EUR/USD Forex Signal For December 2, 2014

Dec 02, 2014

Jeremy Parkinson

Entertainment

EUR/USD Signal Update Yesterday’s signal to go short after a bearish rejection of the 1.2503 level was triggered. Look to protect profit or take partial profits at the first short-term bullish candlestick after the price reaches 1.2420. Levels at 1.2405 and 1.2360 make realistic near-term targets. Today’s EUR/USD Signals Risk 0.75% All trades must be entered […]

What You Need To Know About Investment In China In 8 Charts

Dec 02, 2014

Jeremy Parkinson

Entertainment

Jamil Anderlini, writing in the Financial Times, brought our attention to some Chinese government research about the debt in China and how it has been used for investment in that country. See China has ‘wasted’ $6.8tn in investment, warn Beijing researchers. Looking deeper into the subject, including looking at the paper Anderlini reported on (Inefficient and ineffective […]

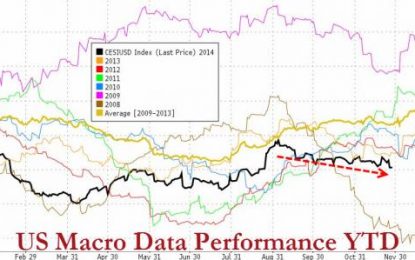

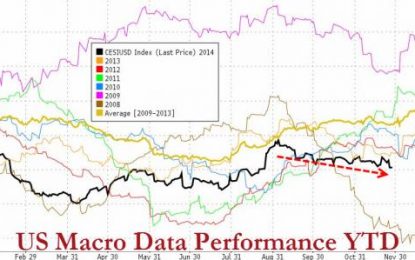

2014 Is Now The Worst Year For US Macro Data Performance Since 2008

Dec 02, 2014

Jeremy Parkinson

Entertainment

Once again the cyclical patterns in US macro data are re-emerging as extrapolated hopes fade into mean-reverting credit-impulse-hangover-driven realities. Despite all the hopes and dreams of escape velocity, cleanest-dirty-shirt-wearing economic enthusiasts, year-to-date performance of Citi’s US Macro Surprise index is at its lowest level since 2008. The worst performing US Macro data since 2008… Whether this […]

Taking The Strategic Intelligence Model To Moscow

Dec 02, 2014

Jeremy Parkinson

Entertainment

I am going to visit Moscow next week. I was invited by the Moscow State Institute of International Relations to speak on strategic analysis, their term for what Stratfor calls strategic forecasting. Going to Moscow would give me pause under any circumstances. I am a product of the Cold War, and for me, at some […]

The Oil-Drenched Black Swan, Part 2: The Financialization Of Oil

Dec 02, 2014

Jeremy Parkinson

Entertainment

All the analysts chortling over the “equivalent of a tax break” for consumers are about to be buried by an avalanche of defaults and crushing losses as the chickens of financializing oil come home to roost. The pundits crowing about the stimulus effect of lower oil prices on consumers are missing the real story, which […]

Biotech Stocks Hit By Profit Taking-More Volatility Lies Ahead

Dec 02, 2014

Jeremy Parkinson

Entertainment

High Flier Tech Stocks Take A Breather NASDAQ Off 1.34% To 4727 Don’t blame the consumer and retail sales for the sell-off. Investors have done very well this year with simple indexing. The SPY SPDR S&P 500 is up 11.4% YTD, the FBT First Trust Biotechnology Index is up 45.7% YTD and the XLK SPDR Technology Index is up 17.5% YTD. Who needs stock […]

Bull Of The Day: Dice Holdings

Dec 02, 2014

Jeremy Parkinson

Entertainment

The economy has continued to heat up as jobs have been added and consumer confidence has increased. While sites like Monster and CareerBuilder dominate the job search, upstarts are beginning to challenge them for market share. Today’s Bull of the Day is looking to organize the world’s talent by providing specialized insights and relevant connections […]

Can Money Just Be Devalued Creating Deflation As A Solution

Dec 02, 2014

Jeremy Parkinson

Entertainment

QUESTION: Mr. Armstrong; Is it possible that governments devalue currencies to confiscate capital like taxes? It really does not seem likely that these people have any intention of moving into hyperinflation. They are increasing money supply but at a slower rate than the destructive deflation. It clearly appears governments are in a confiscation mode and it […]

Commodities Drop; Oil Prices Down

Dec 02, 2014

Jeremy Parkinson

Entertainment

Oil resumed declines after jumping from a five-year low and metals retreated amid the highest commodity-price volatility in two years. Asian stocks rebounded and South Korea’s won led emerging-market currencies higher. West Texas Intermediate crude retreated 0.5 percent by 1:04 p.m. in Tokyo, after yesterday’s 4.3 percent surge from its lowest settlement since September 2009. […]

OPEC Decision Expected And Justified

Dec 02, 2014

Jeremy Parkinson

Entertainment

OPEC meeting went as expected. There was no formal agreement to cut production in the first meeting since the price correction. This part is very similar to 1998. Prices did their thing by falling down and now slowly rebounding. OPEC is making the decision they are not the marginal barrel. Unlike their decision in 1997, […]