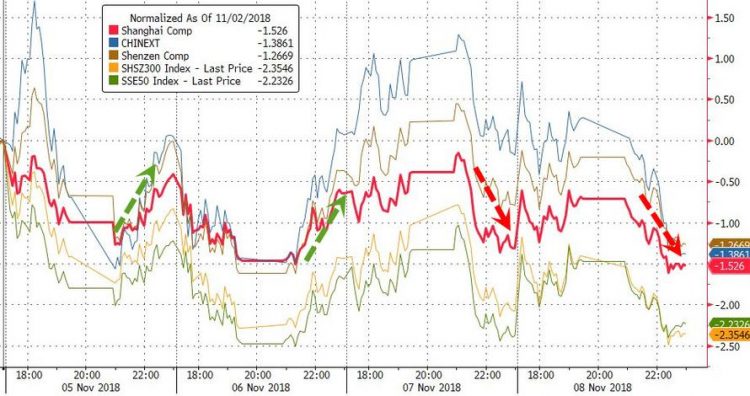

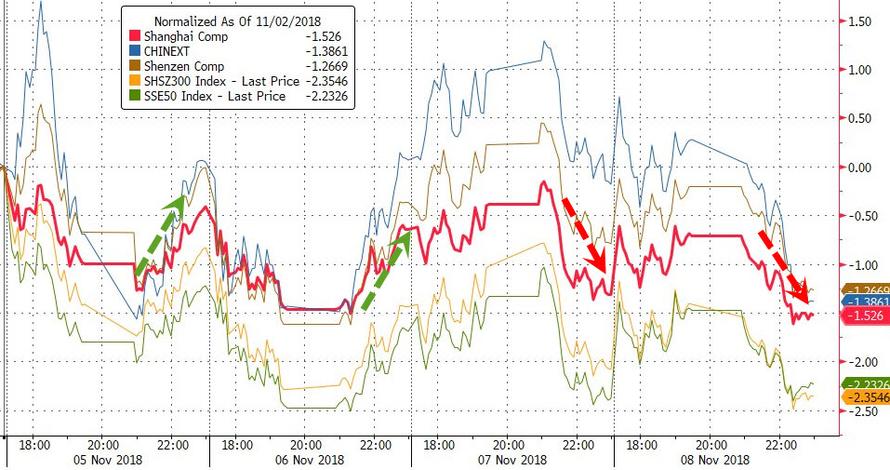

For the second day in a row, the afternoon session in China saw notable selling and no rescue…

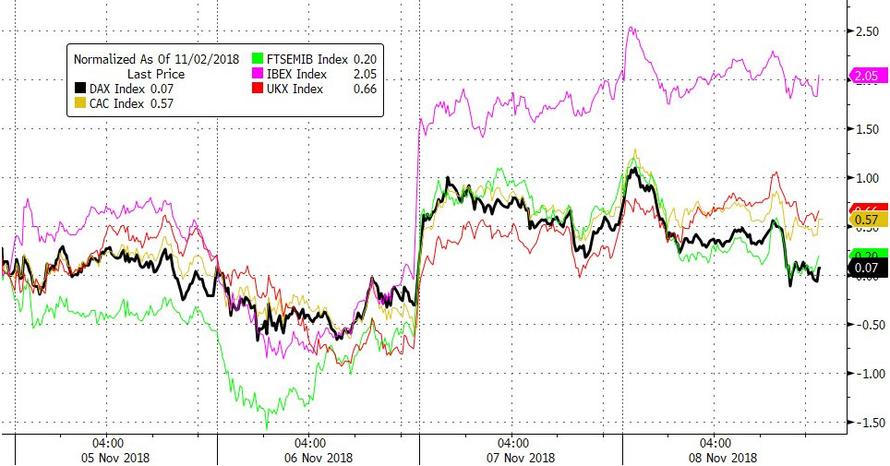

An early pop in Europe faded quickly leaving DAX unchanged on the week… (Spanish stocks are outperforming)

US Stocks, Gold, and bonds ended lower (in price) post-Fed, USD higher…

Stocks were all lower post-Fed.

