After a strong start to the last week of November on Monday, it’s looking like we’ll give back half of those gains this morning. The culprit today? Trade. What else is new? There’s a lot of Fedspeak on the calendar, though, so we’ll be watching for any signs of a change in tone.

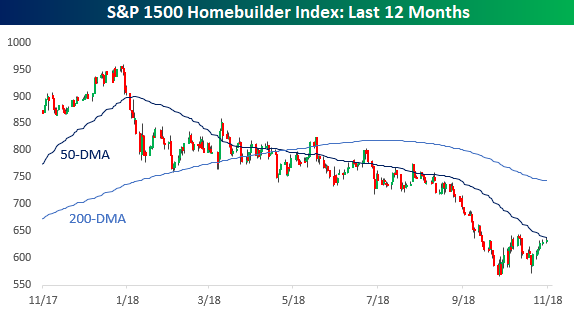

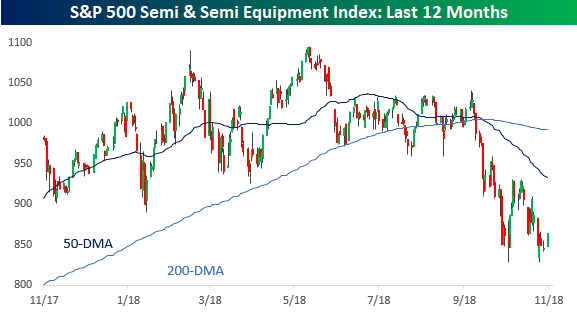

Two sectors of the market we continue to watch religiously are the homebuilders and semis. Both of these groups started to see significant weakness well ahead of the broader market, so if they can stabilize, it stands to reason that it would be a good sign for the market in general. Looking at the two charts below, we have seen some somewhat encouraging signs that the groups are stabilizing, but they are hardly out of the woods yet.

In the case of homebuilders, that group made a successful test of its late October lows in the last week or so, but still hasn’t made a higher high or traded back above its 200-DMA. Until either of those developments unfold, the group could just as easily roll back over.

Semis don’t even look as encouraging as the homebuilders. For now, the group looks to be attempting to establish a double-bottom, but it has yet to show much in the way of a bounce.