Euro Waits For Draghi As ECB To Keep Rates Unchanged

Jul 17, 2017

Jeremy Parkinson

Finance

Fundamental Forecast for EUR/USD: Neutral – The ECB meets this week, but it is an off-cycle meeting for staff projections, so no change in policy is expected. ECB President Draghi’s press conference is in the spotlight. – Profit taking in the Euro is possible if the ECB takes issue with the rally in the exchange rate and […]

Above The 40 – S&P 500 Hits All-time High Alongside Historic Volatility

Jul 17, 2017

Jeremy Parkinson

Finance

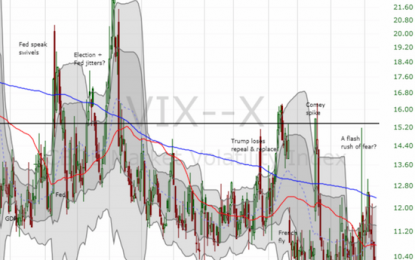

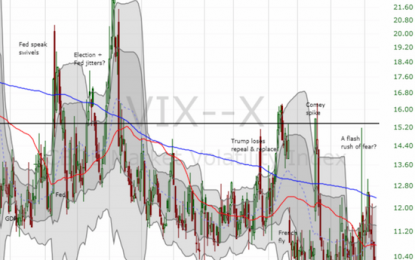

AT40 = 63.2% of stocks are trading above their respective 40-day moving averages (DMAs)AT200 = 59.5% of stocks are trading above their respective 200DMAsVIX = 9.5 (volatility index) (since 1990, only TWO days have been lower, both in December, 1993!)Short-term Trading Call: cautiously bullish Commentary The volatility index, the VIX, closed at a near record low on Friday, […]

India’s Forex Reserves At An All-Time High: Is That A Good Thing?

Jul 16, 2017

Jeremy Parkinson

Finance

by The Indian Economist — this post authored by Indroneel Das India has been a part of global news lately, for all the right reasons. India has evolved from being just another ‘developing nation’ to an emerging global power. While this implies political, military and economic connotations, let us focus on the latter. Very recently, India’s […]

China GDP, Econ Beat Across The Board But Stocks Fall Hard At The Open

Jul 16, 2017

Jeremy Parkinson

Finance

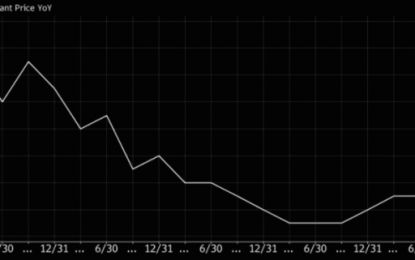

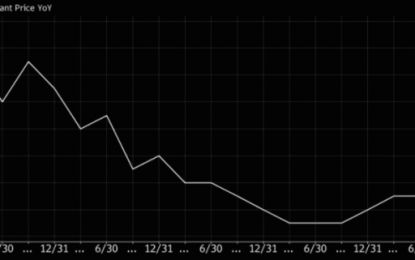

There’s nothing like a deluge of China econ to start your week. Here are the numbers, just out: CHINA 2Q GDP GROWS 6.9% Y/Y; EST. 6.8% CHINA 2Q GDP GROWS 1.7% Q/Q; EST. 1.7% CHINA JUNE INDUSTRIAL OUTPUT RISES 7.6% Y/Y; EST. 6.5% FAI 8.6% H1; EST. 8.5% CHINA JUNE RETAIL SALES RISE 11.0% Y/Y; […]

5 Stocks To Watch This Week – NFLX, BAC, IBM, V, EBAY

Jul 16, 2017

Jeremy Parkinson

Finance

Netflix (NFLX) Consumer Discretionary – Internet Retail | Reports July 17, after the close. The Estimize consensus calls for EPS of $0.18, tWO cents higher than the Wall Street consensus, with revenues in-line at $2.76B. What to watch: Even more so than earnings and revenue actuals, it’s number of subscribers that Netflix investors care about […]

Bitcoin, Ethereum Plunge Accelerates As Scaling Deadline Looms

Jul 16, 2017

Jeremy Parkinson

Finance

Yesterday it was Bitcoin, today it is Ethereum that is taking the brunt of selling pressure (down 20%) but the dumping of virtual currencies is evident across the entire crypto space with the biggest market cap coins tumbling to 2-month lows… Once again it is the so-called ‘civil war’ that is weighing on the entire virtual currency space as we noted […]

How High Can The Euro Go On This Reaction – 116 Or 125-128?

Jul 16, 2017

Jeremy Parkinson

Finance

This upcoming seminar in Frankfurt Germany will deal with both the short-term and long-term. This has been the Year from Political Hell, and it will not end until after the German elections. With the ECB finally throwing in the towel admitting (but certainly not publicly) that nearly 10 years of low to negative interest rates […]

Investment Opportunities In Eastern Europe

Jul 16, 2017

Jeremy Parkinson

Finance

Introduction For the last five years, US stock markets have been a good place to invest. Over that period, the S&P 500 is up 77%. And in the last year, it is up 20%. But there are worrying clouds on the horizon: the price/earnings ratios are creeping up – the S&P 500 is now at […]

Has This Time Been Different?

Jul 16, 2017

Jeremy Parkinson

Finance

One of the main tenets at this space has been to cut away the extremes in your [equity] investing strategy. There are those who see market tops and imminent crashes everywhere, and then there are those who believe debt-financed share buybacks and dividend payments can continue to propel the market higher forever. They are both wrong, but the […]