WTI Crude Oil And Natural Gas – February 5, 2016

Feb 05, 2016

Jeremy Parkinson

Finance

WTI Crude Oil The WTI Crude Oil market tried to rally during the course of the day on Thursday but found far too much in the way of resistance above at the $38 level. By doing so, we ended up forming a shooting star which of course is the most negative candle that you can […]

Incrementum Advisory Board Meeting Q1

Feb 05, 2016

Jeremy Parkinson

Finance

A Comprehensive Discussion of the Economy and Financial Markets The Incrementum Fund’s advisory board has held its quarterly meeting on January 10, and the transcript has just become available. Readers can download the transcript via the link below this post. Unfortunately two board members (Dr. Frank Shostak and Rahim Taghizadegan) were unable to attend this […]

EU Session Bullet Report – The Calm Before The Storm

Feb 05, 2016

Jeremy Parkinson

Finance

EUR/USD Intraday: further advance. Pivot: 1.1115 Most likely scenario: long positions above 1.1115 with targets @ 1.124 & 1.131 in extension. Alternative scenario: below 1.1115 look for further downside with 1.107 & 1.1 as targets. Comment: even though a continuation of the consolidation cannot be ruled out, its extent should be limited. Gold spot Intraday: […]

EUR/USD: Inverted H&S, GBP/USD: Multi-Year Channel

Feb 05, 2016

Jeremy Parkinson

Finance

The recent big moves in Forex markets created opportunities and interesting patterns on the charts. Here are the views from SocGen: Here is their view, courtesy of eFXnews: EUR/USD retested last March levels (1.0570/1.05) and also the multi decadal channel back in November after which it has embarked on a recovery. This week it has confirmed an […]

Hyperinflating Venezuela Used 36 Boeing 747 Cargo Planes To Deliver Its Worthless Bank Notes

Feb 05, 2016

Jeremy Parkinson

Finance

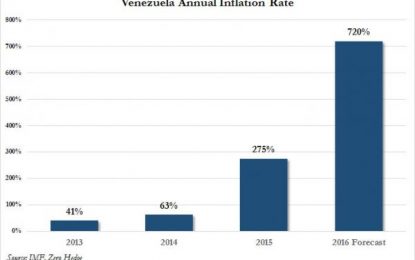

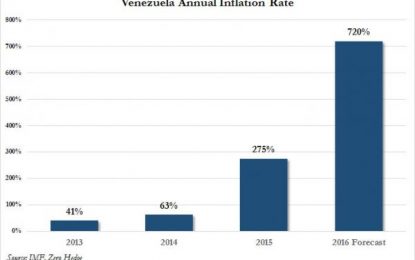

The weeks ago, when we showed “What The Death Of A Nation Looks Like: Venezuela Prepares For 720% Hyperinflation”, we said that after looking at a chart of Venezuela’s upcoming hyperinflation… …a hyperinflation in which the soaring stock market has failed to keep pace with the collapsing currency, thereby mocking all erroneous thought experiments that […]

22 Signs That The Global Economic Turmoil We Have Seen So Far In 2016 Is Just The Beginning

Feb 05, 2016

Jeremy Parkinson

Finance

As bad as the month of January was for the global economy, the truth is that the rest of 2016 promises to be much worse. Layoffs are increasing at a pace that we haven’t seen since the last recession, major retailers are shutting down hundreds of locations, corporate profit margins are plunging, global trade is […]

Germany To Enforce A €5,000 Limit On Cash Transactions

Feb 05, 2016

Jeremy Parkinson

Finance

The German people do not have to worry about their taxes rising because of the Greeks; the refugees are whom they should worry about. Now the German government is joining the rest of the crowd and preparing to move electronic. They will look at introducing a limit of €5,000 euros on any cash transaction to combat money laundering […]

EUR/USD And GBP/USD Forecast – February 5, 2016

Feb 05, 2016

Jeremy Parkinson

Finance

EUR/USD The Euro rallied during the session on Thursday, finally clearing the resistance barrier that had been causing this market to consolidate for some time. Because of this, looks like we are ready to go higher but with the Nonfarm Payroll Numbers coming out today, it’s very likely that the markets will have quite a […]

Explaining Gold’s Relative Expensiveness

Feb 05, 2016

Jeremy Parkinson

Finance

In the blog post “Some gold bulls need a dose of realism“, I noted that relative to the Goldman Sachs Spot Commodity Index (GNX) the gold price was at an all-time high and about 30% above its 2011 peak. I then wrote: “Rather than imagining a grand price suppression scheme involving unlimited quantities of “paper […]

Crude Oil Bottoms And Blues

Feb 05, 2016

Jeremy Parkinson

Finance

Crude oil prices have dropped from about $106 in June of 2014 to briefly under $30 in January of 2016 – down about 74% peak to trough.This appears to be an on-going disaster for oil companies, the banks who loaned money to frackers, oil exporting countries, global stock markets and others. Conventional wisdom suggests that […]