The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year. To wit:

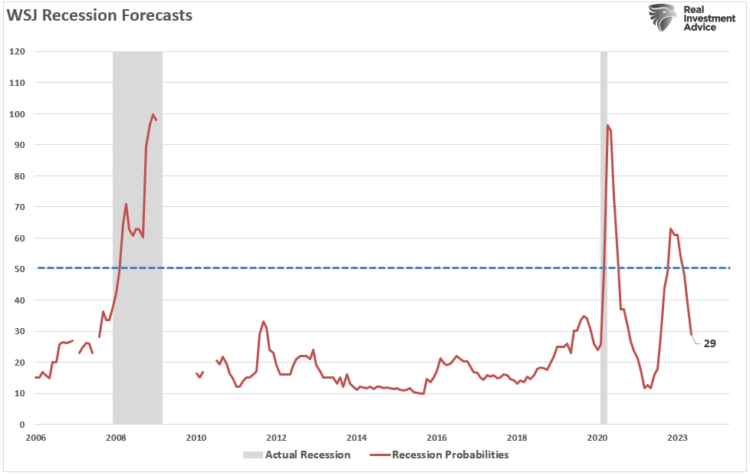

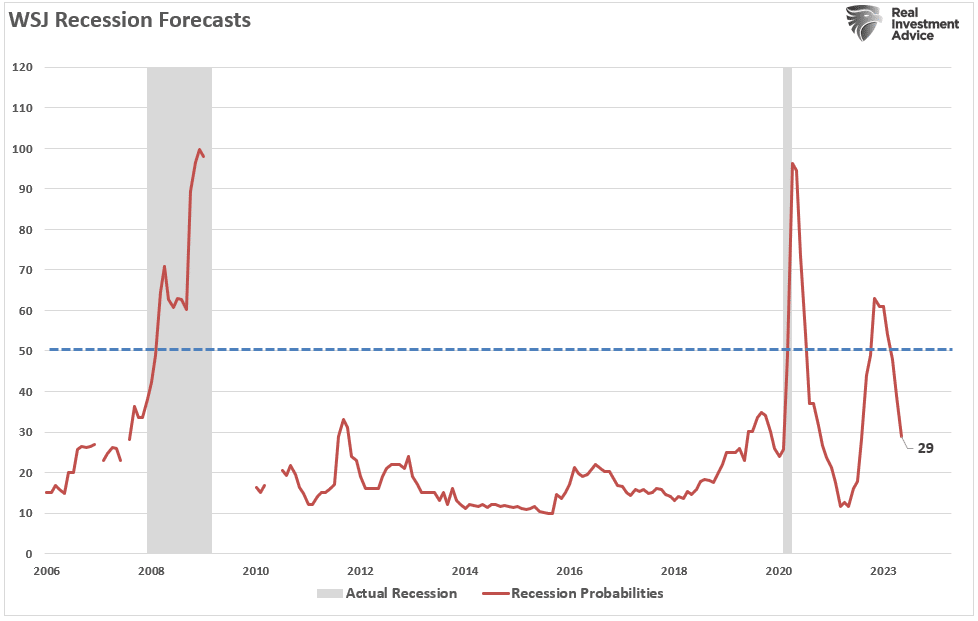

“It has been two years since forecasters felt this good about the economic outlook. In the latest quarterly survey by The Wall Street Journal, business and academic economists lowered the chances of a recession within the next year to 29% from 39% in the January survey. That was the lowest probability since April 2022, when the chances of a recession were set at 28%.

Economists don’t think the economy will get even close to a recession. In January, they, on average, forecast sub-1% growth in each of the first three quarters of this year. Now, they expect growth to bottom out this year at an inflation-adjusted 1.4% in the third quarter.” – WSJ

According to the March retail sales data, consumer spending added “fuel” to economists’ exuberance about this year.

According to the March retail sales data, consumer spending added “fuel” to economists’ exuberance about this year.

