The Stock Whisper Of The Day: GDX, USDU, CHL

Apr 07, 2016Jeremy Parkinson0

Hot stocks of the day: GDX, USDU, CHL Video length: 00:05:19

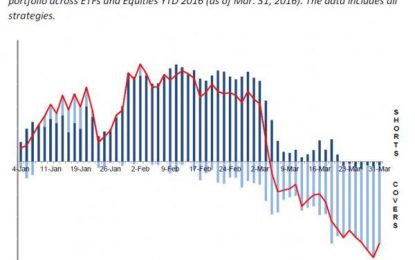

Does Not Compute: The Market Is The “Most Overbought Since 2009” Yet “Most Short Since 2008”

Apr 07, 2016Jeremy Parkinson0

Earlier, we first reported something unexpected: when looking at the constituents of the record short squeeze that started two months ago, and still continues, traders had largely maintained kept single-name shorts, and instead covered short ETF exposure. This followed a previous observation showing that when it comes to NYSE short interest, it is near the […]

Telecom, Mid-Cap Value, And Latin America

Apr 07, 2016Jeremy Parkinson0

Our weekly EdgeCharts display the relative strength rankings for three major market groupings (sectors, styles, and global). Rankings are determined by the intermediate-term momentum of ETFs representing each of the individual categories. Momentum values are annualized to indicate the strength of the intermediate trend (a value of +20 means the category’s intermediate-term trend is sloping […]

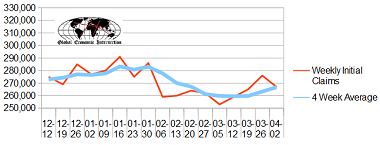

April 2, 2016 Initial Unemployment Claims Rolling Average Again Worsens. But Still The Longest Streak Of Claims Under 300,000 Since 1973

Apr 07, 2016Jeremy Parkinson0

Weekly Initial Unemployment Claims The market expectations (from Bloomberg) were 261,000 to 290,000 (consensus 272,000), and the Department of Labor reported 267,000 new claims. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 263,250 (reported last week as 263,250) […]

Another Close Call

Apr 07, 2016Jeremy Parkinson0

Well, the ES managed to make me jumpy again last night, with a brief bout of green, but mercifully it has once again been repelled from its trend-line. Come ON, people, let’s get some serious downside action. I’m weary of waiting! How about a string of disastrous earnings this month? How’s that sound? Crude oil […]

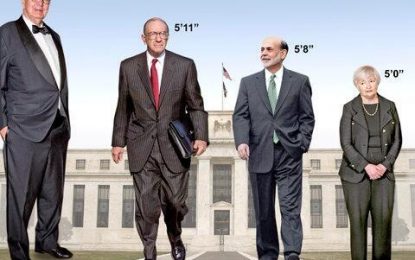

Flip Flopin’ Thursday – Yellen, Bernanke, Greenspan And Volcker Oh My!

Apr 07, 2016Jeremy Parkinson0

Get ready for a quote-fest. All 4 living Fed Chairs will be speaking tonight in New York, ostensibly “for the kids” but really to have an excuse to spin the Hell out of yesterday’s Fed Minutes, which had a nice, fake rally into the close but it’s already reversed in the Futures as we’re down […]

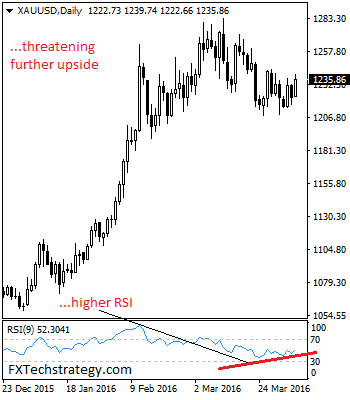

Gold: Consolidates With Upside Bias

Apr 07, 2016Jeremy Parkinson0

Gold: The commodity remains in consolidation mode but faces upside risk. On the downside, support comes in at the 1,220.00 level where a break will turn attention to the 1,210.00 level. Further down, a cut through here will open the door for a move lower towards the 1,200.00 level. Below here if seen could trigger […]

Data Group Is Really Cheap

Apr 07, 2016Jeremy Parkinson0

TM editors’ note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence. Data Group provides print marketing (e.g. direct mail) and other document management services for businesses, with six locations across Canada. I have been watching this company for a few of years, because I […]

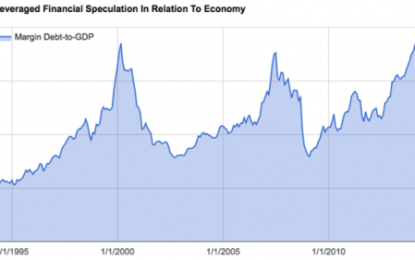

This Time Is Likely Different For The S&P 500 With Rising Margin Debt

Apr 07, 2016Jeremy Parkinson0

A recent article in Business Insider by Jesse Felder from TheFelderReport.com raised a loud alarm bell over rising margin debt levels in the U.S. stock market (see “A closely followed indicator says a 20% drop in stocks could be coming soon“). The article used the following chart as part of an analysis concluding that a […]

How To Save Money And Make Smart Financial Decisions

Apr 07, 2016Jeremy Parkinson0

What are the best ways to save money and manage your investments successfully? Behavioral finance categorizes investors into five different categories. Where are you, and where should you be? Learn why timing the market does not necessarily make you a better investor. In order to save money, you need to make effective financial choices. Professor […]