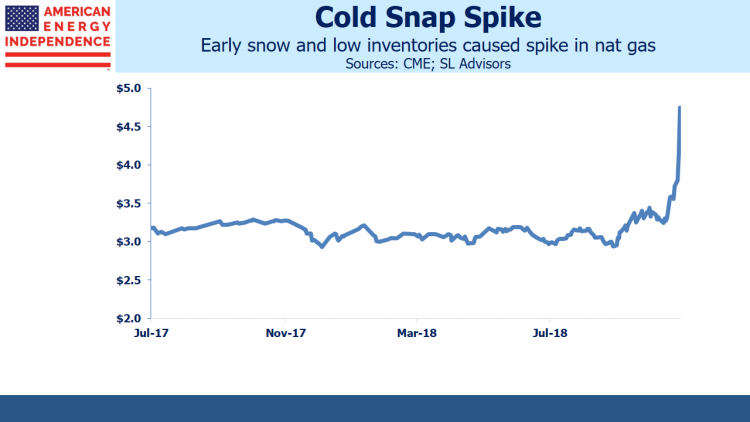

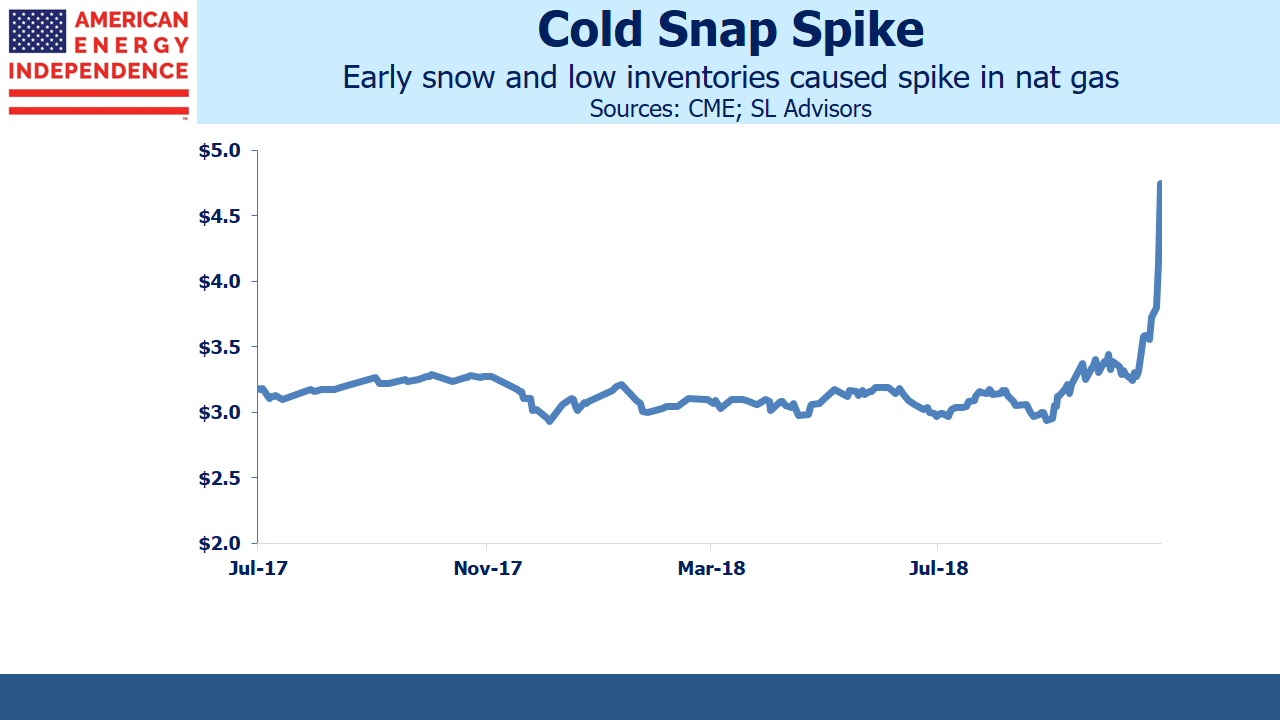

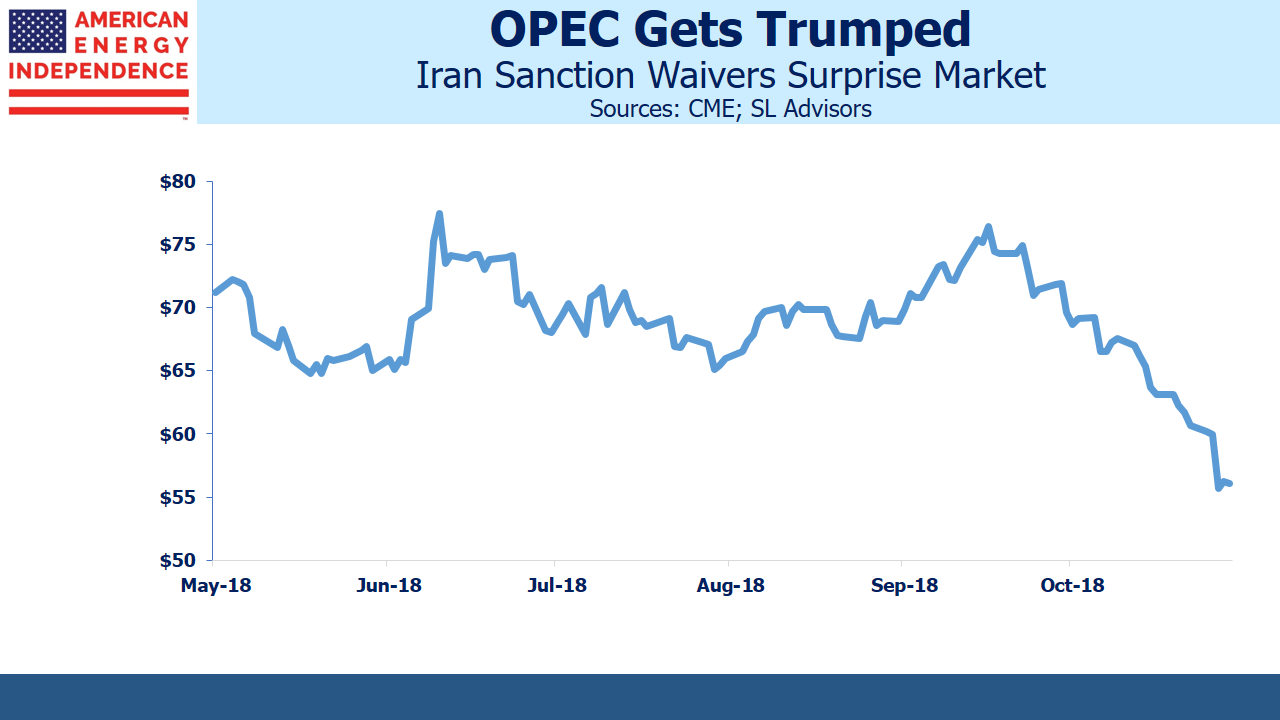

If pipeline stocks moved with natural gas rather than crude oil, their long-suffering investors could look back on a good week. On Tuesday crude was down $5 per barrel for the week, before recovering $2 by Friday. It’s tumbled $20 since early October, bringing Brent Jan ’19 to $66. By contrast, the Jan ’19 natural gas contract stormed out of its $2.90 to $3.50 per Thousand Cubic Feet (MCF) range that has constrained it all year, almost reaching $5 on Wednesday. Rarely have oil and gas been so disconnected.

The energy sector moves to the rhythm of crude. It’s is a global commodity, relatively easy to transport, which allows regional price discrepancies to be arbitraged away. Oil can move by ship, pipeline, rail or truck. Transportation costs vary from a few dollars per barrel for pipeline tariffs or waterborne vessel to $20 or more by truck. Although Canada’s dysfunctional approach to oil pipelines has led to deeply depressed prices, in most cases transport costs are a portion of the cost of a barrel.

