Why Are European Banks Performing Badly? The Santander Case

Apr 06, 2016Jeremy Parkinson0

European banks have under-performed both the S&P 500 and US banks by a wide margin. Santander has improved its bottom-line but its shares keep falling. The main difference between EU and US banks lies on non-performing loans. The unemployment rates in the US vs the EU help explain the under-performance. Photo Credit: Yukiko Matsuoka To say […]

E Halliburton – Maybe ValueAct Really Is “The Mullet”

Apr 06, 2016Jeremy Parkinson0

The proposed merger between Halliburton HAL and Baker Hughes BHI has received a lot of scrutiny over the past several months. Now the DOJ has added ValueAct Capital to the soap opera, suing the hedge fund for an antitrust violation: The lawsuit centers on a 40-year old U.S. law that exempts investors who buy up […]

Morning Call For April 6, 2016

Apr 06, 2016Jeremy Parkinson0

OVERNIGHT MARKETS AND NEWS Jun E-mini S&Ps (ESM16 +0.18%) are up +0.18% and European stocks are up +0.10% as energy producing stocks are higher with a +2.90% rally in crude oil. Crude oil shot higher late yesterday after the API reported that weekly U.S. crude supplies fell -4.3 million bbl. Also, a 2% gain in […]

T2108 Update – A Nervous Market Awaits More Fed Refreshments

Apr 06, 2016Jeremy Parkinson0

(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on […]

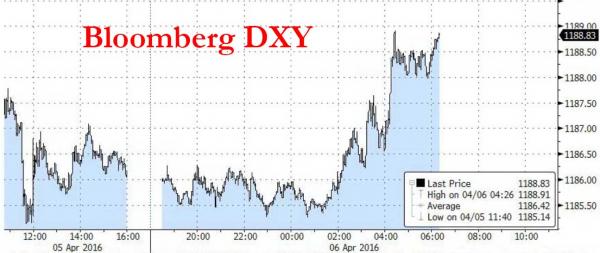

Stocks Rebound In Calm Trading On Back Of Stronger Crude, Dollar

Apr 06, 2016Jeremy Parkinson0

Unlike yesterday’s overnight session, which saw some substantial carry FX volatility and tumbling European yields in the aftermath of the TSY’s anti-inversion decree, leading to a return of fears that the next leg down in markets is upon us, the overnight session has been far calmer, assisted in no small part by the latest China […]

EUR/USD And GBP/USD Forecast – April 6, 2016

Apr 06, 2016Jeremy Parkinson0

EUR/USD The EUR/USD pair initially fell during the day on Tuesday, but turn right back around to form a bit of a hammer. The hammer of course is a bullish sign, and the fact that we formed this hammer at the very top of an uptrend tells me that the buying pressure is still very […]

DAX 30 Aiming To Claw Back Losses

Apr 06, 2016Jeremy Parkinson0

Yesterday’s losing sectors, Energy producers and Automobile manufacturers, are today’s current winners. However, the gains for the DAX 30 today are small in relation to this week’s losses. At the time of writing the index (FXCM: GER30) is up by 52 points from yesterday’s low, but down by 338 points from this week’s high of […]

Don’t Buy The Greatest Fools’ Theory Of Investment Value

Apr 06, 2016Jeremy Parkinson0

We are now entering earnings season once again. Pre-announcements have been the second-worst seen over the past decade. Negative EPS Guidance Approaches 10 Year Record https://t.co/ZtS4L0fEqd pic.twitter.com/ZhgRxeQiqb — Jesse Felder (@jessefelder) April 1, 2016 This has analysts lowering estimates. In fact, they’ve been lowered so far quarterly earnings now look to fall all the way back […]

Pfizer And Allergan To Mutually Terminate Merger, CNBC Reports

Apr 06, 2016Jeremy Parkinson0

Pfizer (PFE) and Allergan (AGN) will mutually terminate their merger this morning following changes in U.S. tax regulations, CNBC’s David Faber reported late last night, citing sources. Pfizer will pay Allergan a $400M breakup fee, Faber added. Shares of Allergan fell yesterday 15% to $236.03 after the Treasury announced new inversion rules. Reference Link

The Coca-Cola Company Losing Some Fizz

Apr 06, 2016Jeremy Parkinson0

The Coca-Cola (KO) Company is currently trading at $46.72 per share. By midday on Tuesday, 4 April the stock was 0.32% lower, for a loss of $0.18. The stock has a 52-week trading range of $36.56 on the low end and $46.93 on the high-end. The price/earnings ratio is 27.96 and the earnings per share is 1.67. Coca-Cola […]