The Stock Market Season Is Changing

Jul 19, 2017

Jeremy Parkinson

Finance

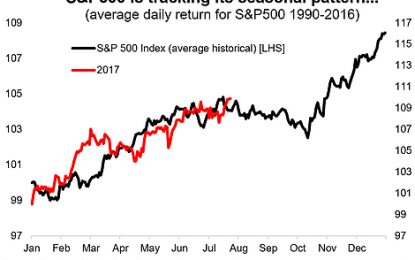

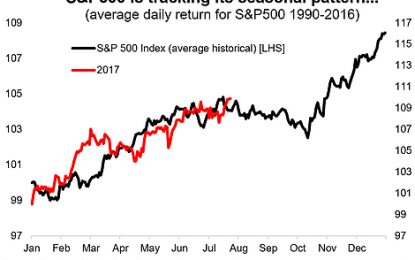

Following on from the popular post on the seasonal turning point for the VIX last week, here’s an insight into seasonality for the S&P 500 and how 2017 is tracking YTD vs the historical seasonal pattern. The first chart shows 2017 superimposed on the historical average and it looks like a fairly decent fit with the implication […]

US Business Cycle Risk Report – Wednesday, July 19

Jul 19, 2017

Jeremy Parkinson

Finance

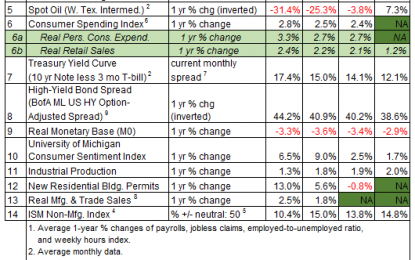

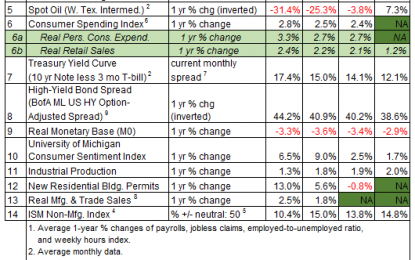

The recent run of soft economic data inspires some pundits to claim that a new recession is brewing. They could be right, but they could just as easily be wrong. Although some numbers published to date have been weaker than expected, a broad profile of economic activity still reflects low recession risk. Near-term projections tell […]

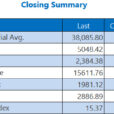

Global Stocks Hit Record High, Set For Longest Winning Streak Since 2015

Jul 19, 2017

Jeremy Parkinson

Finance

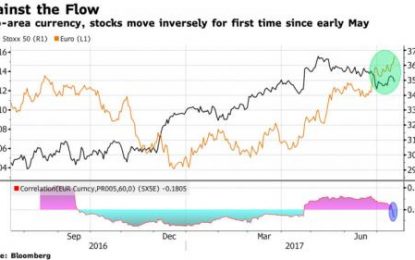

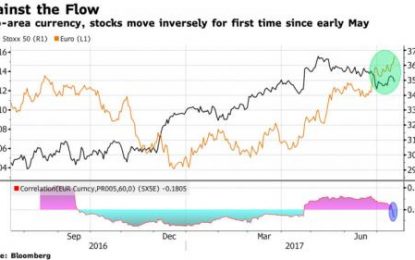

In what has been a less exciting session than the previous two, the euro retraced some recent gains as traders grew concerned they may have overestimated the ECB’s hawkish bias ahead of Thursday’s rate decision; in turn the dollar edged higher after the collapse of the GOP healthcare bill sent it to the lowest since […]

E

Low U.K. Unemployment Rate Not A Signal For Rate Hike

Jul 19, 2017

Jeremy Parkinson

Finance

The Bank of England announced U.K.’s lowest unemployment rate of 4.5% in 45 years thereby triggering comments across the media channels that a rate hike could be next on the cards. However, when you look at the entire basket of numbers released on the most recent jobs report, it could be unwise to jump into […]

