Job growth in March posted a solid gain, inspiring a new round of upbeat comments on the outlook for U.S. payrolls and the economy generally. But newly minted numbers for two multi-factor measures of the labor market hint at a weakening trend. In contrast with the upbeat message in the latest data for payrolls, broadly defined benchmarks of the labor market published yesterday by the Federal Reserve and the Conference Board (CB) reveal a worrisome round of deceleration unfolding in the first quarter. The conflicting signals raise a question: Is the U.S. labor market weaker than the nonfarm employment numbers imply?

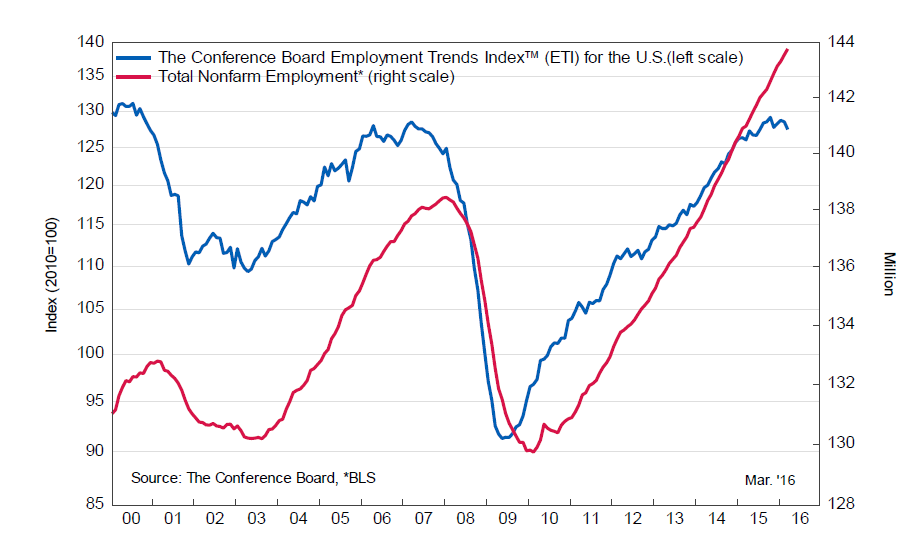

Let’s take a closer look at the data for some insight, starting with the CB’s Employment Trends Index (ETI). This eight-factor benchmark (blue line in chart below) ticked down last month, touching its lowest level since last spring. ETI is still higher on a year-over-year basis, but by a thin 1.1%.

“The Employment Trends Index has been showing signs of weakening in recent months, suggesting that employment growth is likely to slow through the summer,” said Gad Levanon, Chief Economist, North America, at The Conference Board. “With GDP barely growing at a two percent rate, it’s difficult to see how employment can continue to expand by 200,000 or more jobs per month.”

In fact, a 2% rise in GDP constitutes wishful thinking at this point in the dark art of looking ahead to the “advance” first-quarter GDP report that’s scheduled for release at the end of this month. The Atlanta Fed’s GDPNow model as of Apr. 1 is projecting a weak 0.7% growth rate (seasonally adjusted annual rate) in Q1—down from the already sluggish 1.4% gain in last year’s Q4 GDP.

The Federal Reserve’s Labor Market Conditions Index (LMCI) inched up slightly in March, but continues to print at negative values. In fact, this 19-factor index has been below zero for three straight months–the longest stretch of red ink for LMCI since the last recession.