You Cannot Inflate The Debt Away

May 02, 2024

Jeremy Parkinson

Finance

There is a popular meme that the government has an incentive to inflate because the same debt is worth less in real terms at a higher price level. If inflation is high enough, then the government (it is said) can make the debt go away. Inflation is, after all, a tax; doesn’t it then follow […]

Is The Housing Market Going To Crash?

May 02, 2024

Jeremy Parkinson

Finance, No picture

Image Source: Unsplash Join host James Connor and real estate expert Loreen Gilbert, Wealthwise Financial CEO, as they discuss the latest revolving around real estate whether now is the time to rent or buy, and if we’ll ever see fixed 30-year mortgage rates slump down to 3%.Loreen shares own outlook on GDP numbers, interest rate expectations, […]

The Fed Is Giving Investors Fair Warning

May 02, 2024

Jeremy Parkinson

Finance

Image Source: Pixabay Richard Maybury provides a realistic assessment: “…. Everybody is always trying to figure out what these people (The Fed) are afraid of at any given moment, so we can get ready for their actions against it.” Despite overwhelming evidence that inflation is nowhere close to the Fed’s 2% target, Chairman Powell continues to […]

Rates Spark: Payrolls Day, And It’s Potentially A Big One For Rates

May 02, 2024

Jeremy Parkinson

Finance, No picture

Post the FOMC, the information value from US payrolls is amplified in our opinion. It’s a report that can always generate volatility. We think this one has the capacity to create a lot of discussion. Also, the back end of UST and Bund curves are tightly correlated, suggesting inflation risk from the US has been […]

Interest Rate Cuts Are Coming, Right?

May 02, 2024

Jeremy Parkinson

Finance, No picture

Image Source: Unsplash Interest rate cuts are coming. We’ve been hearing that since the fall of 2023. Hasn’t happened. How come? More worrying for investors is what will happen, and how to prepare.In the fall of 2023, with inflation easing and the economy in general seemingly under control, it made sense for the Federal Reserve and […]

Apple Q2 Earnings: Iphone Sales Down 10%, $110 Billion Stock Buyback Announced

May 02, 2024

Jeremy Parkinson

Finance

Image Source: Unsplash Apple Inc (Nasdaq: AAPL) is trading up in extended hours on Thursday after coming in ahead of Street estimates for its fiscal second quarter. iPhone revenue fell short of expectations The stock is gaining even though iPhone did not do all that well in Q2.The flagship handset generated $45.96 billion in revenue in […]

Stocks And Precious Metals Charts – Rally Into The Close

May 02, 2024

Jeremy Parkinson

Finance

Stocks were under a bit of pressure early on but found their footing and rallied into the close.The VIX fell.The Dollar fell.Gold and silver were under pressure and recovered into the close, with silver showing its usual resiliency. The demand for silver in high-tech industrial applications is fueling increased use of bullion. And the central banks […]

May Day! May Day! Market Overboard

May 02, 2024

Jeremy Parkinson

Finance

Image source: Pixabay In this episode of Macro-To-Micro Power Hour from 05/01/24, Samantha LaDuc and Craig Shapiro discuss the dynamic financial market landscape, particularly focusing on recent and upcoming economic events such as the QRA quarterly refunding announcement by Yellen, FOMC statements, and significant S&P 500 company earnings reports. They delve into the implications of these […]

Market Talk – Thursday, May 2

May 02, 2024

Jeremy Parkinson

Finance

ASIA:The major Asian stock markets had a mixed day today: NIKKEI 225 decreased 37.98 points or -0.10% to 38,236.07 Shanghai closed Hang Seng increased 444.10 points or 2.50% to 18,207.13 ASX 200 increased 17.10 points or 0.23% to 7,587.00 Kospi decreased 8.41 points or -0.31% to 2,683.65 SENSEX increased 128.33 points or 0.17% to 74,611.11 […]

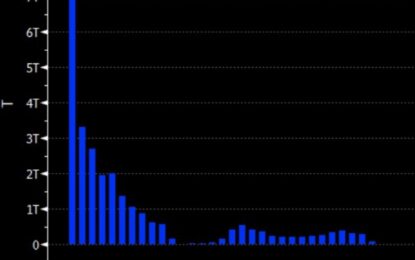

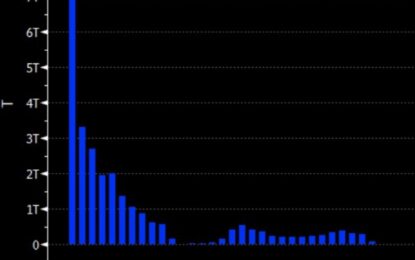

Russell 2000 Earnings Dashboard 24Q1 – Thursday, May 2

May 02, 2024

Jeremy Parkinson

Finance, No picture

Image Source: Pexels Russell 2000 Aggregate Estimates and Revisions The 24Q1 Y/Y blended earnings growth estimate is -8.4%. If the energy sector is excluded, the growth rate for the index is 2.6%. Of the 591 companies in the Russell 2000 that have reported earnings to date for 24Q1, 62.6% reported above analyst expectations. The 24Q1 Y/Y blended revenue growth estimate is -1.2%. If the energy sector is excluded, the growth rate for […]