Buying a house is a big deal. Owning a home comes with many expenses, and if you’re like a lot of people, you may be looking for a way to tighten your budget as much as you can.

For some that can lead to some level of initial disappointment when they realize that they are required to carry mortgage protection insurance.

When is mortgage insurance required?

When is mortgage insurance required?

For many people, getting mortgage protection insurance is not optional. It is a required part of buying a residential property.

It is necessary to have this type of insurance if you are making a down payment on a home that is less than 20% of the purchase price. This may happen because the buyer does not have 20% of the purchase price available to them, or if they find a “fixer upper” and want to spend some of those allocated funds on home improvements rather than sending it all to the mortgage company. This required mortgage insurance is specifically called Private Mortgage Insurance (PMI) and it exists primarily to protect the lender, not necessarily the homeowner. Required PMI insurance is commonly associated with FHA loans where down payments are as low as 3.5%.

How mortgage insurance protection differs From PMI

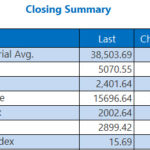

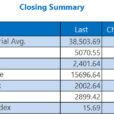

Rates for PMI loans are determined by loan-to-value ratio (LTV) which is a measure of how much equity the owner has in the home. In most cases, this is removed when the LTV is around 78-80% of the value of the loan as long as payments are current.

Mortgage Insurance Protection, offered by Symmetry Financial Group, is a bit different from PMI insurance. Homeowners normally purchase this insurance in order to protect themselves, rather than their lender.

While PMI is used for more conventional loans with a lower down payment, Mortgage Insurance Protection is used in cases of FHA loans backed by the government. There are two components, the upfront premium and the annual premium. Annual premiums can vary depending on the length of the loan. Shorter loan terms mean lower annual premiums. Upfront premiums may be paid outright, or they may be financed into the mortgage.

While Private Mortgage Insurance primarily protects the lender in case you default on your mortgage loan, MIP is more about you, which is why it is important to look at your MIP insurance options closely in order to pick the policy that is best for you. It is designed to protect you if something goes wrong in your life, such as a disabling condition or the loss of a primary breadwinner in your home. At Symmetry Financial Group your policy isn’t a one size fits all expense. Our agent will take the time to decide what kind of coverage you need in order to stay protected. We can also look at other types of insurance that may benefit you so you can truly feel like all the bases are covered for you and your family.

Whether you are buying a new home or looking to refinance your existing home, Mortgage Insurance Protection from Symmetry Financial Group is worth exploring.