VIX To Double Within A Year, Natixis Warns

Jul 13, 2017

Jeremy Parkinson

Finance

Vol-sellers beware. That’s the message from Natixis Global Asset Management’s Brett Olsen and Nicholas J. Elward, in their latest note, as they warn “it stands to reason that the market will see a reversion to the mean and find the VIX trading in the 20+ range before too long.” There has been much discussion lately about how stock […]

International Paper Spikes Higher After Analyst Sees Ecommerce Driving Growth

Jul 13, 2017

Jeremy Parkinson

Finance

Shares of corrugated box maker International Paper (IP) are outperforming broader market measures after being upgraded to buy on eCommerce drivers. E-COMMERCE GROWTH: Goldman Sachs’ analyst Brian Maguire added to the growing list of bullish analyst commentary on International Paper in a research note, after a “deep-dive” into the implications of eCommerce on packaging stocks. […]

What Happens To AAPL Stock Around Iphone Releases?

Jul 13, 2017

Jeremy Parkinson

Finance

There’s no denying that every iPhone release has an impact on AAPL stock, and there are certain patterns the shares follow around the announcement and availability dates. With this year marking the 10-year anniversary of the iPhone, Apple is expected to release three new models, including the special edition iPhone 8. Due to this, AAPL stock […]

The Budget Deficit Under Trump, Excluding Unicorn Effects

Jul 13, 2017

Jeremy Parkinson

Finance

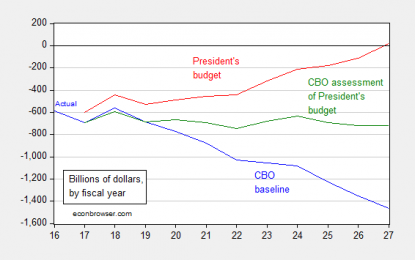

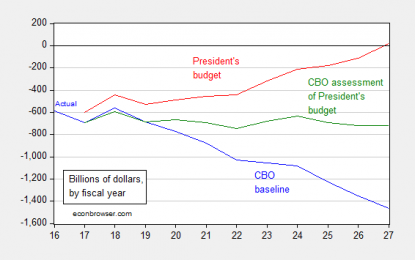

The CBO has just released an assessment of the President’s budget proposal. Balancing the budget looks unrealistic, even given massively sweeping (and unrealistic) spending cuts. Here are the projected budget balances, under CBO baseline (blue), as claimed in the Budget submitted by the White House (red), and as assessed by the CBO (green). Figure 1: Federal budget balance […]

USD/JPY – Can It Clear 115.00?

Jul 13, 2017

Jeremy Parkinson

Finance

USD/JPY finds itself in a precarious position. While the pair remains in an uptrend it is coming dangerously close to forming a double top at the 114.50 barriers unless it can get push higher from buyers to clear the key 115.00 resistance level. Testimony from Janet Yellen today was inconclusive as she failed to offer […]

Ranking The 20 Most Valuable Cryptocurrencies Over Time

Jul 13, 2017

Jeremy Parkinson

Finance

var divElement = document.getElementById(‘viz1499972889156’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’1004px’;vizElement.style.height=’869px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement); This ranking can teach us about the evolving market for cryptocurrencies and the direction it may take as more and more competing players emerge. A MATTER OF SCALE The movement – or lack thereof – of market cap rankings […]

4 Excellent PEG Stocks For GARP Investors

Jul 13, 2017

Jeremy Parkinson

Finance

In a market hurt by external shocks, equity investments need to be properly hedged. A question that arises frequently is whether one should resort to a value strategy that seeks discounted stocks or opt for growth investing in times of extreme market instability. The investing track of the Oracle of Omaha over the past few […]

IMF Rings The Alarm On Canada’s Economy

Jul 13, 2017

Jeremy Parkinson

Finance

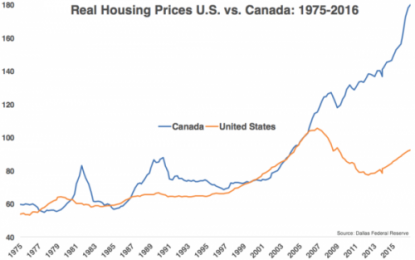

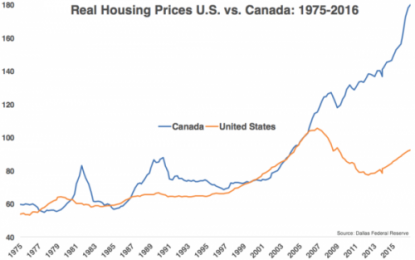

Shortly after yesterday’s rate hike by the Bank of Canada, its first since 2010, we warned that as rates in Canada begin to rise, the local economy which has seen a striking decline in hourly earnings in the past year, which remains greatly reliant on a vibrant construction sector, and where households are the most levered on record, if there […]

That’s Not Low Volatility, This Is Low Volatility…

Jul 13, 2017

Jeremy Parkinson

Finance

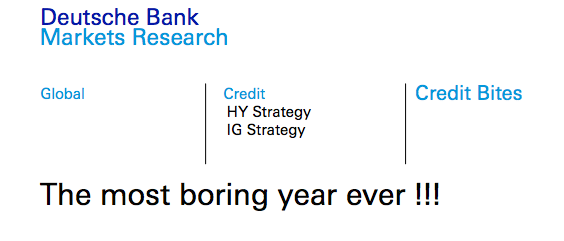

I was chatting with an acquaintance the other day about the resilience of credit in the face of multiple political land mines that, under normal circumstances, would have caused spreads on IG and HY to widen materially. [What? Isn’t that something you talk to your friends about?] We both agreed that while suppressed equity vol. […]

Even The “Experts” Get It Wrong Occasionally

Jul 13, 2017

Jeremy Parkinson

Finance

A friend was lamenting about the difficulty he was having getting “look through” information on closed end funds and ETFs, specifically bond funds, and calling into his online brokerage firm for help didn’t yield much better results. Closed end funds not necessarily being transparent isn’t news and while I am surprised he had the same […]