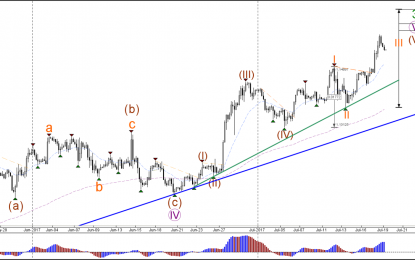

SPX Elliott Wave View: Showing Impulse

Jul 19, 2017

Jeremy Parkinson

Finance

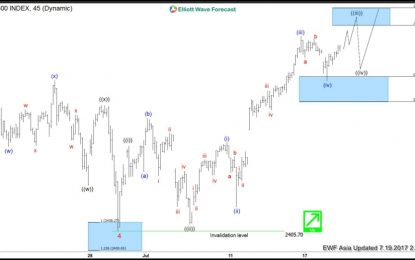

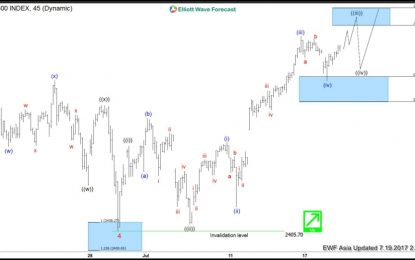

Short term SPX Elliott Wave view suggests the rally from 5/18 low (2352.7) to 6/19 peak (2453.8) ended Minor wave 3. The pullback from 2453.8 to 2405.70 on 6/29 low ended Minor wave 4. Up from there, the rally is unfolding as an impulse Elliott Wave structure with extension. This 5 waves move could be Minute wave ((a)) […]

EUR/USD, GBP/USD Bearish Pullback To 1.15 And 1.30 Within Bullish Trend

Jul 19, 2017

Jeremy Parkinson

Finance

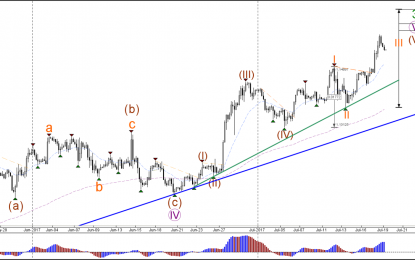

EUR/USD 4 hour After the break above the 1.15 round level resistance, the EUR/USD continues the established bullish trend with yet another higher high. The uptrend shows no signs of weakening as yet and price is on its way towards the Fibonacci targets of wave 3 vs 1. Currently a retracement is taking place, which […]

Above The 40 – A Food-Borne Breakdown And Classic Post-Earnings Gaps

Jul 19, 2017

Jeremy Parkinson

Finance

AT40 = 61.9% of stocks are trading above their respective 40-day moving averages (DMAs) AT200 = 59.8% of stocks are trading above their respective 200DMAsVIX = 9.9 (volatility index)Short-term Trading Call: cautiously bullish Commentary The S&P 500 (SPY) closed effectively flatline with a point and a half gain. The Nasdaq returned to the new-high business with a 0.5% […]

Eurozone ZEW Advances, Current Situations At Highest Level

Jul 19, 2017

Jeremy Parkinson

Finance

Eurozone sentiment indicator ZEW retreated slightly to 35.6 for the month of June from 37.7 in the previous month. This was below expectations of 37.2, and a retreat from its highest levels in 22 months reached last month with a slight increase in participants who believe conditions will aggravate. Nevertheless, the current conditions indicator advanced […]

Dollar Stabilizes On Hump Day, Awaits Thursday’s BOJ And ECB Meetings

Jul 19, 2017

Jeremy Parkinson

Finance

After being shellacked to start the week, the US dollar is being given a small reprieve today as investors await tomorrow’s BOJ and ECB meetings. The US may also report a bounce back in housing starts (residential investment) after a three-month slide. The euro reached a 14-month high yesterday just shy of $1.1585 as it approaches […]

The Markets Are Doing That Thing Again

Jul 19, 2017

Jeremy Parkinson

Finance

The markets are doing that thing again. That thing where everything looks easy. Where the trends are picture perfect. Where good stocks keep doing good things and bad stocks keep doing bad things. Where shorting the VIX seems like the easiest money in the world and where commodities are so fractured as to be all […]