December Stock Considerations

Dec 01, 2014

Jeremy Parkinson

Entertainment

As we head into the home stretch of 2014 a great opportunity is seemingly handed to us for the month of December. That opportunity comes in the form of continued weakness in the oil and materials sector as depressed commodity prices have given rise to a sea of great dividend income opportunities for those willing […]

5 Things Retailers Don’t Want You To Know About Cyber Monday

Dec 01, 2014

Jeremy Parkinson

Entertainment

Black Friday might have been the most anticipated shopping event of the year, but Americans have their attention (and wallets) locked on to the next big spending event: Cyber Monday. This year, Adobe forecasts Cyber Monday sales to reach $2.6 billion, a 15 percent increase over 2013. While there might be a few deals that […]

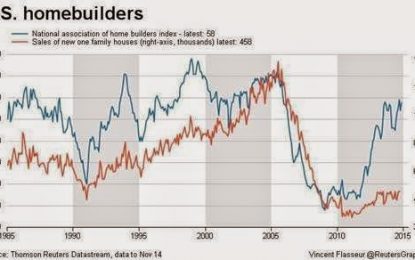

Think Homebuilder Optimism Is Irrational? Think Again

Dec 01, 2014

Jeremy Parkinson

Entertainment

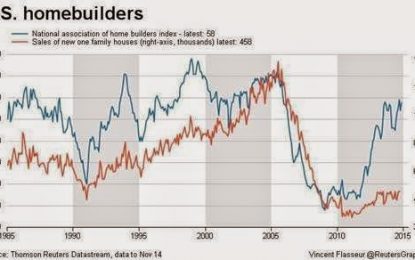

The chart below (and similar comparisons) has been circulated widely in the media and the blogosphere. It shows homebuilder optimism (as measured by the NAHB) far outpacing sales of singly-family homes in the United States. Naive reporters and bloggers have been arguing that builders are simply out of touch with reality. How could homebuilders possibly be […]

E

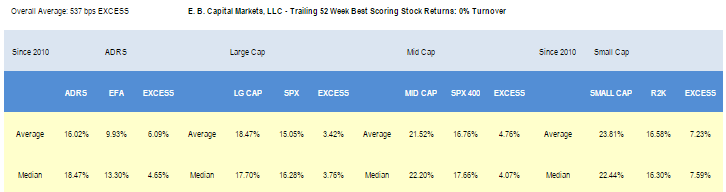

Weekly Report And Seasonality Through February

Dec 01, 2014

Jeremy Parkinson

Entertainment

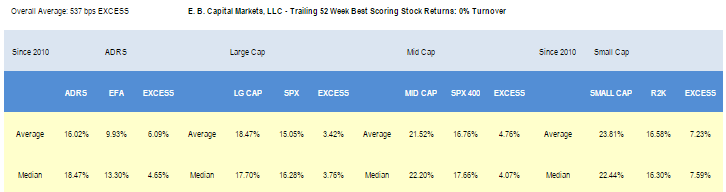

Top scoring weekly returns: Buy and Hold 1 Year Utilities and industrial goods are the two best scoring sectors. Consumer goods, services, and healthcare also score above average. Tilt toward small cap stocks across utilities. In industrial goods, focus on large cap stocks. In consumer goods and healthcare concentrate on large and mid cap stocks, […]

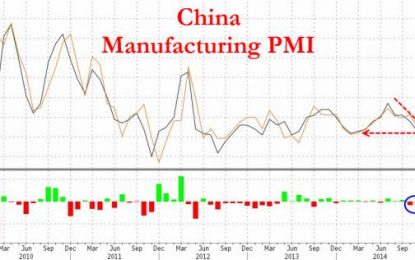

China Manufacturing PMI Drops To 8-Month Lows, Teeters On Brink Of Contraction

Dec 01, 2014

Jeremy Parkinson

Entertainment

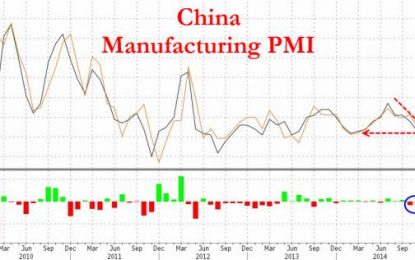

From exuberant credit-fueled cycle highs in July, China’s official Manufacturing PMI has done nothing but drop as the hangover-effect from the credit-impulse weighs once again on the now commodity-collateral crushed nation. At 50.3 (missing expectations of 50.5 for the 2nd month in a row), this is the lowest print since March. All 5 components dropped led […]

How To Ride An Aging Bull

Dec 01, 2014

Jeremy Parkinson

Entertainment

Yesterday marked the fifteenth time I have served as a guest columnist for The Striking Price at Barron’s and How to Ride an Aging Bull is one of the few articles I have written for Barron’s that has not focused almost exclusively on the VIX and volatility. In the Barron’s article I note that pundits have been calling this […]

The Oil-Drenched Black Swan, Part 1

Dec 01, 2014

Jeremy Parkinson

Entertainment

Given the presumed 17% expansion of the global economy since 2009, the tiny increases in production could not possibly flood the world in oil unless demand has cratered. The term Black Swan shows up in all sorts of discussions, but what does it actually mean? Though the term has roots stretching back to the 16th century, today it […]

Investors That Do Not Understand The Power Of Seven Will Lose Money In 2015

Dec 01, 2014

Jeremy Parkinson

Entertainment

Investors and traders around the world continually search to find or increase their edge in the financial markets to boost profits. The next few months are going to be critical for investors because the number seven is now in play for the stock market. What does this mean? In magical lore seven is a magical […]

Milton Friedman Was Wrong. Inflation Is Not Always A Monetary Phenomenon

Dec 01, 2014

Jeremy Parkinson

Entertainment

I have a lot of respect for the late Milton Friedman. I really do. His unapologetic defense of the free market was–and still is–a breath of fresh air amidst the constant drone of calls for the government to “do something” to fix all of our problems, real or imagined. But on the subject of inflation–the […]

Falling Oil Prices, Holiday Shopping Point North For U.S. Recovery

Dec 01, 2014

Jeremy Parkinson

Entertainment

This past week markets hit new highs on Wednesday, only to pull back a bit on OPEC’s decision to hold steady on production quotas. OPEC is in crisis because two of the three biggest oil producers—Russia and the United States—don’t participate in its market rigging activities. With Russia buffeted by sanctions and desperate for revenues and […]