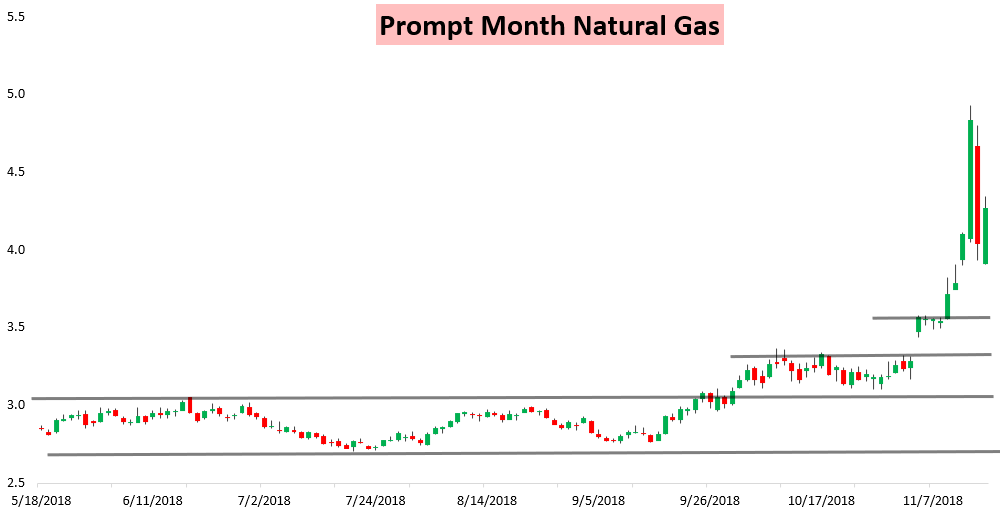

The volatility appears here to stay in the natural gas complex, as the December contract shot 6% higher and continued upwards post-settle on continued risks that the month of December starts quite cold.

