Is The EUR/USD Rise Temporary? Fears Of A Recession Emerge

Apr 09, 2018

Jeremy Parkinson

Finance

The EUR/USD is rising in a very narrow range in the wake of the new week. The signs of a slowdown in the euro-zone are accumulating while US-China trade tensions continue. The technical picture is slightly bearish but the pair is still looking for a direction. The EUR/USD is trading around $1.2300, at the upper […]

Morning Call For Monday, April 9

Apr 09, 2018

Jeremy Parkinson

Finance

Jun E-mini S&Ps (ESM18 +0.59%) this morning are up +0.53% and European stocks are up +0.35% as global stock markets rally on reduced trade concerns between China and the U.S. President Trump’s top economic adviser, Larry Kudlow, said Friday that the U.S. and China are holding “back-channel discussions” to resolve an escalating trade dispute and President […]

Today’s Trades – GBPCHF, USDJPY, USDCHF, EURNZD

Apr 09, 2018

Jeremy Parkinson

Finance

We’re starting the new trading week with stability. U.S. stock futures are pointing to a positive open after selling off sharply on Friday thanks in part to the recovery in Asian and European equities. Treasury yields are also pointing higher, supporting the rally in the greenback. The dollar is up against most of the major […]

Longfin: The Bizarre Crypto-Stock Story That Reached Astounding Extremes

Apr 09, 2018

Jeremy Parkinson

Finance

Source: CNBC On Friday, April 6th, Longfin Corp. (LFIN) rallied 47% right into a trading halt. Ever since LongFin Corp. soared astronomically four days into its stint as a publicly traded company, I have been fascinated by the story. At the time I covered the rally, I wrote: “The trading in recent IPO LongFin Corp. may go […]

David Morgan: Silver Market Set Up Is “Best I’ve Seen For A Very Long Time”

Apr 09, 2018

Jeremy Parkinson

Finance

Listen to the Podcast Audio: Click Here Mike Gleason: It is my privilege now to welcome in our good friend David Morgan of The Morgan Report. David it’s always a real pleasure to have you on and welcome back, how are you sir? David Morgan: Mike I’m doing well, thank you very much for having […]

Fear Fall

Apr 09, 2018

Jeremy Parkinson

Finance

Oil is trying to hold ground after Friday’s fear-based market sell-off. Tariff fears and now talks of global growth fears after a sub-par jobs report, not to mention a rising rig count, sent oil lower. Yet current strong demand, falling OPEC productions as well the possibility of a major reaction by the U.S. after Syria […]

Investors Attempt To Focus On Earnings Season Despite Geopolitical Tensions

Apr 09, 2018

Jeremy Parkinson

Finance

As an investor, when contemplating the words in the geopolitical and macro realm, deciphering words and verbiage can be critical to a portfolio’s performance. The geopolitical environment investors are forced to consider this year likely outweighs that which one had to consider in the more recent past or during previous U.S. administrations. The last couple […]

Tariffs, Stocks And Recessions

Apr 09, 2018

Jeremy Parkinson

Finance

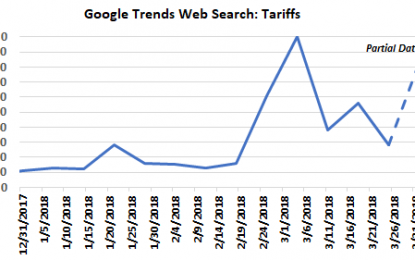

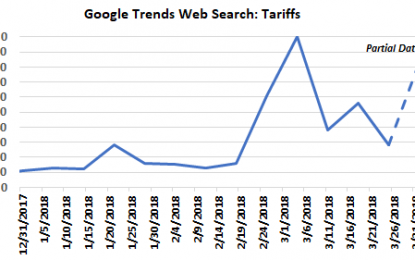

One truism investors know well is the fact the stock market does not perform well in a recession. The recent focus on implementation of tariffs on the U.S.’s largest trading country, China, have some concerned about escalation into an all out trade war and leading to an economic slowdown or recession. Google web search on […]

You Were Warned: MLP’s & “I Bought It For The Dividend”

Apr 09, 2018

Jeremy Parkinson

Finance

In early 2016, I warned investors about the dangers of Master Limited Partnerships (MLP’s) and chasing dividend yields. To wit: “One of the big issues starting in 2016 will be the reversions of MLP’s. Many investors jumped into MLP’s believing them to be a ‘no-brainer’ investment for income with little or no price risk. As I have suggested many […]

E

Taking A Long View

Apr 09, 2018

Jeremy Parkinson

Finance

I am refusing to write about the latest bearishness of stock markets over fear of a trade war. China and Trump are both making big threats as a negotiating strategy. This will go on for months and we have to examine other parts of the stock market. Renaissance Research is recommending a global bank stock I […]