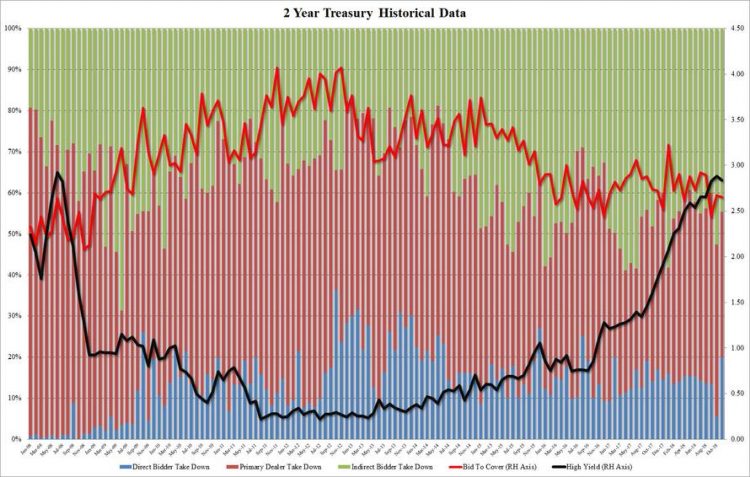

October presented rates traders with a bit of a mystery: virtually every Treasury auction saw a surprisingly low Direct takedown, in some cases Direct bidders taking down the lowest amount of paper offered in years. It now appears to be payback time.

Moments ago, the US Treasury sold $39BN in 2 Year Notes, a $1 billion increase from last month’s offering, which priced at 2.836%, stopping through the When Issued by 0.1bps, and below last month’s 2.881% as a result of the recent decline in rate hike odds.

And while the Bid to Cover was virtually unchanged at 2.65%, down from 2.67% a month ago and below the 2.76 six auction average, it was the internals that were of note because the previously noted collapse in Direct bidders is now gone, and instead in the just-concluded auction Directs took down 19.5%, a nearly 4x increase from October’s 5.5%, and well above the 12.8% six auction average. As a result of the Direct surge, Indirects were awarded 44.9% of the final allotment, down from 52.6% last month, and in line with the 44.0% average, while Dealers took down just 35.6%, the lowest going back to January 2018 when they ended up with just 25.8% of the auction.

Overall, a rather unremarkable auction except to note that it now appears that Directs are trying to overcompensate for their lack of participation in last month’s auctions. Whether this pattern sustains, check back after the 5 and 7Y auctions over the next two days.