Dollar Continues Downward Slide

Jul 21, 2017

Jeremy Parkinson

Finance

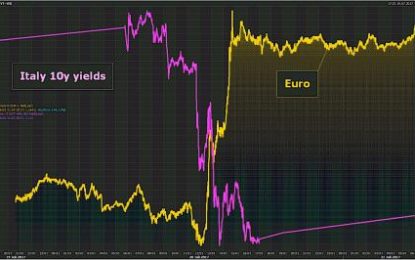

The dollar weakened further early Friday morning with no end to the spiral in sight after European Central Bank President Mario Draghi making comments on Thursday afternoon that sent the common currency to near two-year highs against the greenback.The dollar is now 10 percent down against the euro since the start of 2017. The dollar’s […]

Post-BoC Canadian Dollar Rally Vulnerable To Softening CPI

Jul 21, 2017

Jeremy Parkinson

Finance

– Canada Consumer Price Index (CPI) to Slow for Second Month in June. – Core Inflation to Hold Steady at Annualized 1.3% for Six Consecutive Months. – Retail Crowd Remain Stubbornly Net-Long USD/CAD Since June 7, When It Traded Near 1.3481. Trading the News: Canada Consumer Price Index (CPI) Another slowdown in Canada’s Consumer Price Index (CPI) may tame the […]

Rail Week Ending 15 July 2017: Economic Intuitive Slowing Continues

Jul 21, 2017

Jeremy Parkinson

Finance

Week 28 of 2017 shows same week total rail traffic (from same week one year ago) improved according to the Association of American Railroads (AAR) traffic data. The economically intuitive sectors slowing continues. Analyst Opinion of the Rail Data We review this data set to understand the economy. If coal and grain are removed from the analysis, rail over […]

EUR/USD: Draghi And Trump Sink The Dollar

Jul 21, 2017

Jeremy Parkinson

Finance

Yesterday, trading on the euro/dollar pair closed up. By the end of the day, the euro had appreciated by 115 pips against the dollar, reaching 1.1630. The rate had dropped to 1.1479 before Mario Draghi’s press conference. The European Central Bank decided to maintain rates at their current levels. The base rate remains at zero, […]

E

Why Is Inflation So Low, Virtually Everywhere

Jul 21, 2017

Jeremy Parkinson

Finance

“The most important lesson from the 1930s, as well as from the modern-day Japanese experience, is that monetary policy provides no answer for a chronic deficiency of aggregate demand. Addressing it is a task primarily for fiscal authorities. The idea that central banks should consider making a new promise to raise their inflation targets is […]

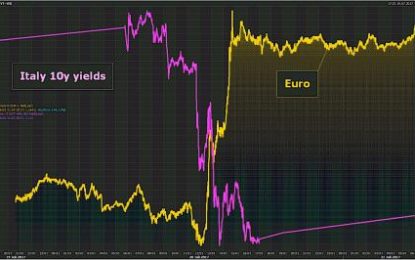

Euro Surges To 2-Year High In “Bipolar” Draghi Reaction; Futures Flat

Jul 21, 2017

Jeremy Parkinson

Finance

The euro’s surge to an almost two-year high put a cap on the global market rally in Friday’s quiet session, with most major exchanges consolidating after a second strong week of gains. The MSCI Asia-Pacific index declined for first time in ten days while the European Stoxx 600 index was fractionally in the green as […]

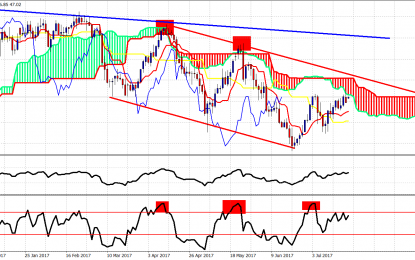

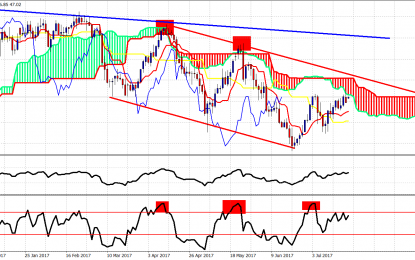

Oil At Important Resistance Area

Jul 21, 2017

Jeremy Parkinson

Finance

Oil price got rejected yesterday once it reached the Daily Kumo (cloud) resistance at 47.30$. Oil price could be making a double top reversal here if we see price remaining below the Daily Kumo (cloud). A rejection at current levels will bring pressure to oil prices. A break below 46-45.70$ could signal a reversal confirmation […]

EUR/USD After The ECB: All The Way To 1.20? Four Opinions

Jul 21, 2017

Jeremy Parkinson

Finance

Mario Draghi tried to be as dovish as possible, but markets didn’t buy it. The move up on EUR/USD was compounded by the new Trump troubles. What’s next? Here are four opinions: Here is their view, courtesy of eFXnews: EUR/USD: Post-ECB: Towards 1.20 Before A Meaningful Correction – SocGen Societe Generale Cross Asset Strategy Research highlights 2 […]

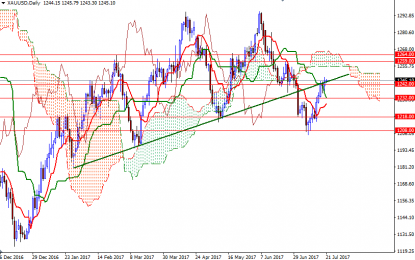

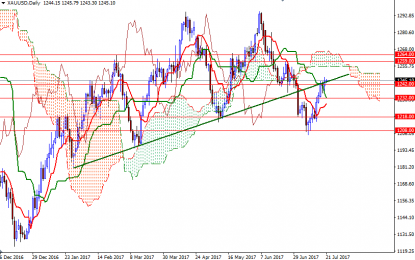

Gold Pushes Higher On Weakening Greenback

Jul 21, 2017

Jeremy Parkinson

Finance

Gold prices rose $3.39 an ounce on Thursday, benefitting from a drop in the U.S. dollar index. The euro surged to its highest level in more than two years after European Central Bank President Mario Draghi said the central bank will discuss when to trim its massive bond purchases in the autumn. Weaker equity markets […]

Dollar Licks Wounds As News Stream Doesn’t Improve

Jul 21, 2017

Jeremy Parkinson

Finance

ECB President Draghi did not argue forcefully enough at yesterday’s press conference to dampen the enthusiasm for the euro. The initial dip was quickly bought and the euro chased above last year’s high near $1.1615, and the gains have been extended to nearly $1.1680 today. The next target is the August 2015 near $1.1715 is near. […]