Schlumberger Announces Second-Quarter 2017 Results

Jul 21, 2017

Jeremy Parkinson

Finance

Schlumberger Limited (NYSE: SLB), with principal offices in Paris, Houston, London and The Hague, is the world’s leading provider of technology for reservoir characterization, drilling, production, and processing to the oil and gas industry. It operates in 85 countries and employs approximately 100,000. Schlumberger reported results for the second quarter of 2017 as follows: Total corporate revenue: […]

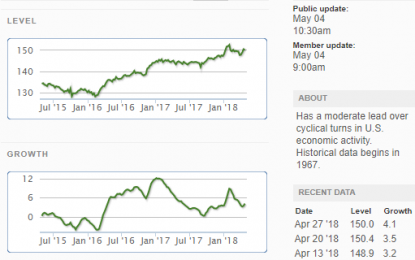

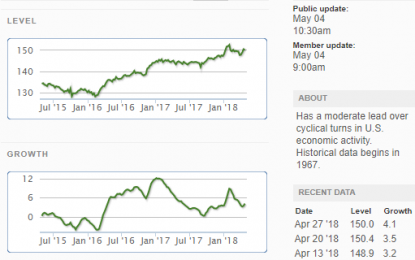

July 2017: ECRI’s WLI Growth Index Rate Marginally Ticks Up

Jul 21, 2017

Jeremy Parkinson

Finance

ECRI’s WLI Growth Index which forecasts economic growth six months forward remains in positive territory for over one year – after spending the previous 35 consecutive weeks in negative territory. This is compared to RecessionAlerts similar weekly leading index. Also, ECRI released their coincident and lagging indices. Analyst Opinion of the trends of the weekly […]

American Axle Plunges After Reports Of Deep GM Production Cuts

Jul 21, 2017

Jeremy Parkinson

Finance

Shares of drivetrain maker American Axle (AXL) are plunging after reports of potentially significant production cuts at General Motors (GM). GM PRODUCTION CUTS: According to an earlier report from Reuters, the auto giant is weighing “whether to cancel at least six passenger cars in the U.S. market after 2020, including the Chevrolet Volt hybrid, which […]

Waste Management (WM) Stock Analysis

Jul 21, 2017

Jeremy Parkinson

Finance

Next time you take your trash out or see your neighbor’s cans on the side of the garage/house – I hope you now think of dividend investing. This dividend stock analysis proudly brings Waste Management (WM) to the forefront this summer. We performed a dividend stock analysis on this company and industry competition to see […]

GBP/USD 4-Hour View: Standard A-B-C Correction Lower?

Jul 21, 2017

Jeremy Parkinson

Finance

If this pattern is a standard A-B-C correction lower; the target is 1.2826 calculated by Wave C being the same length of Wave A. Also, this brings into another common level–prior Wave 4 of the impulse higher at 1.2808. Support for our GBP/JPY short it may be…

Quick Take: Rates, Earnings And Russia In Focus

Jul 21, 2017

Jeremy Parkinson

Finance

My apologies for the dearth of morning missives this week. As I mentioned, I have been technology- and communications-challenged of late. However, the good news is that my tech travails appear to be coming to an end as I have a shiny new computer, a landline phone, AND upgraded internet. It will suffice to say […]

Gold/Silver Shorts Extreme

Jul 21, 2017

Jeremy Parkinson

Finance

The gold-futures and silver-futures short positions held by speculators have rocketed up to extremes in recent weeks. These elite traders are aggressively betting for further weakness in gold and silver prices. But history has proven extreme shorts are a powerful contrarian indicator. Right as speculators wax the most bearish as evidenced by their collective bets, […]

Europe ETF (FEP) Hits New 52-Week High

Jul 21, 2017

Jeremy Parkinson

Finance

For investors seeking momentum, First Trust Europe AlphaDEX Fund (FEP – Free Report) is probably on radar now. The fund just hit a 52-week high, and is up about 30.7% from its 52-week low price of $27.67 per share. But are more gains in store for this ETF? Let’s take a quick look at the fund and the […]

Which European Strategies Work Now?

Jul 21, 2017

Jeremy Parkinson

Finance

With the news flow we’ve seen thus far in 2017, it would have been difficult to predict any broad-based strategies focused on European equities being up 20% or more around the half-year point. Yet:1 European equity indexes have significantly outperformed U.S. equities, giving credence to the belief that after elections ended up outside of the […]

Long Term Yields At Key Inflection Point – Be Ready For Higher Rates!

Jul 21, 2017

Jeremy Parkinson

Finance

Fund Manager Dana Lyons thinks we are in for rising yields over the long term. We look at the charts as well as some other factors that make Dana and his team believe this will be a long term trend. Dana also comments on the broad equity markets and if they will start breaking down. […]