Rising inflation in March didn’t deter consumers, who continued shopping at a more rapid pace than anticipated, the Commerce Department reported Monday. Retail sales increased 0.7% for the month, considerably faster than the Dow Jones consensus forecast for a 0.3% rise though below the upwardly revised 0.9% in February, according to Census Bureau data that is adjusted for seasonality but not for inflation.” – CNBC

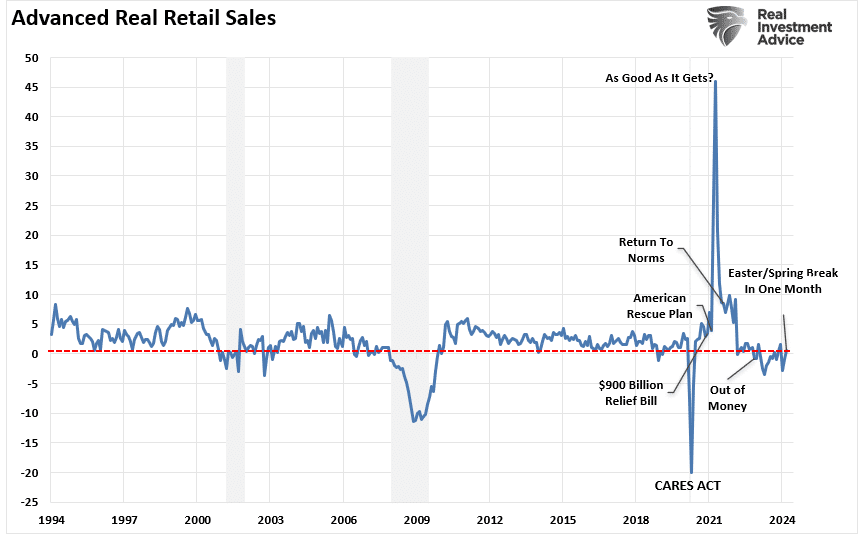

The chart below shows the monthly change in the retail sales data over the last two years. While mainstream economists trumpeted the strength of the consumer, the March retail sales data had some interesting points worth noting.First, retail sales data was extraordinarily weak from October to January, the traditionally strongest shopping months of the year. That period included Halloween, Thanksgiving, Christmas, and NYear’sr’s. So, to some degree, the strength of spending over the last two months is unsurprising as, eventually, consumers need to buy goods or services previously postponed.Secondly, while the March retail sales data was strong, it was weaker than February. However, March contained two significant spending periods, Spring Break and Easter, which generally don’t occur. Since Spring Break and Easter are considerable travel and shopping periods, it is unsurprising that the retail sales data increased with oil prices rising. As shown below, there is a very high correlation between nominal retail sales and oil prices.

While mainstream economists trumpeted the strength of the consumer, the March retail sales data had some interesting points worth noting.First, retail sales data was extraordinarily weak from October to January, the traditionally strongest shopping months of the year. That period included Halloween, Thanksgiving, Christmas, and NYear’sr’s. So, to some degree, the strength of spending over the last two months is unsurprising as, eventually, consumers need to buy goods or services previously postponed.Secondly, while the March retail sales data was strong, it was weaker than February. However, March contained two significant spending periods, Spring Break and Easter, which generally don’t occur. Since Spring Break and Easter are considerable travel and shopping periods, it is unsurprising that the retail sales data increased with oil prices rising. As shown below, there is a very high correlation between nominal retail sales and oil prices.

Paying More For The Same Amount

Economists often overlook another important point about the retail sales data. As noted above, the March retail sales report was NOT adjusted for inflation. Furthermore, the report is in nominal “dollar volume” and not the amount of goods or services sold. Oil and gasoline prices are an excellent example of the issue with the retail sales data.Let’s assume you own a car with 18-gallon fuel tank. Your daily activities are mostly going to work, going to the grocery store, eating out, having entertainment, etc. As such, you consume one tank of gas each week. Here is the math:

Week 1: 18-gallons of gas @ $3/gallon = $54.

