Have I mentioned that this bubble in stocks – the one that most economists and analysts still claim “is not a bubble” – is now the greatest by far in its numerical advance, its percentage gains, and time frame? You’re damn right I have!

I’m broadcasting the warning far and wide, to any who will listen. Hopefully I can save a few, including you…

Unfortunately, people fat and drunk and high on free-money crack don’t see any bubble (nor do they want to, even if they could)! They especially don’t see the double bubble that has formed.

Real estate and stocks have both bubbled together strongly in similar time frames since 2012. They continue to do so, although the Dow Home Construction Index is signaling a warning, as I shared with you here.

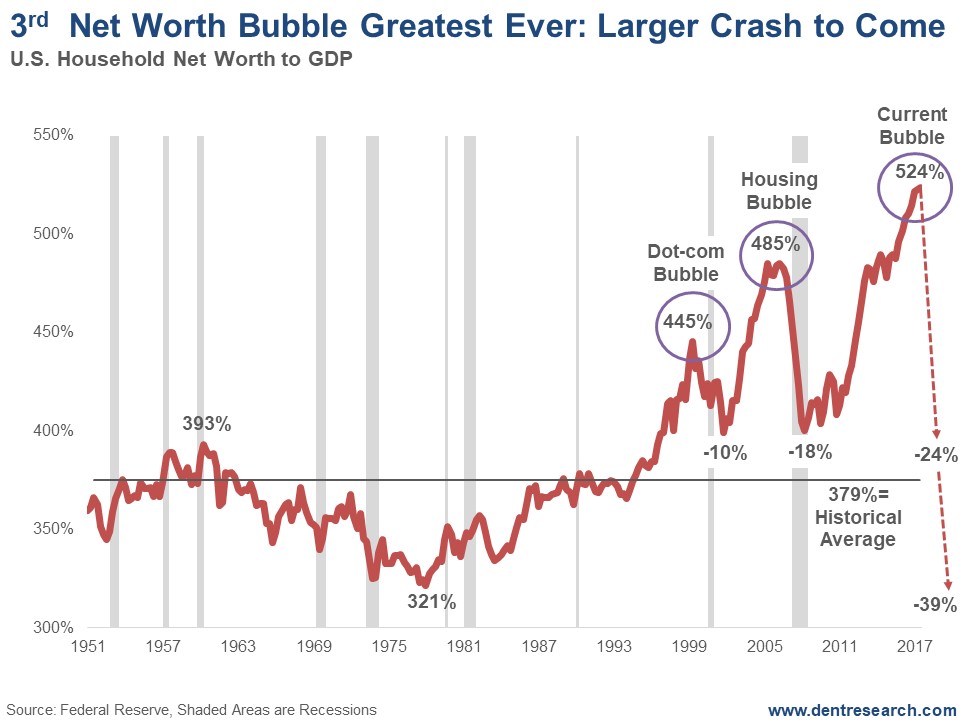

Look at this chart…

It shows household net worth as a percentage of GDP as far back as it was measured in 1951.

We’re in uncharted territory for sure.

The peak in the last generational wave and long-term bull market was in early 1961 at 393% net worth to GDP. I’m sure it wasn’t as high even in the great 1929 bubble top. Back then fewer people owned homes or stocks.

The bottom hit in 1978 at 321%, down 18%. It took until late 1989 to get back to the historical average of 379% and until 1997, or 19 years, to get back to that 1961 high.

Then the first bubble, driven more by the tech stock bubble, saw new highs of 445% between 2006 and 2007. That fell 10% back to around 400% in 2009… not so bad because real estate held up, cushioning the fall.

The second bubble was driven more by real estate, as it bubbled for the first time, and accelerated to 485% in early 2000. It then dropped a more serious 18%, back to 400%. That time around, both sectors were down, and net worth was slower to accelerate again because Real estate didn’t bottom until mid-2012.

But from 2012 into recently, we’ve seen the greatest net worth bubble ever! It’s reached a staggering 524% of GDP… we’re rich!