Aussie CPI Falls, But Broader Picture Keeps RBA Projections Intact

Jul 26, 2017Jeremy Parkinson0

CPI Falls Back over 2Q Australian CPI came in below expected over the 2Q printing 1.9% year over year, well beneath the 2.2% level forecast. Despite the decline underlying measures of inflation, which the RBA focus on, were in line with expectations at 0.5% quarter over quarter. However, annual underlying inflation remains below the bank’s […]

Give Me Those Old Time Fundamentals

Jul 26, 2017Jeremy Parkinson0

Oil prices had its biggest up move of the year, rising 3.3% on lower supply and higher demand. I don’t mean to be so fundamental about the fundamentals, but in truth, that’s why we soared! Oil prices surged even before the American Petroleum Report (API) reported another massive crude oil crude withdrawal. The 10.23-million-barrel draw, […]

Testing Equity Factor Allocation Strategies With Random Portfolios

Jul 26, 2017Jeremy Parkinson0

Designing and managing asset allocation strategies based on factors is promoted in some corners as a better way to build portfolios. Not surprisingly, there’s no shortage of studies that support this view. But the jury’s still out on whether it’s prudent to throw out the standard asset-class buckets. Factor-based investing can play a productive role […]

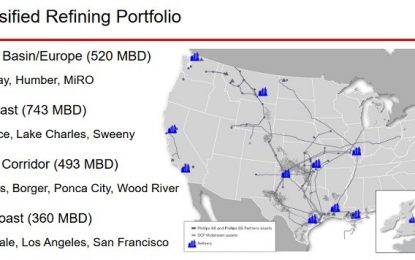

Blue Chip Stocks In Focus: Phillips 66

Jul 26, 2017Jeremy Parkinson0

Investors looking for stable dividends should first look at blue-chip stocks. When we use the term ‘blue chip’, we are referring to stocks with 100+ years of dividend payments to shareholders, and at least a 3% current dividend yield. Stocks that have both of these qualities have an ideal mix of dividend history, and high […]

Glaxo (GSK) Beats Q2 Earnings, Misses Sales

Jul 26, 2017Jeremy Parkinson0

GlaxoSmithKline plc (GSK – Free Report) , one of the largest health care companies, reshaped its business following the Mar 2015 completion of the three-part, inter-conditional transaction with Novartis related to its Consumer Healthcare, Vaccines and Oncology businesses. Under the deal, Glaxo sold its oncology assets to Novartis and acquired Novartis’ Vaccines business (excluding influenza vaccines). […]

Dollar Bounces Ahead Of Fed

Jul 26, 2017Jeremy Parkinson0

The US Dollar continued to edge cautiously higher as investors look to the upcoming monetary policy decision from the US Federal Reserve Bank. Given the current state and the outlook for inflationary trends in the US, expectations are generally lower that the Fed will not make any policy adjustment when they announce the outcome of the […]

Australian Consumer Price Index Drops Beyond Expectations

Jul 26, 2017Jeremy Parkinson0

The annual inflation rate in Australia slowed down unexpectedly during the 2nd quarter, an indication that the pressure on the cost was decreasing after a sharp shrinkage at the beginning of the year. The Consumer Price Index registered an annual increase of 1.9% in the 2nd quarter, after a 2.1% increase in the previous quarter, […]

Preview For July FOMC Decision & Outlook For USD-pairs, JPY-crosses

Jul 26, 2017Jeremy Parkinson0

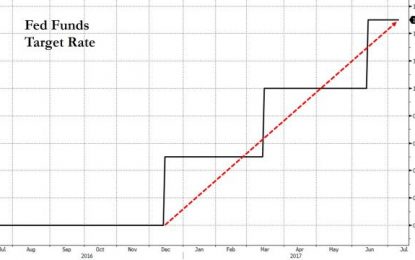

The week truly begins for the US Dollar today, which was trading flat on the day at the time this article was written, even though the Federal Reserve is not expected to move on rates. After all, the July FOMC meeting is an ‘off-cycle’ meeting, or one that won’t produce a new summary of economic […]

Business Customers Are Tired Of Being Bilked Of Billions; Demand Rate Increases On Their Bank Deposits

Jul 26, 2017Jeremy Parkinson0

As we’re all well aware by now, once Trump was elected on November 8th the Fed suddenly decided it was no longer necessary to prop up asset prices in the United States with artificially low interest rates.As such, they’ve embarked on their first rate-hiking spree since the last one ended just over a decade ago. […]

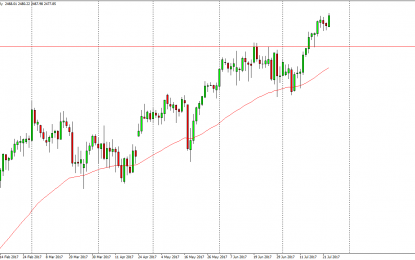

S&P 500 And Nasdaq 100 Forecast – Wednesday, July 26

Jul 26, 2017Jeremy Parkinson0

S&P 500 The S&P 500 has rallied during the day again on Tuesday, reaching to higher levels. It looks as if we are going to go looking for the 2500 level above, so pullbacks should be buying opportunities. Those pullbacks should continue to offer value the traders will take advantage of but today is the […]