That week, the store adds $54 to the monthly retail sales total for selling 18 gallons of gasoline. However, the price will increase to $4 per gallon next week.

Week 2: 18-gallons of gas @ $4/gallon = $72.

Here is the question.While the retail sales data increased by $18 in week two, did the consumer purchase more gasoline? In other words, if the economy’s strength is ultimately measured by how much we produce (gross domestic product), then does spending more for the same amount of goods or services equate to a stronger economy?The picture is quite different if we adjust the nominal retail sales data for inflation. Again, it is unsurprising that even on an inflation-adjusted basis, retail sales rose in February after declining for four months previously. However, with March containing Spring Break and Easter, the data suggests a weaker consumer that headlines tout. It is worth noting that retail sales data is not very useful in determining whether the economy is nearing a recession. As shown below, an annual growth rate of 2% has been a good marker for economic growth. As such, retail sales should grow at roughly 2% annually as well, given that personal consumption expenditures comprise approximately 70% of the economic equation. However, other than 2007, retail sales did not clarify economic strength.

It is worth noting that retail sales data is not very useful in determining whether the economy is nearing a recession. As shown below, an annual growth rate of 2% has been a good marker for economic growth. As such, retail sales should grow at roughly 2% annually as well, given that personal consumption expenditures comprise approximately 70% of the economic equation. However, other than 2007, retail sales did not clarify economic strength. In other words, spending more for the same amount of goods and services is not a sign of economic strength.

In other words, spending more for the same amount of goods and services is not a sign of economic strength.

Economic Forecasts Tend To Be ErroneousFurthermore, while the recent nominal sales data was robust, it is crucial to remember the economic data has a significant lag. Each of the dates below shows the economy’s growth rate immediately before the onset of a recession. You will note in the table that in 7 of the last 10 recessions, real GDP growth was running at 2% or above. In other words, according to the media, there was NO indication of a recession. But the next month, one began. Crucially, I am not saying a recession is starting next month. However, I suggest that relying heavily on one month’s retail sales data to claim the economy avoided a recession is not likely ideal. Let’s revisit that chart of the WSJ economic forecast. I have added two notations: the start and end of recessions and when the NBER officially dated that period. As shown in both previous recessions, WSJ economists had a very low probability of the economy entering a recession just before it occurred.

Crucially, I am not saying a recession is starting next month. However, I suggest that relying heavily on one month’s retail sales data to claim the economy avoided a recession is not likely ideal. Let’s revisit that chart of the WSJ economic forecast. I have added two notations: the start and end of recessions and when the NBER officially dated that period. As shown in both previous recessions, WSJ economists had a very low probability of the economy entering a recession just before it occurred. The reality is that on an inflation-adjusted basis, the retail sales data suggests the consumer remains weak. While spending more to buy the same amount of goods or services may look good on paper, the average household has less money to spend elsewhere. As shown, the annual rate of change in real retail sales is near some of the lowest levels outside of a recession.

The reality is that on an inflation-adjusted basis, the retail sales data suggests the consumer remains weak. While spending more to buy the same amount of goods or services may look good on paper, the average household has less money to spend elsewhere. As shown, the annual rate of change in real retail sales is near some of the lowest levels outside of a recession. Lastly, consumer credit supporting retail sales will become more problematic with rising interest rates. Higher interest rates tend to reduce the average growth rate of retail sales data.

Lastly, consumer credit supporting retail sales will become more problematic with rising interest rates. Higher interest rates tend to reduce the average growth rate of retail sales data. Our advice is to remain cautious about economic exuberance. Those forecasts are often disappointing.More By This Author:Treasury Cash Soars Providing A Liquidity Reprieve

Our advice is to remain cautious about economic exuberance. Those forecasts are often disappointing.More By This Author:Treasury Cash Soars Providing A Liquidity Reprieve

Bank Rule Changes To Help Fund The Deficit

The Magnificent Seven Are Struggling- What Might It Mean?