Wal-Mart Plans For More Innovation?

Aug 23, 2017Jeremy Parkinson0

Last year, Wal-Mart’s U.S. stores and Sam’s Club brought in a combined revenue of $365.4 billion, which is about ten percent of all non-automotive retail in spending in the U.S. Most of the country’s GDP depends on consumer spending. So having the market share of nearly one tenth of all retail spending is evidence of […]

July New Home Sales Down 9.4% From June

Aug 23, 2017Jeremy Parkinson0

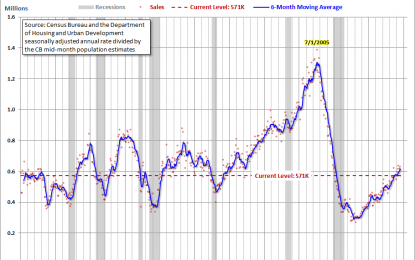

This morning’s release of the July New Home Sales from the Census Bureau came in at 571K, down 9.4% month-over-month from a revised 630K in June. Seasonally adjusted estimates back to April were also revised. The Investing.com forecast was for 612K. Here is the opening from the report: Sales of new single-family houses in July 2017 were […]

OPEC To Decide On Ending Or Extending Production Cuts In November

Aug 23, 2017Jeremy Parkinson0

Last week, Crude Oil tumbled despite the huge decline in the US Crude Oil Inventories, which posted the biggest weekly decline since September of last year. Crude Oil prices ignored these figures and continued to decline further. Brent touched $50, and WTI slid to 46.50’s. Some OPEC reports came out, and that led to a […]

Bulls Or Bears?

Aug 23, 2017Jeremy Parkinson0

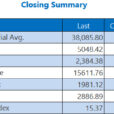

I’m playing both sides of the market right now, as it is becoming near impossible to put full faith in the case of the bulls or the bears. Indicators VIX – Close to going back into the 10’s yet again as VIX lost 14% yesterday. Now down over 27% since Thursday’s close. T2108 (% of stocks trading […]

US New Home Sales Miss With 571k – USD Slips

Aug 23, 2017Jeremy Parkinson0

US new home sales fell short of expectations falling by 9.4% to 571K. However, the fall is from 630K in June, an upwards revision from the original release. The fall in July is attributed to supply rather than demand. Nevertheless, the US dollar is falling across the board. Perhaps the publication serves as an excuse […]

The Gullible Nation

Aug 23, 2017Jeremy Parkinson0

As was widely reported yesterday, the huge surge in stocks was caused by excitement over the prospect of Trump getting major tax reform pushed through. Seriously… my query is this… are you out of your Vulcan mind? How does ANYONE think that the President, who in seven months has the single accomplishment of nominated a judge to the SCOTUS (an act any of us […]

Global Financial Crisis 10 Years On: Gold Rises 100% From $650 To $1,300

Aug 23, 2017Jeremy Parkinson0

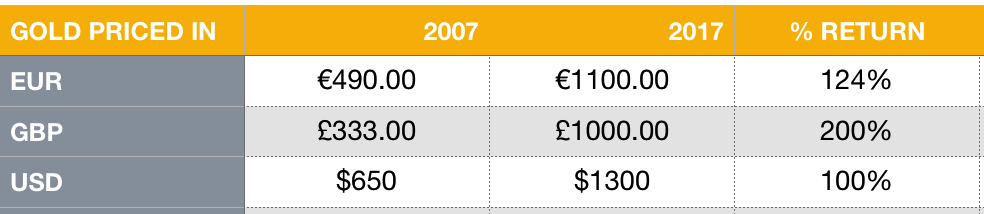

Gold price up over 100% in major currencies since financial crisis Has outperformed majority of equity and bonds Global debt continues to increase despite claims of ‘recovery’ Gold remains an important safe-haven in long-term Gold prices from August 9th 2007 to August 9th 2017 It has been ten years since the global financial crisis began to […]

USDJPY Elliott Wave View: Turning Lower

Aug 23, 2017Jeremy Parkinson0

Short-term USDJPY Elliott wave view suggests that the decline from 7/11 peak is unfolding as a double three Elliott wave structure. Decline to 108.71 low ended Minor wave W and Minor wave X bounce ended at 110.95 peak. Subdivision of Minor wave Y is unfolding as a Zigzag structure. Minute wave ((w)) of ((Y) ended at 108.59 low […]

Economics: The Failure Of The Trump Presidency

Aug 23, 2017Jeremy Parkinson0

This is a second update on the economy with some thoughts on where we are in the business cycle. Yesterday, in my first update, I talked about monetary policy because of the upcoming Fed meeting in Jackson Hole. This time, I want to talk more about the political economy. I think the headline mostly gets at […]

Look Out: Euro Jumps As Draghi Silent On FX Risk, PMIs Come In Hot

Aug 23, 2017Jeremy Parkinson0

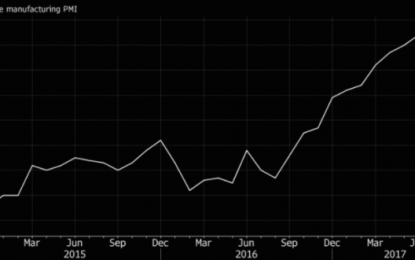

Score one for the crowd who thinks that Mario Draghi is going to have a difficult time keeping a lid on euro strength. You’ll recall that there’s considerable debate about whether the ECB chief will use his Jackson Hole speech as an opportunity to try and jawbone the euro lower after the latest ECB minutes flagged “FX […]