Ten Reasons Why Stocks Can’t Sell-Off Big Time

Mar 28, 2018

Jeremy Parkinson

Finance

While driving back from Lake Tahoe last weekend, I received a call from a dear friend who was in a very foul mood. Following the advice of another newsletter that I won’t mention, he bailed out of all his stocks on the February 9 meltdown. He was promised that Armageddon was coming, and the Dow […]

Should You Buy Wesco Aircraft Holdings Inc. Now?

Mar 28, 2018

Jeremy Parkinson

Finance

Shares of Wesco Aircraft Holdings Inc. (NYSE: WAIR) are receiving a lot of investor interest as of late due to the stock’s 16.4% increase over the last month. Shareholders are now asking themselves whether the company’s current stock price is reflective of its true value or if shares have even further upside from here. Let’s take a […]

Rosey Grier Says Relax About The Ted Spread

Mar 28, 2018

Jeremy Parkinson

Finance

Did I miss the memo that we should all become STIR traders? Over the past month, the financial pundits’ infatuation seems to have moved from VIX to LIBOR, with everyone keenly aware of each tick in the TED spread. Here is the scary chart of the TED spread (the difference between US dollar eurodollar funding and American government treasury […]

Is The Fed Panicking: Yield Curve Tumbles To Fresh 11-Year Lows

Mar 28, 2018

Jeremy Parkinson

Finance

Despite the stock market’s Amazon-bounce gains, US Treasury yields are lower and the yield curve flatter once again – tumbling to its flattest since Oct 2007. Deja vu all over again… 10Y Yields are holding below 2.80%… And the yield curve has crashed to fresh flats not seen since Oct 2007… The entire curve is rolling […]

Media Leaders And Laggards

Mar 28, 2018

Jeremy Parkinson

Finance

You can see, at a glance (monthly charts below of FOXA, CMCSA and TWX), which media giants are leading or lagging each other overall…they are all at or below their respective major resistance levels. The only one whose momentum indicator is above zero on this long-term timeframe is FOXA…if it plunges and falls below zero, no doubt the others will weaken further. On the flip side, […]

Inverted Yield Curve – Will This Time Be Different?

Mar 28, 2018

Jeremy Parkinson

Finance

The stock market’s positive tone quickly evaporated after the expected quarter-point hike in the Fed Funds rate on March 21st. Markets love certainty; the latest rate increase was the sixth since the FOMC started raising rates in December 2015 and baked into the market cake. As such, a short relief rally ensued. With certainty past, […]

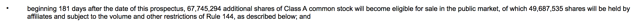

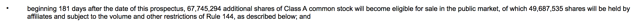

CarGurus Could Be Driven Lower By Lockup Expiration

Mar 28, 2018

Jeremy Parkinson

Finance

The 180-day lockup period for CarGurus, Incorporated (CARG) ends on April 10, 2018. (Source: Nasdaq.com) When this six-month period concludes, the company’s pre-IPO shareholders will have the ability to sell their more than 67 million currently-restricted shares. (Source: S-1/A) The potential for an increase in the volume of shares traded on the secondary market could negatively […]

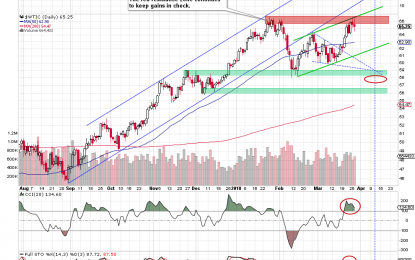

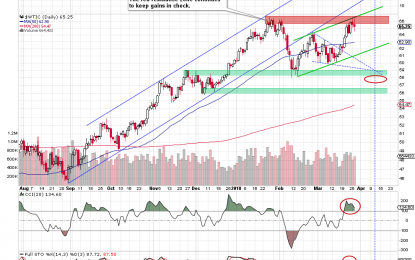

Crude Oil – Hello Elliott, My Old Friend

Mar 28, 2018

Jeremy Parkinson

Finance

The test of the resistance line, the triangle apex reversal, the a-b-c waves in the zigzag pattern… What connects them? Give us 28 paragraphs and 975 words and you will see that these seemingly mismatched concepts will form a meaningful and promising scenario. Technical Analysis of Crude Oil Let’s start with the well-known daily chart (charts […]

Fourth-Quarter GDP Final Estimate Hits 2.9%,Tops Consensus

Mar 28, 2018

Jeremy Parkinson

Finance

The third estimate of fourth-quarter GDP is 2.9%, up 0.4 percentage points from the second estimate. The BEA revised its Fourth-Quarter 2017 GDP estimate to 2.9%, topping the consensus estimate of 2.7%. Rick Davis at the Consumer Metrics Institute provides this summary. The boost in the headline number resulted from upward revisions to contributions from consumer spending (+0.17%) and […]

Tesla Crash Sinks Stock: Shorts Rejoice, Bulls See Opportunity

Mar 28, 2018

Jeremy Parkinson

Finance

Tesla Inc. (Nasdaq: TSLA) is the latest Wall Street darling to be ravaged by bears due to an onslaught of negative headlines. The deadly Tesla crash in California has sparked a regulatory investigation, which is only adding to the liquidity concerns and worries about the Model 3 ramp. Tesla stock plunged to its lowest level in […]