And US equities tried their best to rally after the open but it all fell apart after The Fed’s hawkish statement…

US equity markets bounce stalled at crucial technical levels (S&P 100DMA, Nasdaq 200DMA, Dow 50DMA)

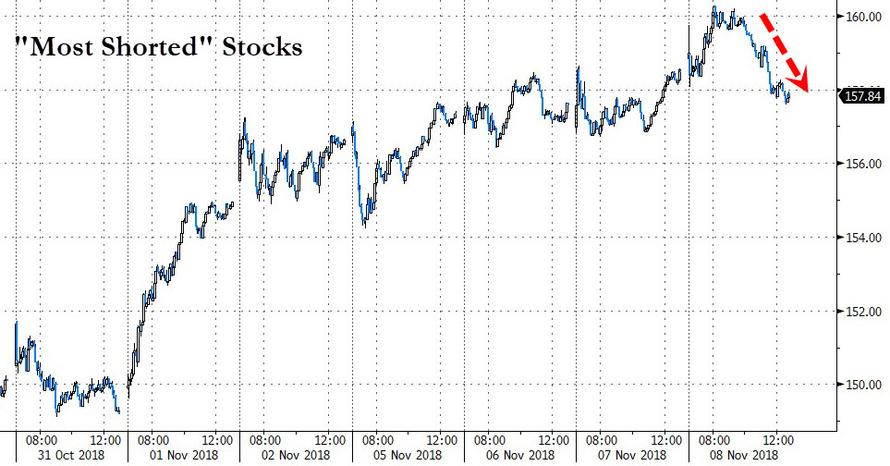

After 5 straight days of short-squeezing higher, “Most Shorted” stocks ended red today…

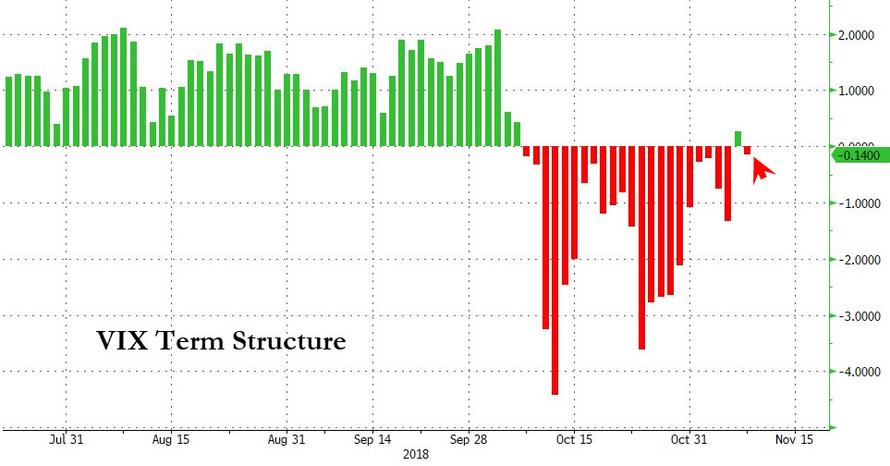

VIX term structure shifted back into inversion today as stocks sank…

Energy stocks sank today – as you’d expect – finally starting to catch on the to collapse in crude…fun-durr-mentals

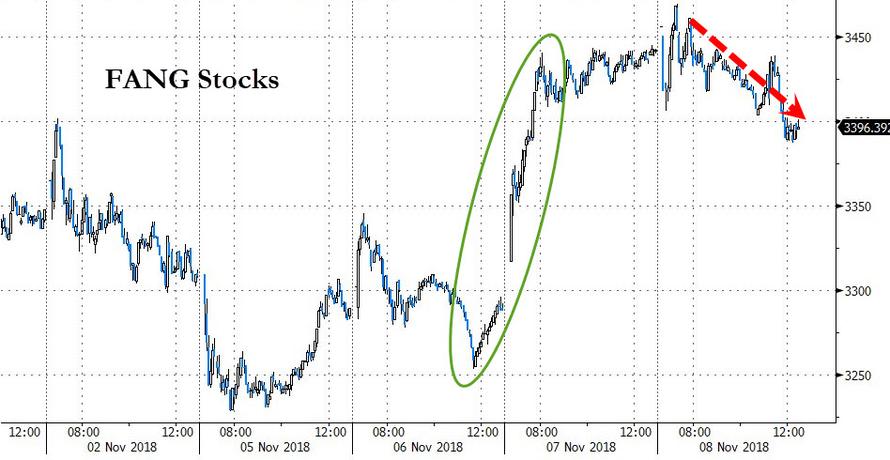

Yesterday’s exciting surge in FANG stocks stalled rather notably today…

Treasury yields were higher on the day (though the 30Y outperformed, ending unchanged) pushing higher after The Fed…