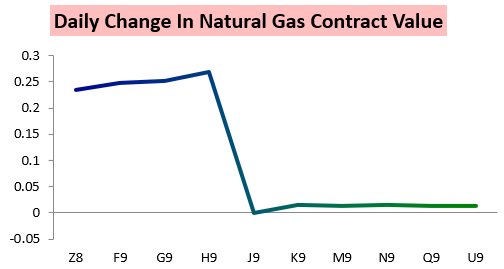

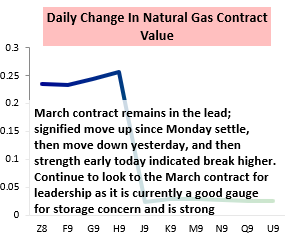

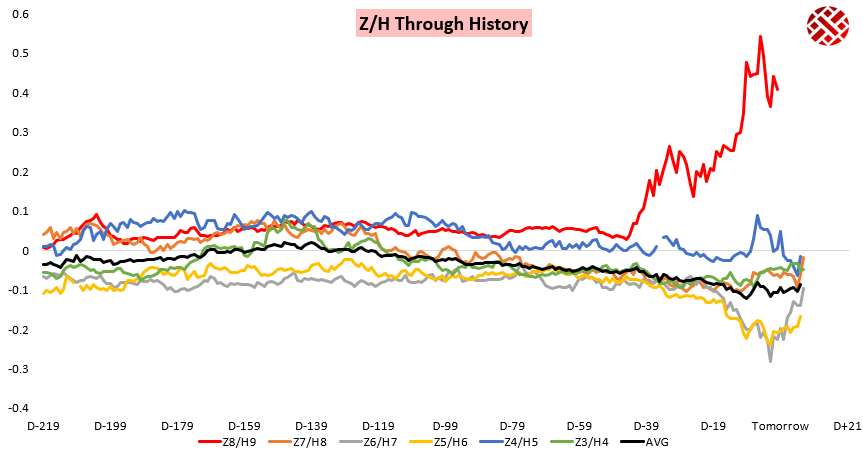

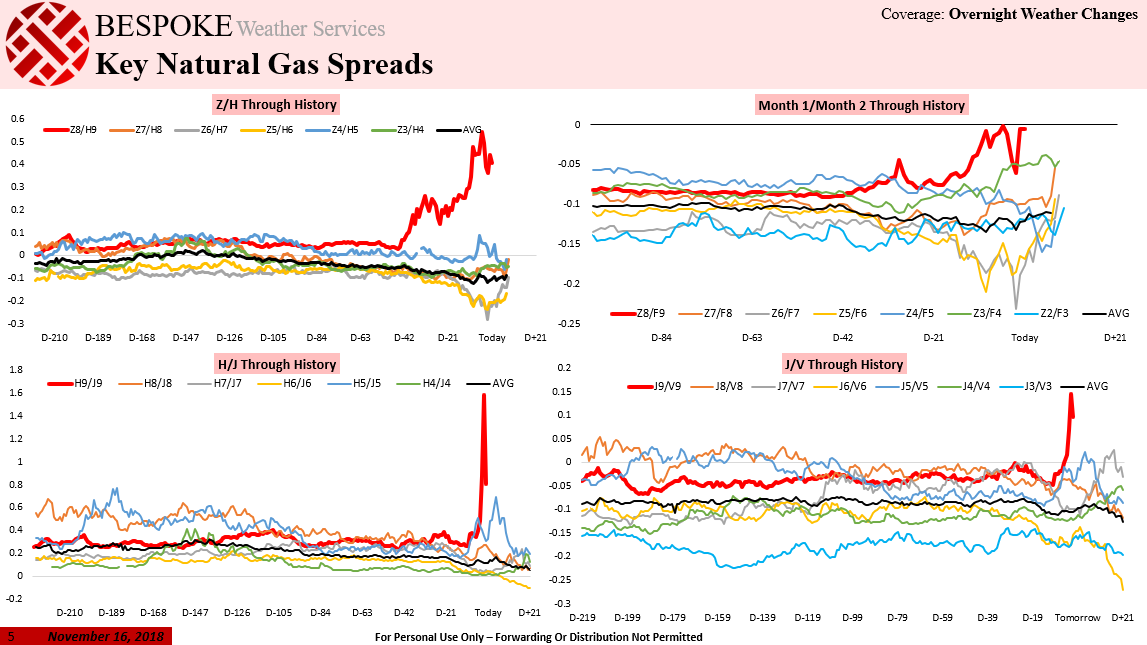

The theme of March leadership continued as well, with the March contract logging the largest gain again today after it led Tuesday and Wednesday as well.

Friday morning we warned to look for this March strength intraday as a signal that prices would remain strong, which verified well with the March contract very strong into the close with prices going out near the highs.

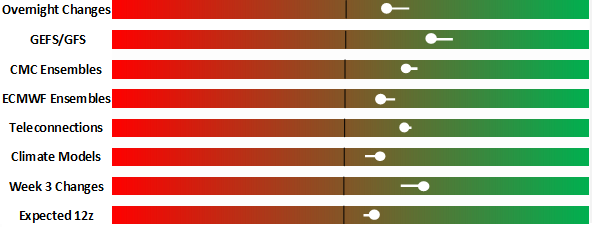

It was a wild week in the natural gas complex overall, though, with prices shooting higher earlier in the week before Wednesday’s absolute blowout, followed by a full retrace of Wednesday’s explosion Thursday. Overnight we noted yet another increase in bullish weather risks in the long-range, leading us to see “more support” and an “initial cash bump” for prices today off increased long-range cold risks.

We also warned that while overnight models were actually a bit less bullish in the medium-range with some warm risks, Week 3 cold risks were likely to increase on models Friday and 12z model guidance would increase those cold risks in the long-range, which played out on a colder 12z European model run.

Admittedly it was an extraordinarily volatile week, and after we held Slightly Bullish sentiment in reports Monday and Tuesday we turned Neutral the last few days due to extremely low confidence in the face of enormous volatility. Still, we did well to identify the key trends driving the market and the price bias each day as we saw increasingly cold long-range risks responsible for the spike today (and had warned of more upside risks still Tuesday night).

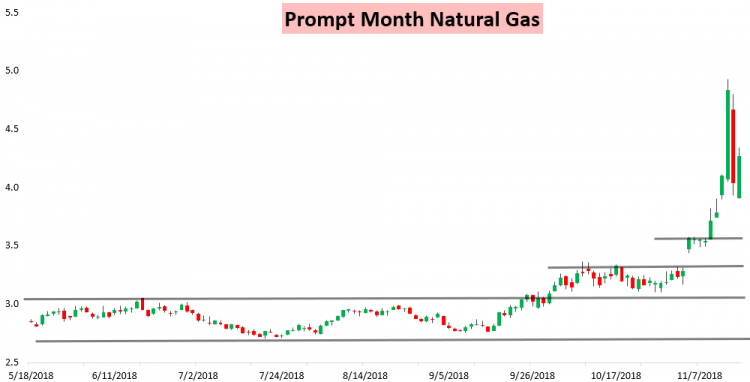

The 5-year average natural gas; after an extremely slow summer and fall, you can see how that has really ticked up.