Will Climate Change Destroy The Global Economy?

Jul 20, 2017Jeremy Parkinson0

Climate change is on course to do a lot of harm to our planet. That is why concerned economists like myself advocate measures that would at least slow the pace of damage and give us more time to adapt. Paradoxically, though, economists rarely discuss what global warming is likely to do to the economy itself. […]

Morning Call For Thursday, July 20

Jul 20, 2017Jeremy Parkinson0

OVERNIGHT MARKETS AND NEWS Sep E-mini S&Ps (ESU17 +0.03%) this morning are up +0.05% at a fresh all-time nearest-futures high. European stocks are up +0.36% ahead of the conclusion of the 2-day ECB policy meeting and press conference from ECB President Draghi. Signs of strength in the global economy are positive for world stock prices after […]

Euro At Risk As The ECB Disappoints Stimulus Withdrawal Hopes

Jul 20, 2017Jeremy Parkinson0

All eyes are on the European Central Bank. Recent comments from ECB officials have confounded the markets, stoking volatility. First, President Mario Draghi hinted that maintaining a neutral policy stance amid improving economic conditions may require tweaks, which the markets read as hinting at a reduction in QE asset purchases. The very next day, other ECB […]

Preparing For The Bottom: Part 4 – Gold Stocks And Bonds

Jul 20, 2017Jeremy Parkinson0

In the first part of the Preparing for THE Bottom series, we emphasized the need to be sure to stay alert and focused in the precious metals market, even though it may not appear all that interesting. We argued that preparing for the big moves in gold that are likely to be seen later this year […]

World Stocks Hit Record High For 10th Consecutive Day In “No-Vol Nirvana”

Jul 20, 2017Jeremy Parkinson0

The relentless risk levitation continued overnight, as global shares extended their stretch of consecutive record highs on Thursday for a 10th day after a cautious BOJ lifted Asian stocks to a decade high with a dovish announcement that offered no surprises, while pushing back Kuroda’s 2% inflation target to 2020, the 6th consecutive delay. With […]

Uranium Miners Catch A Bid: Is It Sustainable?

Jul 20, 2017Jeremy Parkinson0

Some of the uranium miners including the ETF URA have moved back above the 30-week EMA. Is the new rally sustainable or could it be a fake rally which leads to more consolidation? I take at the uranium market from a Stage Analysis perspective in the following video: (Video length 00:09:20)

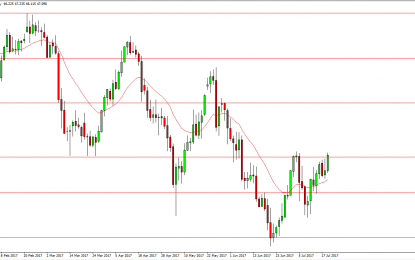

WTI Crude Oil And Natural Gas Forecast – Thursday, July 20

Jul 20, 2017Jeremy Parkinson0

WTI Crude Oil The WTI Crude Oil market rallied during the session on Wednesday, breaking above the top of the shooting star from Tuesday. This is a technically strong signal, and if we can break above the top of the range for the day on Tuesday and Wednesday, that would be a very strong sign […]

Markets Trades Marginally Lower; Metal & Software Stocks Fall

Jul 20, 2017Jeremy Parkinson0

Indian share markets gave up its early gains during the afternoon session and were trading below the dotted line. Losses are largely seen in metal stocks, software stocks, and auto stocks. While, capital goods stocks and bank stocks traded in green. The BSE Sensex is trading lower by 45 points and the NSE Nifty is trading lower by 20 points. Meanwhile, the BSE Mid Cap index is down by […]

JPM Elliott Wave Bullish Structure

Jul 20, 2017Jeremy Parkinson0

The Elliott Wave view for JPMorgan Chase (NYSE: JPM) suggests the rally from February 2016 low (52.5) to 03/01/2017 peak (93.98) have ended wave (3). The pullback from there unfolded as zigzag ABC structure which ended wave (4) at 06/01/2017 low (81.79). Up from there, the stock rallied in another zigzag structure before ending that short term cycle after reaching extreme on […]

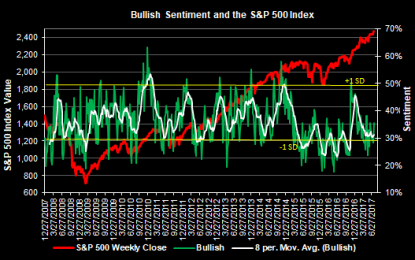

Jump In Investor Bullish Sentiment But Remains Below Long Run Average

Jul 20, 2017Jeremy Parkinson0

Yesterday, the American Association of Individual Investors released their Sentiment Survey results for the week ending 7/19/2017. These results show individual investors’ bullish sentiment increased 7.3 percentage points to 35.5%. This is the highest reading since early May when bullish sentiment was reported at 38.1%. This jump in bullish sentiment still has the level below the long […]