Headline data for truck shipments similar trends and growth rates.

Analyst Opinion of Truck Transport

I tend to put heavier weight on the CASS index which continues to show a strong and upwardly trending rate of growth improvement year-over-year. However, this month the CASS rate of improvement is 6.2 % YoY whilst the ATA is 6.3 % YoY.

It should be pointed out that the trucking movements are improving YoY – and the likely reason is the shift from box stores to eRetailers.

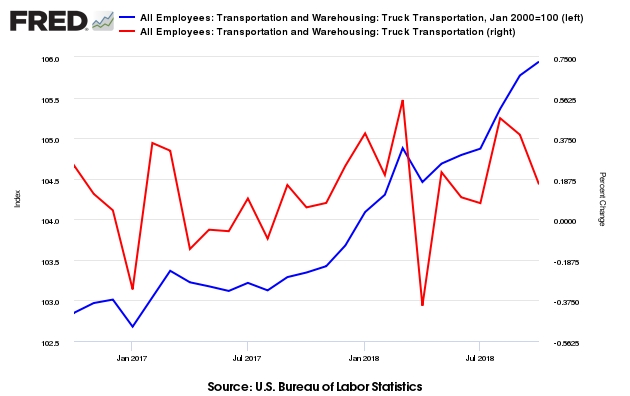

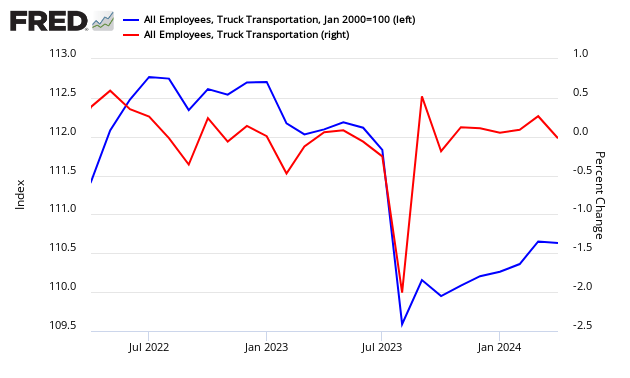

Econintersect tries to validate truck data across data sources. It appears this month that jobs growth says the trucking industry employment levels rate of growth slightly slowed in September – which is consistent with Cass. Please note using BLS employment data in real time is risky, as their data is normally backward adjusted (sometimes significantly).

ATA Trucking

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 6.3 % in October after increasing a revised +0.1 % in September.

Said ATA Chief Economist Bob Costello:

After slowing at the end of the third quarter, truck freight surged in October. Last month’s strength was due, at least in part, to strong import numbers, especially on the West Coast. This is likely a pull ahead of imports as shippers try to take delivery of goods before January 1 when tariffs on a large list of goods China increases from 10% to 25%.

ATA Truck tonnage this month (not updated by ATA for October)

Compared with October 2017, the SA index increased 9.5%, up from September’s 3.8% year-over-year increase. Year-to-date, compared with the same period last year, tonnage increased 7.3%.

source: ATA

CASS FREIGHT INDEX REPORT

The Transportation economy continues to signal solid economic growth; perhaps not at the scorching pace other data feeds that represent smaller segments of the freight flows, we continue to see the Cass Freight Shipments and Expenditures Indices as one of the single strongest proxies for what is happening in the overall U.S. freight markets. The freight markets, or more accurately goods flow, has a well-earned reputation for predictive value without the emotional or anchoring biases that are found in many models which attempt to predict the broader economy.