On Obama And The Nature Of Failed Presidencies

Nov 18, 2014

Jeremy Parkinson

Entertainment

We do not normally comment on domestic political affairs unless they affect international affairs. However, it is necessary to consider American political affairs because they are likely to have a particular effect on international relations. We have now entered the final phase of Barack Obama’s presidency, and like those of several other presidents since World War II, […]

TapImmune Shares Gain 28% On Pending Catalysts And Published Comments By CEO

Nov 18, 2014

Jeremy Parkinson

Entertainment

Shares of TapImmune, Inc. (OTCBB:TPIV) rose nearly 30% on Monday after the firm was mentioned positively by analysts reacting to recently published comments by Chairman & CEO Glynn Wilson, PH.D. Wilson, in an exclusive interview with Life Sciences Intellectual Property Review estimates the Seattle-based company will be worth more than a $1 billion in just five years. The U.K. Based Life Sciences […]

One Reason Why Sickcare Is Outrageously Expensive: Needless Scans/Tests

Nov 18, 2014

Jeremy Parkinson

Entertainment

Add easy profits from needless tests to defensive medicine and no cost controls or real competition, and we have the perfect formula for waste, fraud, profiteering, bad medicine and dysfunctional, unaffordable healthcare. Why is sickcare (a.k.a. “healthcare”) absurdly unaffordable in America? There are many structural reasons which I have covered in depth for years, but one […]

Financial Repression Authority With Michael Pento

Nov 18, 2014

Jeremy Parkinson

Entertainment

Gordon T. Long and Michael Pento discuss financial repression.

EUR/USD Forex Signal For November 18, 2014

Nov 18, 2014

Jeremy Parkinson

Entertainment

EUR/USD Signal Update Yesterday’s signals expired without being triggered. Today’s EUR/USD Signals Risk 0.75% Trade only between 8am and 5pm London time. Short Trade 1 Go short following bearish price action on the H1 time frame immediately following the next touch of 1.2562. Place the stop loss 1 pip above the local swing high. Move the […]

EC

And Now The Richest .01 Percent

Nov 18, 2014

Jeremy Parkinson

Entertainment

The richest Americans hold more of the nation’s wealth than they have in almost a century. What do they spend it on? As you might expect, personal jets, giant yachts, works of art, and luxury penthouses. And also on politics. In fact, their political spending has been growing faster than their spending on anything else. […]

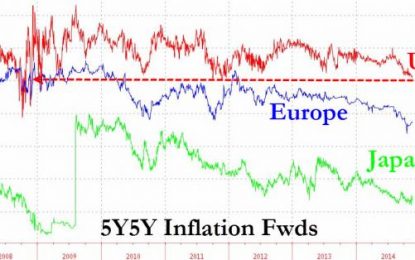

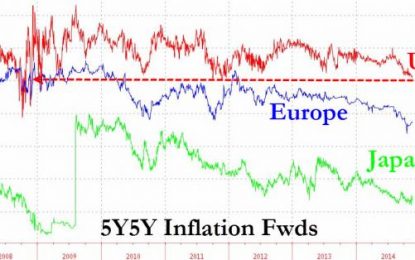

Fed Inflation Barometer Tumbles To Lowest Since 2008

Nov 18, 2014

Jeremy Parkinson

Entertainment

Despite The Fed’s Jim Bullard proclaiming last week that inflation expectations had rebounded (by which we assumed he meant the Dow), 5-year forward 5-year inflation expectations just dropped in the US to the lowest since 2008. The rest of the world is no better. In spite of promised and delivered policies Japanese and European inflation expectations are […]

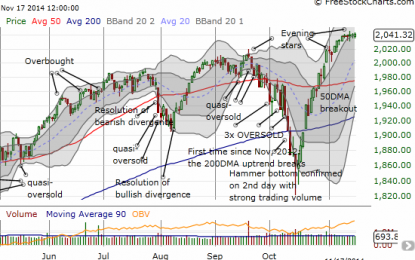

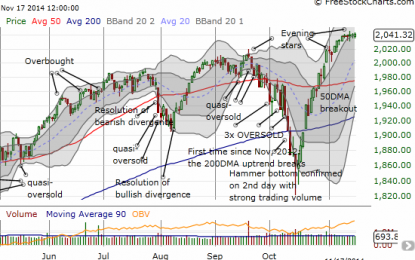

T2108 Update – Apple Watch: An Important Fade From All-Time Highs

Nov 18, 2014

Jeremy Parkinson

Entertainment

T2108 Status: 63.3%T2107 Status: 51.6%VIX Status: 14.0General (Short-term) Trading Call: Hold (bullish positions); aggressive bears can short with a tight stop at fresh all-time highsActive T2108 periods: Day #21 over 20%, Day #19 over 30%, Day #16 over 40%, Day #14 over 50%, Day #9 over 60% (overperiod), Day #91 under 70% (underperiod) Reference Charts (click […]

The 6 Economic Indicators To Follow This Week

Nov 18, 2014

Jeremy Parkinson

Entertainment

This week we will receive a flood of US economic data. Just this morning, US Industrial Production reported a month over month (MoM) decrease of 0.11% in October, missing the Estimize consensus for an increase of 0.23%. Weakness was seen in mining, which fell 0.9% after a 1.6% boost in September, and utilities, which slipped […]

The Japanese GDP Release: The Bad And The Not So Bad

Nov 18, 2014

Jeremy Parkinson

Entertainment

Instead of a 0.2% q/q increase as in the WSJ survey, GDP declined 0.4% [0] [1] It’s pretty bad news, but here are a couple of observations, following up on my previous post on Japan. Figure 1: Log GDP (blue) and consumption (red), in Ch.05¥, normalized to 2012Q4=0. Source: Cabinet Office, and author’s calculations. First, the drop is in output is […]