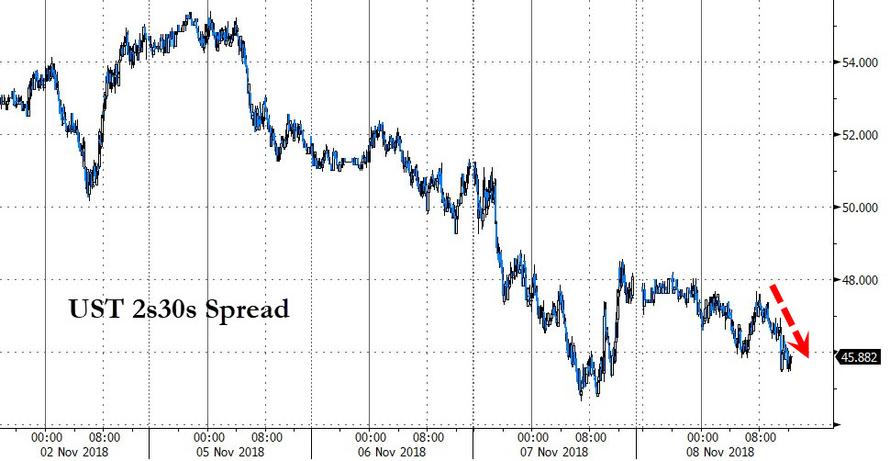

The yield curve flattened notably…

Either bond yields go lower or cyclicals are set to soar…

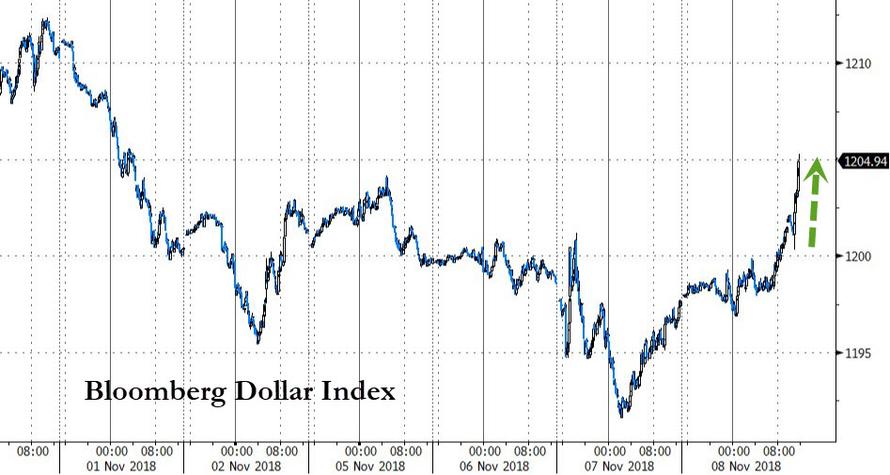

The USD Index was heading higher into the Fed statement and extending its gains notably after…

