US Payrolls Rise Less Than Forecast In May But 1-yr Gain Ticks Up

Jun 02, 2017

Jeremy Parkinson

Finance

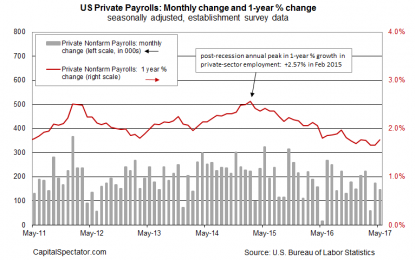

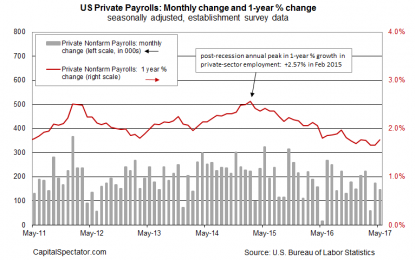

Employment at US companies increased 147,000 in May (in seasonally adjusted terms), according to this morning’s update from the Labor Department. The rise is below expectations, based on Econoday.com’s consensus forecast for a 173,500 jump in payrolls. The advance also represents a downshift from April’s 173,000 increase. But the softer monthly comparison was offset by a slightly […]

Forex Weekly Outlook – June 5-9 2017

Jun 02, 2017

Jeremy Parkinson

Finance

The US dollar was on the back burner throughout most of the week as data remained mixed and speculation about the Fed decision mounts. A rate decision in Australia, the ECB’s critical decision and the UK elections stand out in the first full week of June. Here are the highlights for the upcoming week. Fed […]

Sabine Royalty Trust: Quality Assets Fuel 5% Dividend Yield With Potential For Growth

Jun 02, 2017

Jeremy Parkinson

Finance

Sabine Royalty Trust (SBR) fared relatively well in 2016. It suffered right alongside the other royalty trusts, but Sabine maintained a high dividend payout thanks to the resilience of its quality assets. Sabine is on the high dividend stocks list thanks to its substantial dividend yield. You can see the full list of established 5%+ yielding […]

NFP Reaction: Mediocre Jobs Report Unlikely To Derail June Hike, But Raises Yellow Flags

Jun 02, 2017

Jeremy Parkinson

Finance

As we noted earlier this week, a Fed rate hike in less than two weeks’ time was basically a “done deal” heading into today’s Non-Farm Payrolls report (see “Sector showcase: The utility of utilities for handicapping the Fed” for more). When the jobs figures were released, at least a few traders had to reevaluate that outlook. On […]

Non-Farm Friday June 2: Is America Working?

Jun 02, 2017

Jeremy Parkinson

Finance

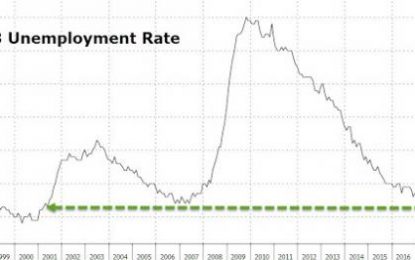

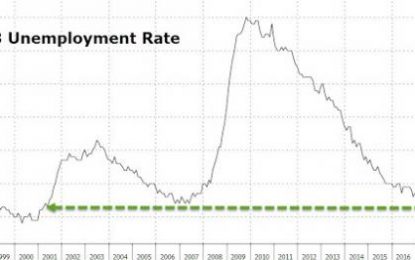

Unemployment is LOW! As noted in the Fed’s Beige Book (which we discussed in Wednesday’s Live Trading Webinar), low unemployment is restraining growth due to a lack of qualified applicants. Low immigration isn’t helping either – to the point of crops rotting in the fields due to lack of laborers. The Fed is becoming very […]

Return On Gross Invested Capital (ROGIC): Explanation & Examples

Jun 02, 2017

Jeremy Parkinson

Finance

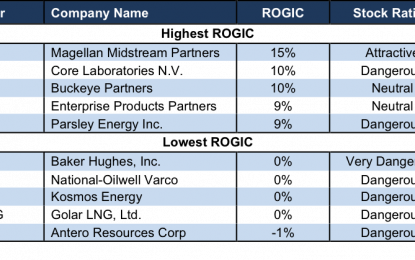

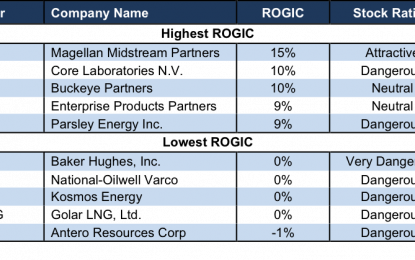

Return on invested capital (ROIC) is not only the most intuitive measure of corporate performance, but it is also the best. It measures how much profit a company generates for every dollar invested in the company. Return on gross invested capital (ROGIC) (seen in Figure 1) provides additional insights into the profitability of highly-capital intensive […]

US Jobs Market: Much Worse Than Official Data Suggests

Jun 02, 2017

Jeremy Parkinson

Finance

I am out of commission today following a small surgery, so I want to thank my new friends at Morningside Hill Capital Management for standing in for me with today’s posting. The question over the strength of today’s job market is key to understanding the durability of the economy and the markets going forward. Pavel Velkov, […]

The Stock Whisper Of The Day: LULU, AMD, TLT, FCX

Jun 02, 2017

Jeremy Parkinson

Finance

People Not In Labor Force Soar By 608,000

Jun 02, 2017

Jeremy Parkinson

Finance

While the payrolls report (and wage gains) was an unmitigated disaster for anyone seeking “evidence” of an economic rebound (i.e., the Federal Reserve), there was some good news in the Unemployment rate which declined from 4.4% to 4.3%, the lowest going back to 2001. There is just one problem with the above “silver lining”: the […]

Drop In The Us Unemployment Rate Not Sufficient To Mask Disappointing Report

Jun 02, 2017

Jeremy Parkinson

Finance

The US unemployment rate unexpectedly fell to 4.3%, a new multi-year low, but it is a misleading optic for what is a disappointing report. It is likely not weak enough to put much doubt into expectations for a Fed hike later this month, but it will reinforce the caution in the Beige Book and in recent […]