A Bearish Citi Warns “Bigger Forces Are At Play”, Pointing To Its ‘Chart Of The Week’

Jul 17, 2017

Jeremy Parkinson

Finance

Over the next three weeks, the investing world will shift its attention away from the endless chatter of central bankers and concerns about the state of the economy, and instead focus on second quarter earning season, which launched on Friday with results from the three biggest US banks which showed that chronically low volatility is […]

The Fed Shifts The Future Focus For The S&P 500 In Week 3 Of July 2017

Jul 17, 2017

Jeremy Parkinson

Finance

In the third week of July 2017, Fed Chair Janet Yellen may very well have single-handedly reversed the momentum for short term interest rate hikes at the U.S. Federal Reserve. Writing at Real Investment Advice, Lance Roberts had perhaps the best summary of what happened when the Fed’s Yellen testified before the U.S. Congress on Tuesday, 11 […]

Bitcoin Is Facing Key Support At 1737

Jul 17, 2017

Jeremy Parkinson

Finance

BTCUSD recently broke below the bottom support trend line of the triangle pattern on its 4-hour chart and the ascending trend line on the daily chart, and is now facing the key support at the May 27 low of 1737. BTCUSD Daily Chart As long as the Bitcoin price is above 1737 level, the price […]

Forex Week In Review – Monday, July 17

Jul 17, 2017

Jeremy Parkinson

Finance

Last week was a positive affair for the world’s major markets with all indexes making gains. In Europe over the course of the week, the FTSE was up on last week’s close by 0.37% at 7378.4; the DAX ended at 12632, up by 2% on last week’s close; the CAC was up by 1.8% to […]

Emerging Markets: Preview Of The Week Ahead – Monday, July 17

Jul 17, 2017

Jeremy Parkinson

Finance

Written by my colleague Dr. Win Thin EM FX ended the week on a firm note, helped by softer than expected US data. Indeed, EM FX was up across the board for the entire week and was led by BRL, MXN, and ZAR. The ECB meeting this week will draw some interest, especially after the […]

Gold Prices Rise As Soft US Data Cools Fed Rate Hike Bets

Jul 17, 2017

Jeremy Parkinson

Finance

Gold prices soared after a disappointing round of US economic data cooled Fed rate hike speculation, pushing the US Dollar lower alongside front-end Treasury yields (as expected). Not surprisingly, that increased the appeal of anti-fiat and non-interest-bearing assets including the yellow metal. From here, a lull in top-tier scheduled event risk may put risk appetite trends in control of […]

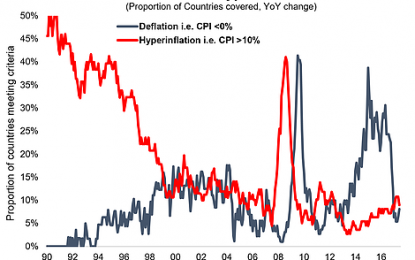

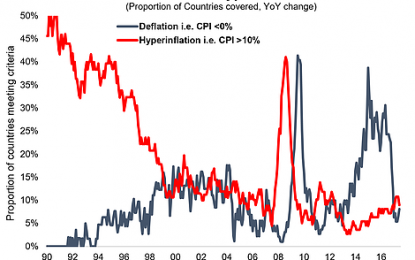

Global Inflation Trends

Jul 17, 2017

Jeremy Parkinson

Finance

Recently the main talk in markets was reflation, but about 2 years ago everyone was talking about deflation: why deflation was structural, all the thematic aspects of deflation, and new normal and new paradigms. But in the end, it appeared to be cyclical or transitory – as the chart below shows. The chart shows the proportion of […]

BOE Warns Popular 35-Year Mortgages Shackle Consumers With “Lifetime Of Debt”

Jul 17, 2017

Jeremy Parkinson

Finance

Consumers in the UK have been on a credit binge since the Bank of England cut its benchmark interest rate to an all-time low as investors braced for the widely anticipated economic shock of Brexit – a shock that, unsurprisingly, has yet to arrive, despite warnings from the academic establishment that a “leave” vote would […]

Dollar Starts Week With A Struggle

Jul 17, 2017

Jeremy Parkinson

Finance

The dollar hovered near a 10-month low during early Asian trading as investors continued to doubt whether the United States would tighten monetary policy as aggressively as originally expected. Data out of the U.S. late last week showed disappointing readings for consumer prices and retails sales which started the dollar’s struggle and called Federal Reserve […]

EC

HH

Can Japan End Its Easy-Money Addiction?

Jul 17, 2017

Jeremy Parkinson

Finance

The shock landslide defeat of PM Shinzo Abe’s Liberal Democratic Party (LDP) in the recent Tokyo metropolitan elections — and the triumph there of Tokyo Governor Koike’s new party (Tomin First) — has lit a faint hope that the radical Japanese monetary expansion policy could be on its way out. The flickering light though is not strong […]