First, what is the difference between these two methods of investing? We walked through leveraged ETFs last time, so we will focus mainly on margin trading today. Margin trading refers to borrowing funds from a broker in order to trade an asset such as stocks. The purpose of the loan is to amplify the gains on the invested position. However, margin trading is inevitably subject to the risk of substantial losses in the meantime. Hence, the purchased asset is also the collateral for the loan. Oftentimes, a broker allows an account to borrow up to 50% of the purchased price of a stock. The portion that is not borrowed funds is called the initial margin. A broker usually requires a minimum balance to be maintained in the account. This restriction is called the maintenance margin. If the account balance falls below the maintenance margin, your broker will send you a margin call and ask you to deposit funds to meet the requirement.

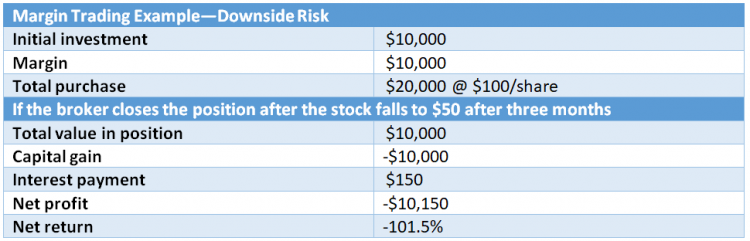

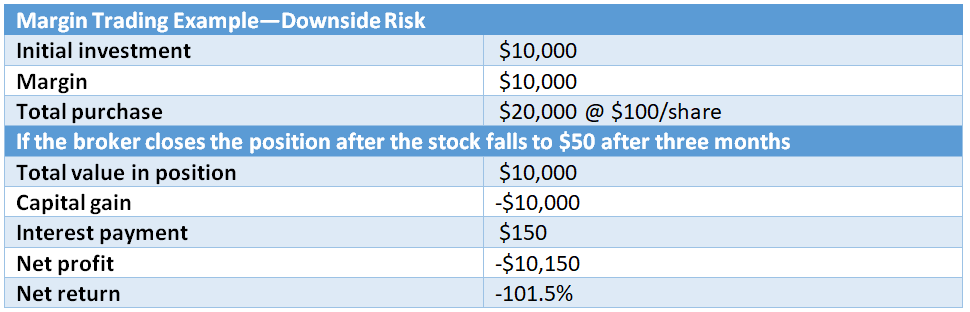

In a worst-case scenario, if an investor fails to deposit funds to meet the margin requirement, the broker can force-sell the investor’s stocks without notice. Margin liquidation is the main risk embedded in margin trading. Investors could lose 100% of their investment and possibly more by using margin. To demonstrate, we will use the example summarized in the table below. Assume we borrow 50% to purchase 100 shares of a stock at $100 a share, with a 6% interest rate, and ignore transaction costs. Hypothetically, the stock price goes down to $50 three months later. We are then left with zero equity and 100% debt. We also need to pay the interest on the loan to the broker, who will likely close the position if we fail to add any funds. If we don’t, we will lose 100% of our investment plus roughly 1.5% interest on the $10,000, for a total -101.5% return.

Table 1. Margin trading example – downside risk

What if we used a leveraged ETF and had the same stock movement? Although there is no ETF tracking just one stock, we will assume that there is, for the sake of simplicity. The short answer is that we would lose the 100% investment as the ETF fell to $0 per share. But we wouldn’t be subject to more than a 100% loss, as all ETFs incorporate the management fees into their NAVs.