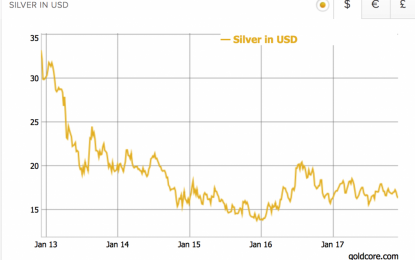

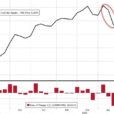

Silver’s Positive Fundamentals Due To Strong Demand In Key Growth Industries

Dec 04, 2017

Jeremy Parkinson

Finance

– Increased efforts in green energy and advanced technology set to boosts silver’s demand – Four-year supply deficit set to increase due to fewer mine openings and discoveries – Bank manipulation may be why silver underperforming – TD Securities and the Bank of Montreal expect silver to be best performing precious metal in 2018 – […]

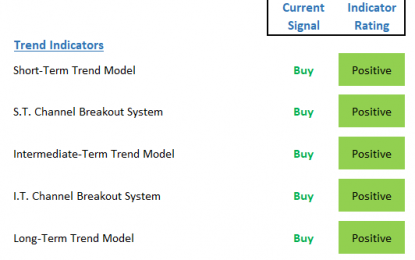

The Next Leg Higher?

Dec 04, 2017

Jeremy Parkinson

Finance

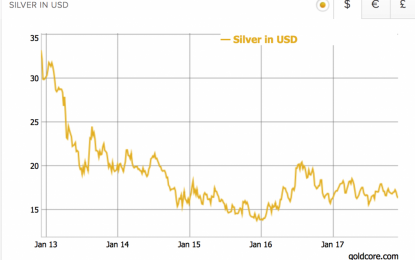

Good Monday morning and welcome back to what appears to be a celebration of tax reform on Wall Street. But before we get ahead of ourselves in terms of how far the bulls are going to run today, let’s start the week with a look at my key market models/indicators and see where we stand. […]

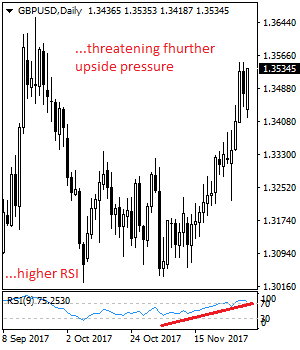

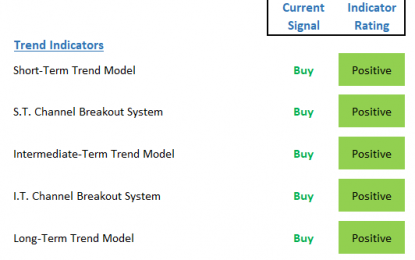

GBP/USD: Bullish, Biased To The Upside On Trend Resumption

Dec 04, 2017

Jeremy Parkinson

Finance

GBP/USD: The pair now faces risk of a trend resumption after reversing its Friday losses on during Monday trading session. Support lies at the 1.3500 level where a break will turn attention to the 1.3450 level. Further down, support lies at the 1.3400 level. Below here will set the stage for more weakness towards the […]

Keep Faith In Rising P/E: Play 5 Top-Ranked Stocks

Dec 04, 2017

Jeremy Parkinson

Finance

Generally, investors love stocks with a low price-to-earnings (P/E) ratio. The general perception is that the lower the P/E, the higher will be the value of the stock. The simple logic that a stock’s current market price does not justify (is not equivalent to) its higher earnings and therefore has room to run is behind […]

Dollar Bounces On High Hopes

Dec 04, 2017

Jeremy Parkinson

Finance

The US Dollar was broadly higher on Monday after the US Senate approved legislation to overhaul the controversial US tax reform code. With the exception of a single vote, all Republican members voted in favor of the legislation which includes significant rate cuts for corporations and high-income tax payers. Analysts say that gains on the […]

The Bear’s Lair: Triumph Of The Bureaucrats

Dec 04, 2017

Jeremy Parkinson

Finance

The typical form of human government moved from absolute monarchy, to oligarchy, to democracy, but it did not stop there. As government grew, popular control over it declined, while its own bureaucracy became the principal factor determining its direction. We have now reached the stage where to term the result a “democracy” is laughably in […]

Positive Expectations, But Will S&P 500 Continue Higher?

Dec 04, 2017

Jeremy Parkinson

Finance

Intraday trade: Our Friday’s intraday trading outlook was bearish. It proved accurate because the S&P 500 reached our intraday profit target level of 2,615 (daily low at 2,605.52). the index fell sharply following relatively neutral opening of the trading session. The market has managed to close neutral (-0.2%). We still can see some short-term technical […]

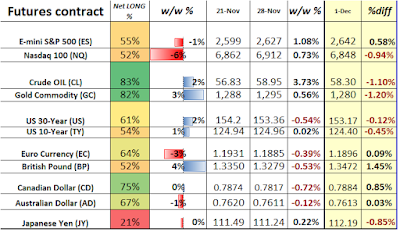

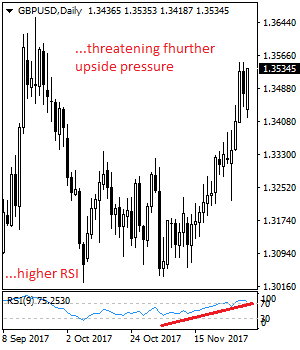

Pound’s Breakout Exposes Yearly Highs

Dec 04, 2017

Jeremy Parkinson

Finance

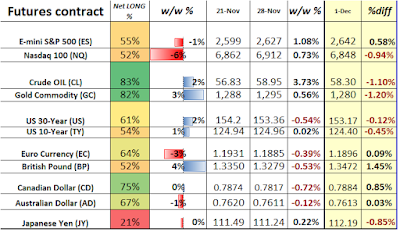

Speculators piled into the British pound, triggering a range breakout, according to the latest Commitment of Traders (COT) report. Equity markets remain resilient despite cautious positioning trends by (non-commercial) speculators and an increased bout of volatility. Meanwhile, speculators were mixed in terms of positioning vs the USD, but managed to up their extremely bullish bets […]

What’s The Point, Gold And Silver Report

Dec 04, 2017

Jeremy Parkinson

Finance

A reader emailed us, to ask a few pointed questions. Paraphrasing, they are: Who cares if dollars are calculated in gold or gold is calculated in dollars? People care only if their purchasing power has grown. What is the basis good for? Is it just mathematical play for gold theorists? How does knowing the basis […]

Latest Thoughts On U.S. Market Valuations

Dec 04, 2017

Jeremy Parkinson

Finance

Professor Jeremy Siegel recently appeared on CNBC and suggested that the U.S. equity markets were approaching fair value and that markets might “pause” some of their strong gains in 2018. Siegel still believes corporate tax cuts are one factor that supports the market strength and that earnings should receive a boost from pending changes. He […]