EUR/USD Forex Signal – Tuesday, July 11

Jul 11, 2017

Jeremy Parkinson

Finance

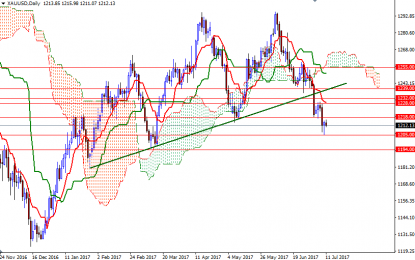

Yesterday’s signals were probably not triggered as the bullish price action took place a little way below the support level identified at 1.1388. Today’s EUR/USD Signals Risk 0.75%. Trades may only be entered before 5pm London time today. Long Trades Go long following a bullish price action reversal on the H1 time frame immediately upon the […]

Euro Bund Market Observations (Ending One-Time-Framing)

Jul 11, 2017

Jeremy Parkinson

Finance

Looking at the plain daily chart, we can observe the end of the one-time-framing lower behavior which occurred for several weeks as Friday’s high got taken out. A previous balance area seems to be supportive for now. Looking at the weekly volume profiles, we can identify a double distribution profile. The market opened inside of […]

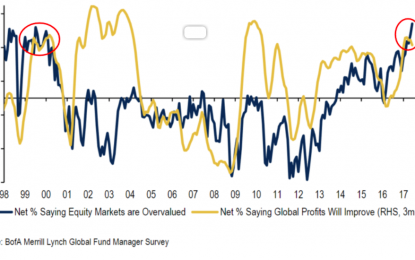

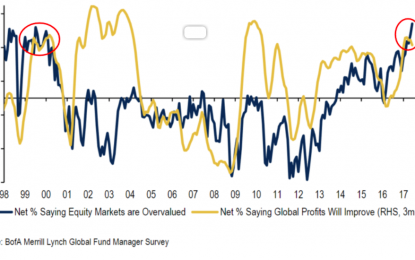

We Are Seeing Classic Late-Cycle Signs Everywhere

Jul 11, 2017

Jeremy Parkinson

Finance

We know it’s hard to believe, but we’ve closed out the first week of 3Q 2107. For some, it was a vacation week, for others like those of us here at Tematica it was a busy one. As much as we love a holiday, especially July 4th, the downside is compressing five days of trading, […]

The Changing Face Of The UK’s Working Class

Jul 11, 2017

Jeremy Parkinson

Finance

When the recent General Election was first called, many people (MPs included) thought that the results were already a sure thing, with little chance of any upset. How misplaced their certainty proved to be when the performance of almost all major parties in the polls defied expectations, for better or worse. Significant losses for the Tories and SNP despite […]

Will Volatility Continue To Flatline?

Jul 11, 2017

Jeremy Parkinson

Finance

So the VIX has flatlined. It’s been meandering along in a sideways direction for nearly four years. In fact, the four-year chart of the VIX looks like an electrocardiograph (EKG) of a recently diseased person. Sure, you’ll see an occasional blip. But not even a dead person has a ruler-straight EKG line. Sorry, folks — […]

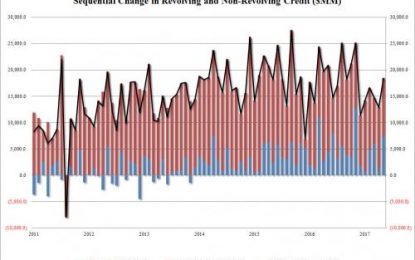

Consumer Credit Surges Most Since November 2016

Jul 11, 2017

Jeremy Parkinson

Finance

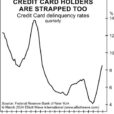

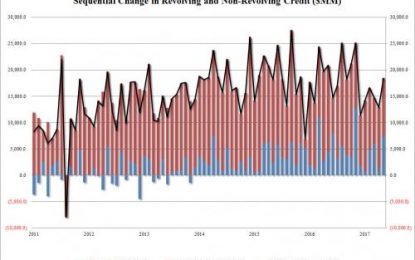

After a big miss in April, when US consumer credit posted its smallest monthly increase in 6 years, resulting form a slump in demand for revolving credit, one month later things promptly reverted back to normal, and according to the Fed, in the month of May, total consumer credit rose by $18.4 billion, well above […]

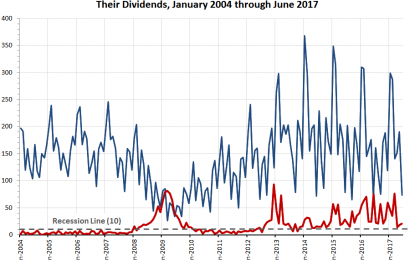

Dividends By The Numbers For June 2017

Jul 11, 2017

Jeremy Parkinson

Finance

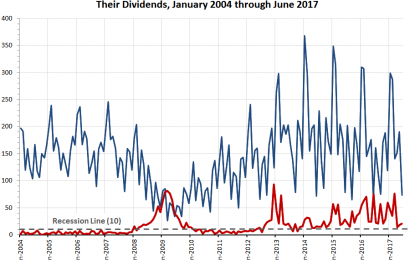

June 2017 ended the best quarter for dividends in the last three years. Before getting into the tally of dividend data for the month, let’s take a quick look at the number of publicly-traded U.S. companies that either increased or decreased their dividends in each month from January 2004 through June 2017 in the following […]

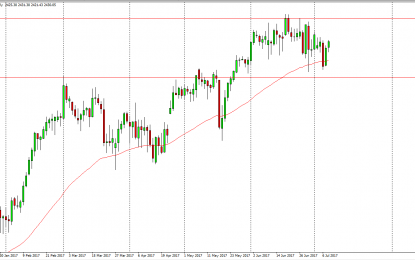

S&P 500 And Nasdaq 100 Forecast – Tuesday, July 11

Jul 11, 2017

Jeremy Parkinson

Finance

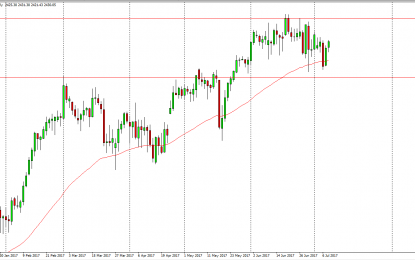

S&P 500 The S&P 500 initially fell on Monday but found enough support underneath to bounce and reach towards the 2430 level. The market looks likely to continue to grind to the upside, perhaps trying to reach towards the 2450 handle above. A break above that level would send this market to the 2500 level, […]

Stage Analysis Gold And USD

Jul 11, 2017

Jeremy Parkinson

Finance

This post will use Weinsteins Stage Analysis to examine where we are in both Gold and the USD. For this analysis, I will use Weekly charts and highlight the Weekly 30ema as a guidepost for our analysis. First let’s start with a bit of History and go back to 1998 to 2002 to examine the […]

Gold Mildly Up On Short Covering

Jul 11, 2017

Jeremy Parkinson

Finance

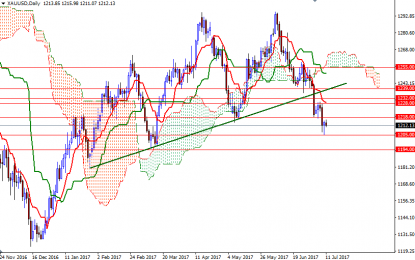

Gold started the week on the back foot, testing the $1208-$1205 area, but managed to recover its earlier losses and ended the day up $1.55 at $1214.09 an ounce. Gold has come under renewed pressure in recent days, as investors recalibrated their outlook on U.S. monetary policy in the light of recent economic data. The […]