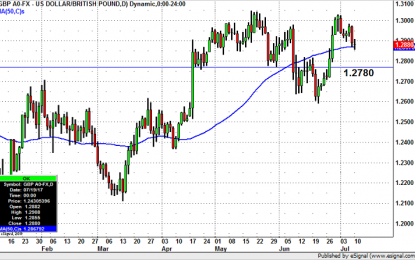

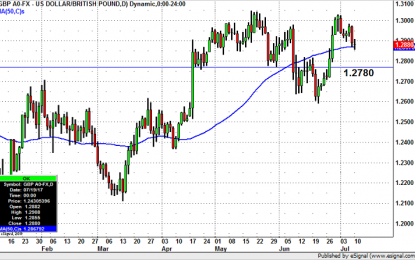

GBP/USD – Buy Or Sell?

Jul 10, 2017

Jeremy Parkinson

Finance

From a fundamental perspective, GBP/USD should be trading lower. Consistently softer UK data casts doubt on the hawkish comments from the Bank of England. Service, manufacturing and construction sector activity slowed in the June while industrial and manufacturing production turned negative. This along with a stronger pound in May caused the trade deficit to […]

Europe Stocks Look Interesting

Jul 10, 2017

Jeremy Parkinson

Finance

There was an interesting article written recently by Barry Ritholtz who says that people are feeling cautious towards the market, so they are looking for technical reasons to support their caution. I kind of agreed with the article, but some of the market caution seems reasonable to me. For instance, John Murphy mentioned in his […]

6 Technology Stocks Set To Beat Estimates In Q2 Earnings

Jul 10, 2017

Jeremy Parkinson

Finance

The second-quarter 2017 earnings season is in its initial stage with just 23 S&P 500 members or 4.6% of the index’s total membership reporting their quarterly results as of Jul 7, according to the latest Zacks Earnings Preview report. Per the Preview article, the trend this earnings season indicates that we may finally see back-to-back four quarters […]

Goldman Is Going To Explain What’s Next For Bonds And You’re Going To Listen

Jul 10, 2017

Jeremy Parkinson

Finance

Remember what I wrote last night in “Why We’re Vulnerable: CTAs’ ‘Oversized Loss’ Betrays Extreme Positioning“? No? That’s ok. It was Sunday evening and you were probably drunk (I would have been too had I not almost drank myself to death last November). But long story short, that post (which you should read if you […]

Dividend Champion Portfolio July Update

Jul 10, 2017

Jeremy Parkinson

Finance

The High Yield Dividend Champion Portfolio is a publicly tracked stock portfolio on Scott’s Investments. Its goal is to capture quality high yield stocks with a history of raising dividends. The screening process for this portfolio starts with the “Dividend Champions” as compiled by DRIP Investing. The list is comprised of stocks that have increased their dividend payout for […]

Gold And Silver Capitulation

Jul 10, 2017

Jeremy Parkinson

Finance

The big news this week was the flash crash in silver late on 6 July. We will publish a separate forensic analysis of this, as there is a lot to say and see. It’s hard to tell—we don’t have the tools to measure such a thing—but it seems like the hype and aggression from the […]

ETF Watchlist: Week Of July 10, 2017

Jul 10, 2017

Jeremy Parkinson

Finance

Friday’s market rally following a strong jobs report pushed the major indices back into the green for week and kicked off a solid start to Q3. The Dow, Nasdaq and the S&P 500 were all up marginally, but the real market action is set to kick off later this week as earnings season is back! […]

The Bears Suck When It Comes To Sell-Offs, So Just Buy

Jul 10, 2017

Jeremy Parkinson

Finance

They do suck. I mean how many times can the bears possibly blow a sell-off that is handed to them on a silver platter. Consequently, sell-offs that appear to be substantial, like the one last Thursday, has become a green light to buy the dip. Sure you can have a few multi-day sell-offs but those […]

The Last Time Hedge Funds Were This Short Gold, It Rallied 18% In A Month

Jul 10, 2017

Jeremy Parkinson

Finance

Gold is suffering its worst drawdown this year, and hedge funds are betting more losses are in store… but judging by the precious metals’ performance the last two times hedgies piled in like this, the ‘smart money’ may be about to get a nasty surprise… As Bloomberg notes, signs that global central banks, including the Federal Reserve, are […]

May 2017 Headline Consumer Credit Grew

Jul 10, 2017

Jeremy Parkinson

Finance

The headlines say consumer credit rate of annual growth grew from last month. Our analysis disagrees – and we see a moderately lower growth rate. Analyst Opinion of the Consumer Credit Situation Not only does this data set suffer from backward revision (moderate to significant enough to change trends), but the use of compounding (projecting […]