess…it could be at any point at which “credit-risk” becomes a concern. The important point is that “when” it occurs, it will start a “liquidation cycle” as “margin calls” trigger more selling which leads to more margin calls. This cycle will continue until the liquidation process is complete.

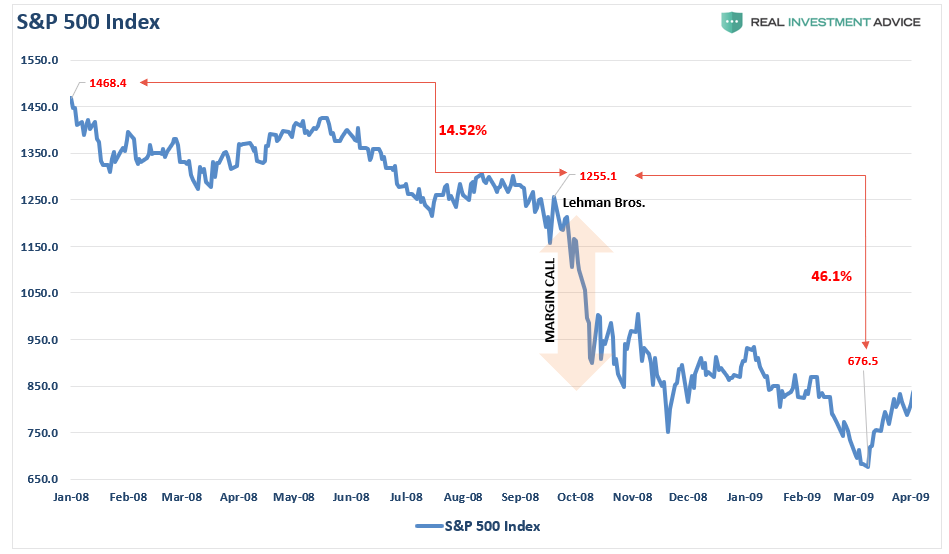

The last time we saw such an event was here:

Notice that from January 1st through September of 2008 the market had already declined from the peak by 14.5%. This “slow-bleed” decline was dismissed by the bullish media as we were in a “Goldilocks economy:”

Sound familiar?

Then, the “Lehman moment” occurred and the world changed and the realization we were in a recession would occur 3-months later.

From the end of September to March of 2009, the market lost an additional 46.1%. The bulk of the at loss occurred quickly as banks and brokerage firms scrambled to pull in margin lines.

The selling was relentless. It was also where many individuals found out there is a point where portfolios become an “Imported Rug Store” and “Everything Must Go.”

This is the problem with “margin debt.”

This is why we continue to urge caution.

The “bear market” in stocks is growling more loudly.

Last week, we further reduced equity risk further bringing exposures down to just 43% of our portfolios. On a rally to the 200-dma which fails, we will reduce risk more.