Wall Street loves to label stuff. When markets are rising it’s a “bull market.” Conversely, falling prices are a “bear market.”

Interestingly, while there are some “rules of thumb” for falling prices such as:

There are no such definitions for rising prices.

Simply, rising prices are “bullish.”

It’s all a bit arbitrary and rather pointless.

As investors, it is important to understand what a “bull” or “bear” market actually is.

Here is another extremely important definition for you.

Investing is the process of placing “savings” at “risk” with the expectation of a future return greater than the rate of inflation over a given time frame.

Read that again.

Investing is NOT about beating some random benchmark index which requires taking on an excessive amount of capital risk to achieve. Rather, our goal should be to grow our hard earned savings at a rate sufficient to protect the purchasing power of those savings in the future as “safely” as possible.

As pension funds have found out, counting on 7% annualized returns to make up for a shortfall in savings leaves individuals in a vastly underfunded retirement situation. Making up lost savings is not the same as increasing savings towards a future required goal.

Nonetheless, when it comes to investing, Bob Farrell’s Rule #10 is the most relevant:

“Bull markets are more fun than bear markets.”

Of this, there is no argument.

However, understanding not only the difference between a “bull” and “bear” market, but when a change is occurring, is critical to capital preservation and appreciation.

So, what really defines a “bull” versus a “bear” market.

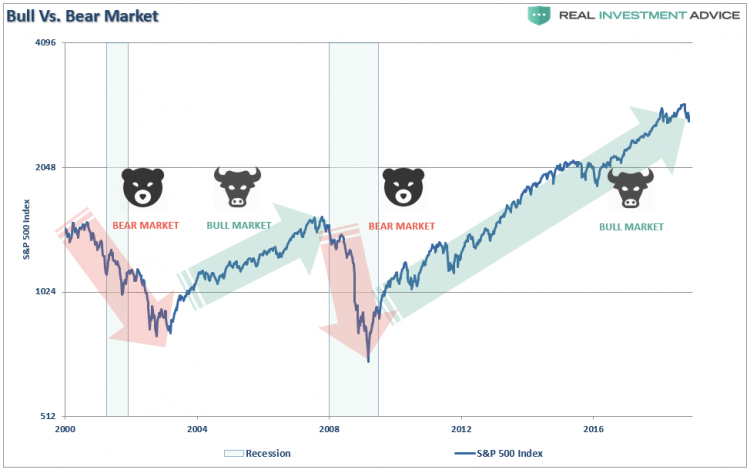

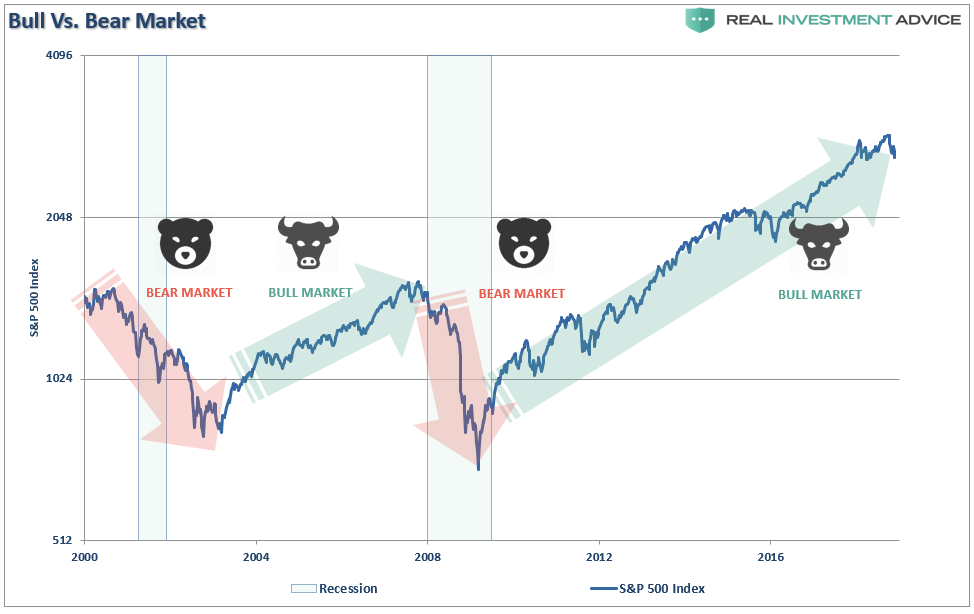

Let’s start by looking at the S&P 500.

Bull and bear markets are obvious with the benefit of hindsight.

The problem, for individuals, always comes back to “psychology” with respect to our investing practices. During rising, or “bullish,” markets, the psychology of “greed” not only keeps individuals invested longer than they should be but also entices them into taking on substantially more risk than they realize. “Bearish,” or declining, markets do exactly the opposite as “fear” overtakes the investment process.