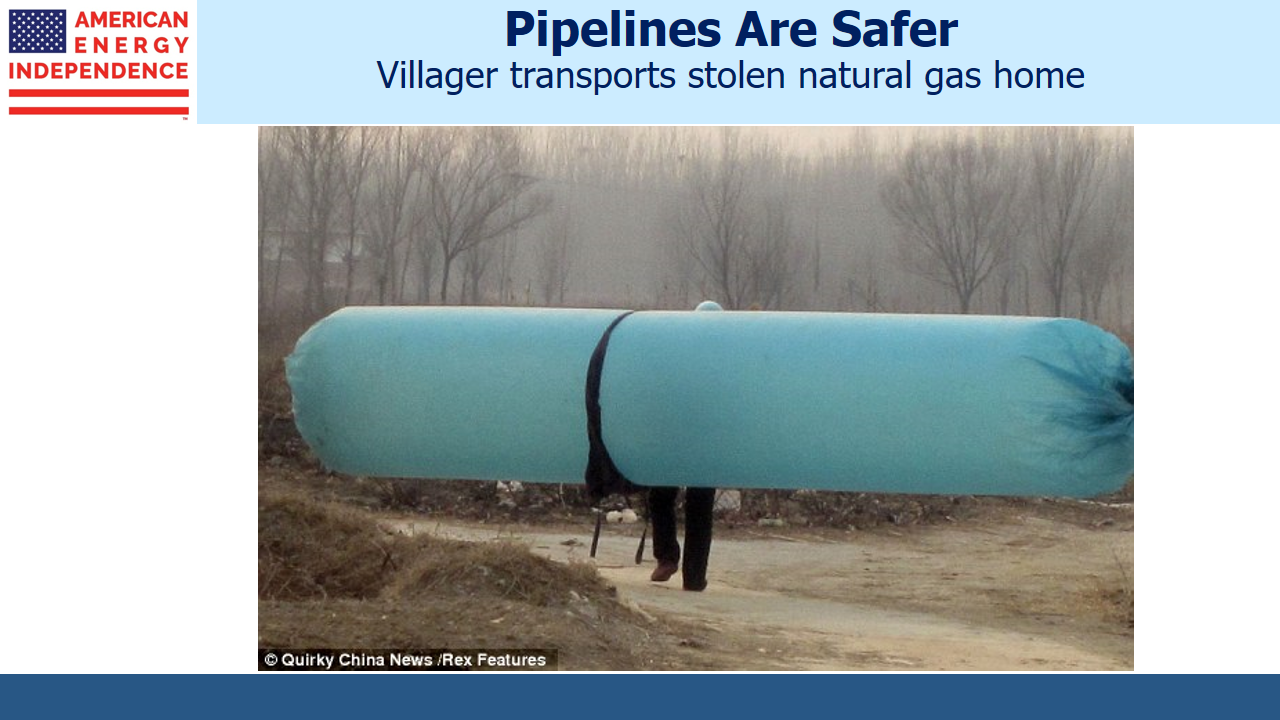

By contrast, natural gas (specifically methane, which is used by power plants and for residential heating and cooking) generally only moves through pipelines or on specially designed LNG tankers in near-liquid form. Long-distance truck transportation isn’t common because liquefying methane to 1/600th of its gaseous volume requires thick-walled steel tanks. Methane moved as Compressed Natural Gas (CNG) is only 1% of its normal volume (i.e. requires 6X more storage volume than LNG) which generally renders long-haul truck transport uneconomic. LNG shipping rates from the U.S. to Asia are $5 or more per MCF, more than the commodity itself. The 10-15,000 mile sea journey is worth it because prices in Asia are $8-15 per MCF, compared with normally around $3 per MCF in the U.S.

The result is that natural gas prices vary by region far more than crude oil.

There are price discrepancies within the U.S. too. The benchmark for U.S. natural gas futures is at the Henry Hub, located in Erath, LA. This is where buyers of $5 per MCF January natural gas can expect to take delivery. By contrast, 700 miles west in the West Texas Permian basin, natural gas is flared because there isn’t the infrastructure to capture it. Gas is flared because it’s worthless. Mexican demand is coming, but construction south of the border is running more slowly than expected.