My 5 Favorite Mid Cap Stocks

Nov 10, 2017

Jeremy Parkinson

Finance

Today I wanted to find 5 Mid Cap Stocks that not only made great returns in the last year but still seemed to have some more upside momentum. I used Barchart to sort the S&P 400 Mid Cap Index stocks first for the highest Weighted Alpha, then again for technical buy signals of 80% or more. Next […]

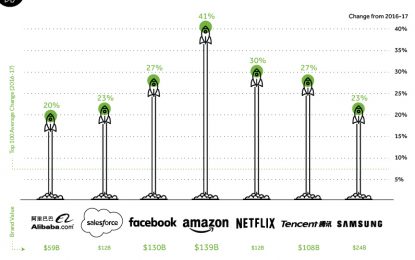

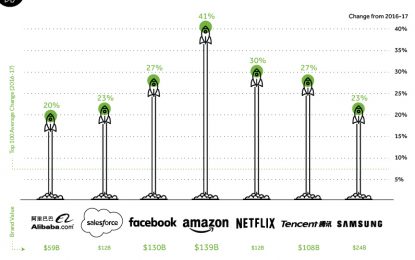

The World’s Fastest Growing Brands In 2017, By Value

Nov 10, 2017

Jeremy Parkinson

Finance

In a modern business era of near-constant disruption, which brands are winning the hearts of consumers the fastest? Today’s charts look at the brands that are trending upwards. See below for the brands that have gained the most in brand value since last year, as assessed by BrandZ in their report on the world’s 100 most valuable […]

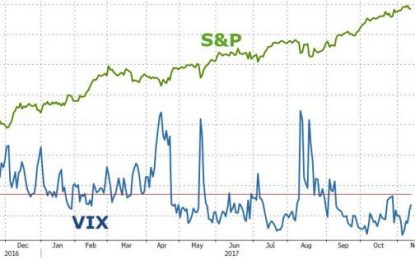

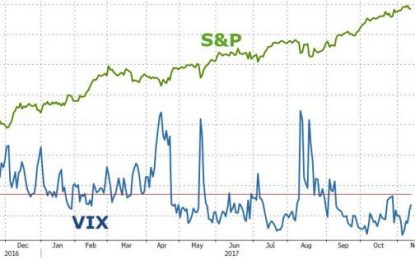

Hindenburg Omen Sighted As Stocks Suffer First Weekly Loss In 2 Months

Nov 10, 2017

Jeremy Parkinson

Finance

Credit markets to stocks this week… Video length: 00:00:06 Before we start – let’s celebrate. As @BespokeInvest notes, we’re making history today: first 12 month period in the history of the S&P 500 without a 3% drawdown. The VIX is also the lowest on the record using a rolling 12 month average. All major indices ended […]

Dividends Attracting People To Energy Stocks

Nov 10, 2017

Jeremy Parkinson

Finance

Crude Oil seems to be a lot stronger than it usually is this time of the year. People are now attracted to energy stocks. Video Length: 00:20:10

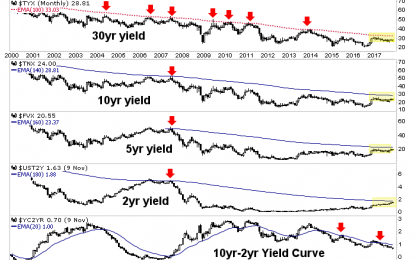

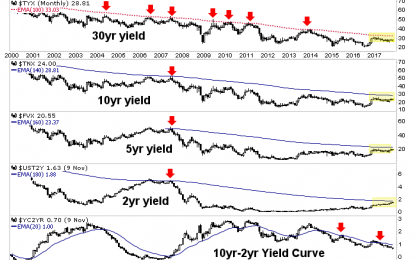

Macro Plan Still On Track For Stocks, Commodities & Gold

Nov 10, 2017

Jeremy Parkinson

Finance

As I’ve been noting again, again, again, again, and again the macro backdrop is marching toward changes. I’d originally thought those changes would come about within the Q4 window and while that may still be the case, it can easily extend into the first half of 2018 based on new information and data points that have come in. One thing that […]

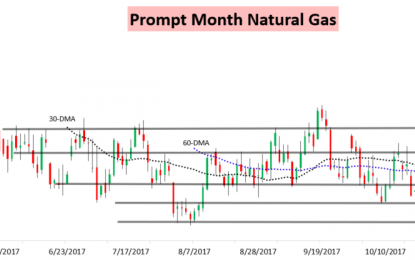

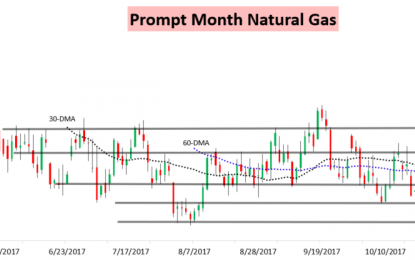

Natural Gas Continues Its Grind Higher Into The Weekend

Nov 10, 2017

Jeremy Parkinson

Finance

Prompt month natural gas prices have now logged gains 7 days in a row, yet each of the last 4 days we have not seen a gain over a percent. Prices have continued this steady grind higher as we have continued adding GWDDs to our 15-day forecast, so the weather has continually been providing support. […]

Hot Options Report For End Of Day – Friday, November 10

Nov 10, 2017

Jeremy Parkinson

Finance

Top Tickers For End Of Day, November 10th: CBS, AAPL, GE, MU

USD/JPY Fails To Break Higher – Forecast Nov. 13-17, 2017

Nov 10, 2017

Jeremy Parkinson

Finance

Dollar/yen made an attempt to move higher as the leaders of both countries met, but never went too far, finding itself falling back down. What’s next? The first release of Japanese GDP coincides with the all-important US inflation report. The question remains open: bounce or break? USD/JPY fundamental movers Tax reform issues, Trump and Abe meet Tax reform […]

4 Hot ETF Deals For Singles’ Day

Nov 10, 2017

Jeremy Parkinson

Finance

Singles’ Day is here and e-shoppers in China will be seen binging on what is touted as the world’s busiest online shopping day. Also known as anti-Valentine’s Day, the date 11.11 is special for those who are single. E-commerce players have a tradition of enjoying a huge rally on the Singles’ Day shopping fervor. Last […]

EC

HH

Somehow Food Companies Are No Longer Viewed As Stable, Defensive, Attractive Investments

Nov 10, 2017

Jeremy Parkinson

Finance

For decades the consumer staples sector was viewed by investors as a stable and predictable cash flow generator with above-average dividend yields and below-average volatility. In particular, food companies like Kraft and Pepsi fit the bill, with brands that stood the test of time. Lately, however, investor sentiment has shifted. While brand names continue to […]