And as the dollar rallied, yuan slumped…

And EM FX plunged…

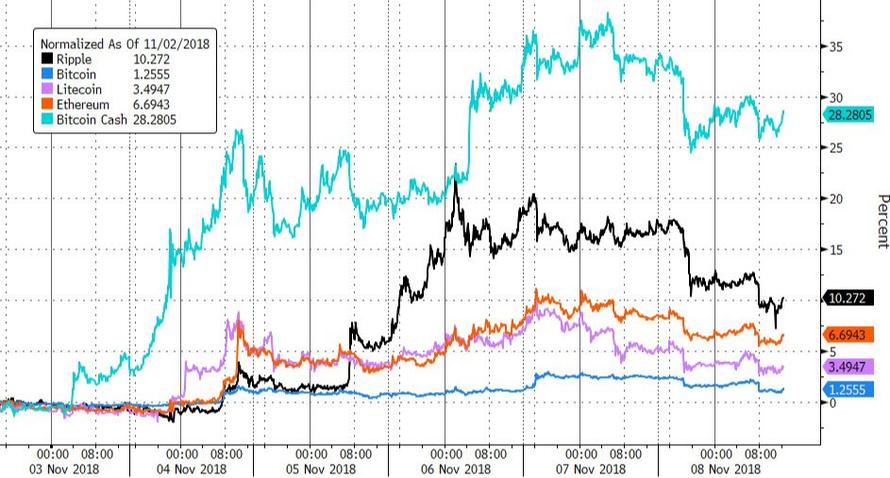

Dollar strength also weighed on cryptos…

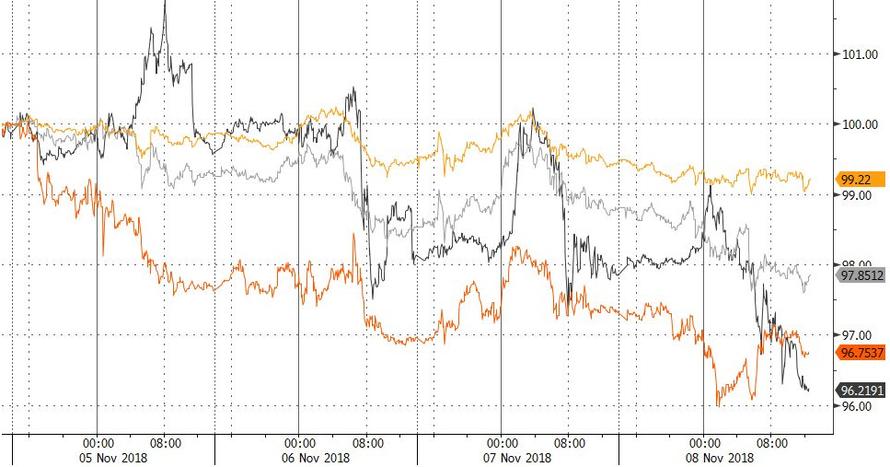

Crude and Copper lead the commodity carnage this week and PMs faded too as the dollar jerked higher…

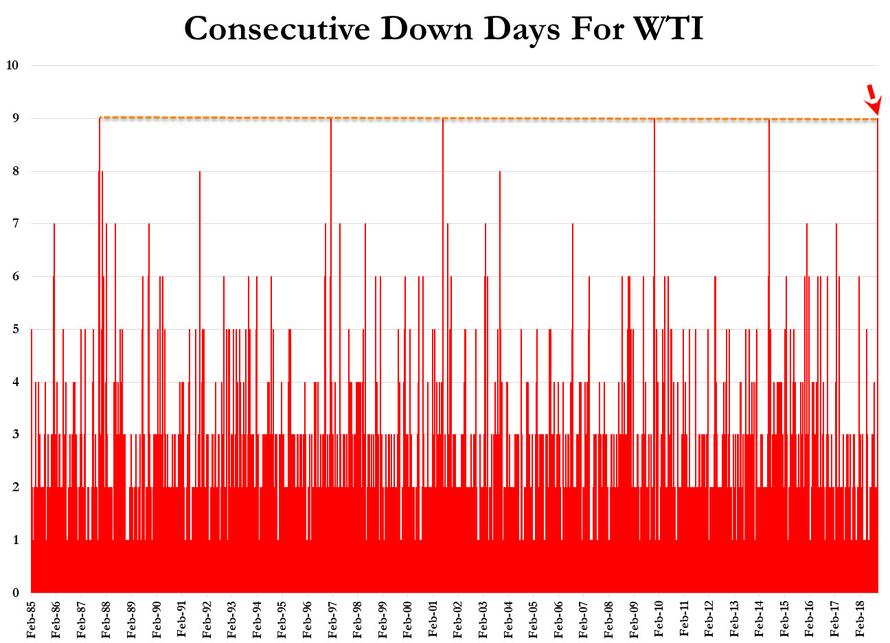

WTI Crude down 9 days in a row into a bear market, down 21.25% from Oct highs to 7-month lows…(a Hawkish Fed and OPEC-break-up chatter did not help)…

In 33 years of futures contract trading, it has never been down 10 in a row…