Gold Slips On Profit Taking

Apr 18, 2017Jeremy Parkinson0

Gold prices edged lower on Monday as investors took profits from a recent rally that pushed the market to the highest level in five months. U.S. stock markets reversed some of the steep losses witnessed last week, making gold less attractive. Gold’s surge last week was fueled by heightened geopolitical risks and President Donald Trump’s […]

The Bear’s Lair: How Do We Fix Finance?

Apr 18, 2017Jeremy Parkinson0

National Economic Council Director Gary Cohn, formerly President of Goldman Sachs, startled markets last week by suggesting that the United States should re-impose the Glass-Steagall division between commercial and investment banking. That is probably desirable on balance, but the U.S. and global financial system was already a mess when Glass-Steagall was removed in 1999. We […]

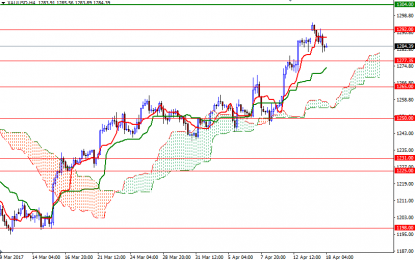

Gold Elliott Wave View: Pullback Completed

Apr 18, 2017Jeremy Parkinson0

Short term Elliott Wave view in Gold (XAU/USD) suggests that cycle from 4/10 low (1246.92) is unfolded as an impulse Elliott wave structure where Minute wave ((i)) ended at 1257.2, Minute wave (ii) ended at 1250.8, Minute wave (iii) ended at 1279.75, Minute wave (iv) ended at 1271.69 and Minute wave (v) of (a) ended at yesterday’s peak 1295.6. […]

After ‘Modest’ 250% S&P Returns, Corporate Pension Funding Levels Roughly Same As 2008

Apr 18, 2017Jeremy Parkinson0

We spend a lot of time writing about public pensions because the aggregate underfunding levels, $3 – $5 trillion on the low end, are simply staggering and at some point they will be realized for the ponzi schemes that they are and the systemic risk they represent to the global financial system. Until then we’ll […]

The Recent Market’s Strongest Stocks: Utilities, REITs…and Homebuilders

Apr 18, 2017Jeremy Parkinson0

Sellers once again lost their advantage as the S&P 500 (SPY) came roaring right back from its ugliest close since the U.S. Presidential election. The bullishness on the day was on full display with the number of new all-time highs well out-pacing new all-time lows by 181 to 79. While the S&P 500 still has to prove itself […]

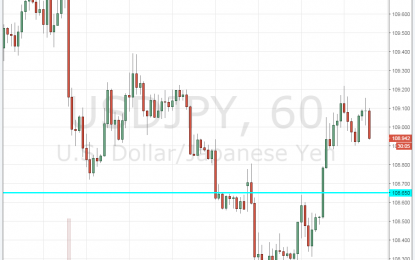

Euro, Commodity Dollars May Suffer As Yen Gains On France Election

Apr 18, 2017Jeremy Parkinson0

Worries about the nearing first round of the French presidential election may preoccupy investors as European markets return after the Easter Monday holiday. The leading four candidates are clustered near the 20 percent support mark, making it unusually difficult to divine who might move on to the second round after an initial poll in April 23. The […]

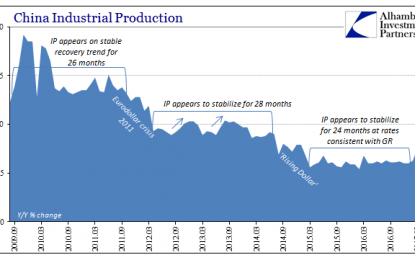

Assessing China’s Economic Risks

Apr 18, 2017Jeremy Parkinson0

First quarter GDP in China rose 6.9%, better than expected and above the government’s target (6.5%) for 2017. It stands to reason, however, that if Communist officials thought they could get 6.9% to last for the whole year they would have made it their target, especially since 6.5% would be less than the GDP growth […]

Dollar Strength A Good Thing? Mnuchin Pulled The Easter Bunny

Apr 18, 2017Jeremy Parkinson0

The US dollar had an Easter Monday slump, mostly against the yen on geopolitical worries. However, things turned around when US Treasury Secretary Steven Mnuchin contradicted his boss’s words about the US dollar. The recently minted Secretary gave an interview to the Financial Times and said (emphasis mine): As the world’s currency, the primary reserve currency, I think that […]

Dear Hedge Funds: This Is Who Is Responsible For Your Deplorable Returns

Apr 18, 2017Jeremy Parkinson0

Over the past several years we have repeatedly stated that despite protests to the contrary, the single biggest factor explaining the underperformance of the active community in general, and hedge funds in particular, has been the ubiquitous influence of the Fed and other central banks over the capital markets. Specifically, back in October 2015, we wrote […]

ETF Watchlist: Week Of April 17

Apr 18, 2017Jeremy Parkinson0

After rallying impressively since the election, the markets may finally be starting to show signs of fatigue. For the first time since November, the S&P 500 has closed below its 50 day moving average. Volatility has begun to move back up, albeit modestly, and geopolitical events could begin putting real downward pressure on stocks. The […]